Cardano [ADA] ticks the right boxes as Valentine upgrade approaches

- Large addresses went on an ADA accumulation spree.

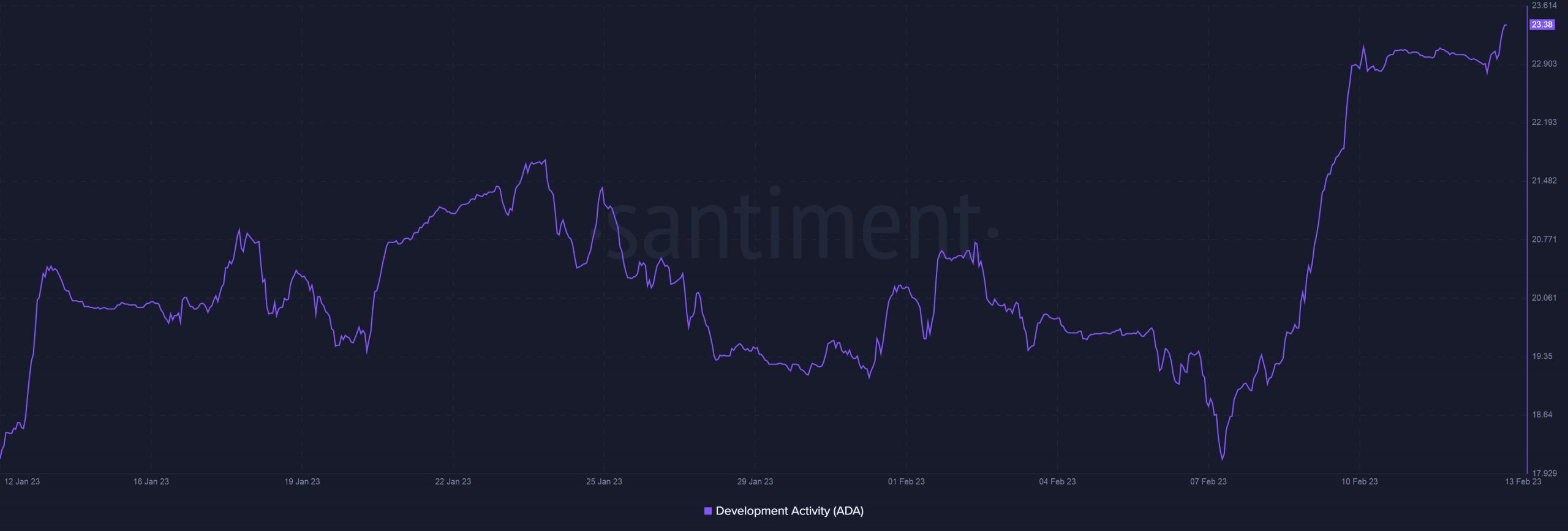

- Cardano network registered a rise in development activity.

Slowly but steadily, Cardano [ADA] broke out of the shackles of the 2022 bear market. According to a tweet by Santiment, whale transactions on the network have swelled up since the start of February 2023, clocking an average of 1700 daily transactions.

? #Cardano's brutal 2022 is far from a distant memory, even with a nice +45% rally here in 2023. Our latest insight looks at the #onchain upside that is peeking, including a major rise in whale activity, trader losses that lessen future risk, and more. https://t.co/sZPBdzQYyf pic.twitter.com/SvK9Sx5HjS

— Santiment (@santimentfeed) February 14, 2023

How much are 1,10,100 ADAs worth today?

A deeper dig into the data showed that accumulation by large addresses holding between 10,000 to 10 million ADA coins shot up, marking an impressive recovery since the FTX debacle.

ADA’s bullish rally saw its token holders pocket gains of about 50% since the start of 2022.

Community waits for Valentine’s Day!

There has been considerable hype building in anticipation of the Valentine upgrade, which is scheduled for 14 February.

According to Cardano builder Input Output HK, the new upgrade will advance blockchain interoperability and encourage cross-chain dApp development.

In collaboration with @cardanostiftung @emurgo, an update proposal was submitted yesterday to upgrade the Cardano mainnet to protocol v8, which will take effect on Tuesday, February 14, 2023 at 21:44:51 UTC.

1/4— Input Output (@InputOutputHK) February 10, 2023

Coinciding with this, the development activity on the network has picked up decisively, according to Santiment’s data. Over the last seven days, this metric has jumped by 27%, spreading a fresh wave of optimism in the Cardano fanbase.

Overview of the Cardano’s key parameters

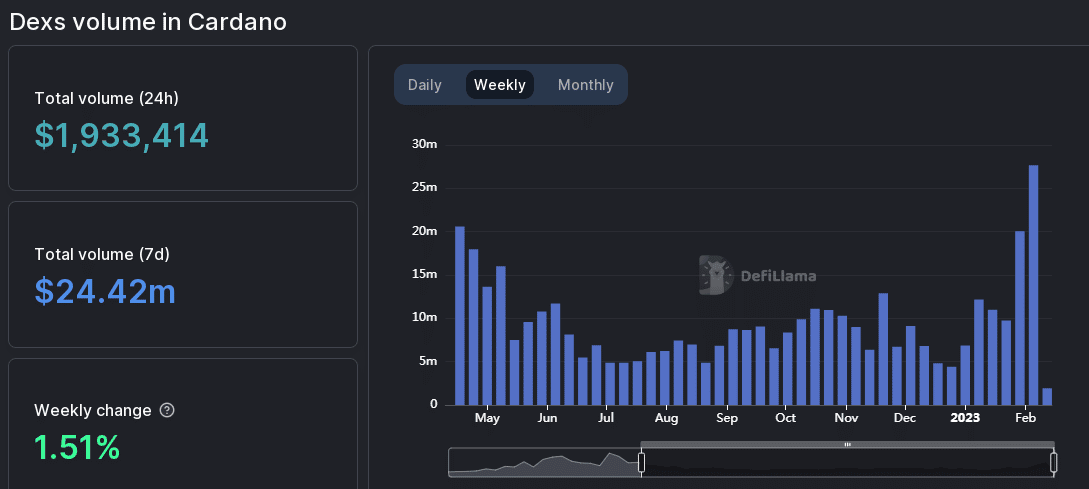

Notably, Cardano recorded a strong performance on the decentralized finance (DeFi) front as well. The total value locked (TVL) and the decentralized exchange (DEX) trading volume on the network made a sharp rebound from the lows of 2022 and sat at $24.42 million at press time, per DeFiLlama.

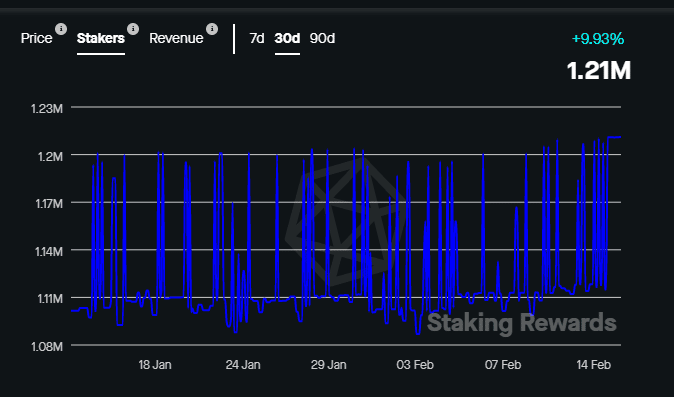

Cardano remained the second largest crypto currency by staking market cap. Over 71% of its circulating supply was staked in the network’s smart contract, according to data provided by Staking Rewards.

The number of stakers increased by about 10% in the last 30 days. Surprisingly, the interest in staking grew, despite a decline in the revenue generated for stakers.

Realistic or not, here’s ADA’s market cap in BTC’s terms

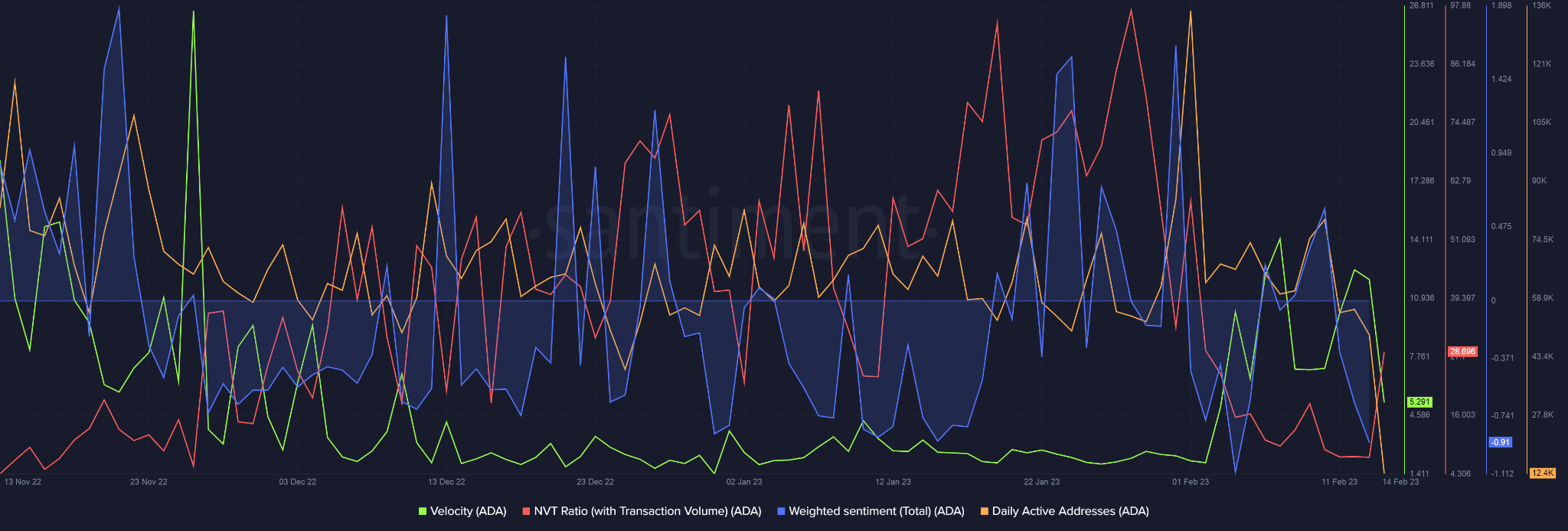

On the flip side, daily active addresses on the network tapered down in February 2023, which was counter-intuitive. The velocity dipped as well, implying that transaction volume was still on the lower side.

The network value to transactions (NVT) ratio spiked, lending evidence to the observation that network value was more than on-chain activity. The weighted sentiment was in the negative territory, which was also surprising.