Cardano: Analyst thinks ADA could surge 10x in 2025 – Why?

- An analyst projected that ADA could surge to $7.1, a 10X rally from current levels.

- Search interest on Google declined in March as top whales offloaded slightly.

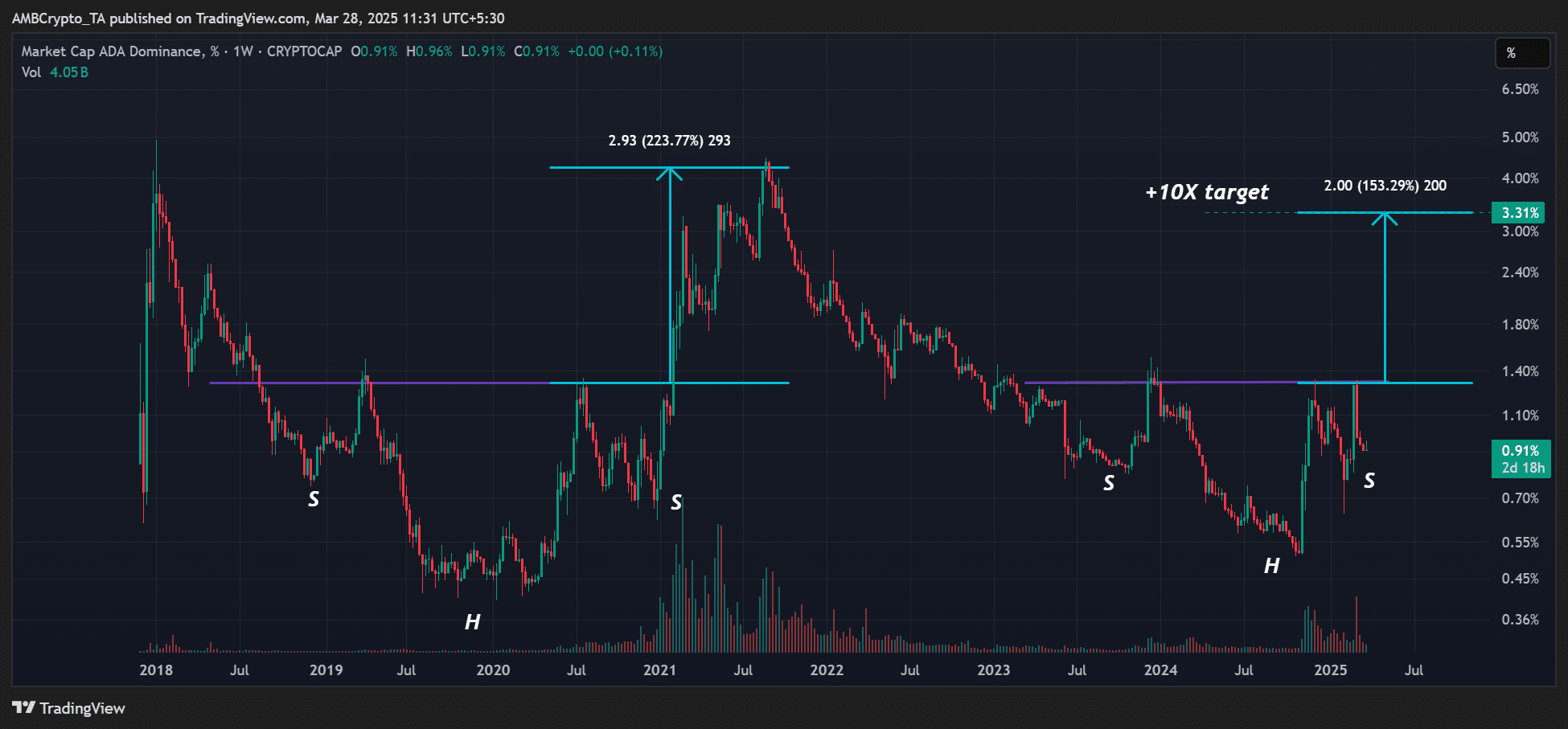

According to an analyst’s projection shared by a Cardano [ADA] ecosystem insider, ADA appeared primed for a potential 10X rally.

The analyst cited historical patterns, especially the bullish inverse head and shoulders formation, that led to a massive rally to ADA’s top in the past cycle. If validated, that would translate to an ADA price target of $2.9 or $7.1.

AMBCrypto reproduced a log scale of his ADA dominance chart to get a much clearer picture of his outlook.

Indeed, the formation suggested a potential 153% rally for ADA dominance. But were there other indicators leaning toward such a bullish outlook?

ADA search interest vs. whales

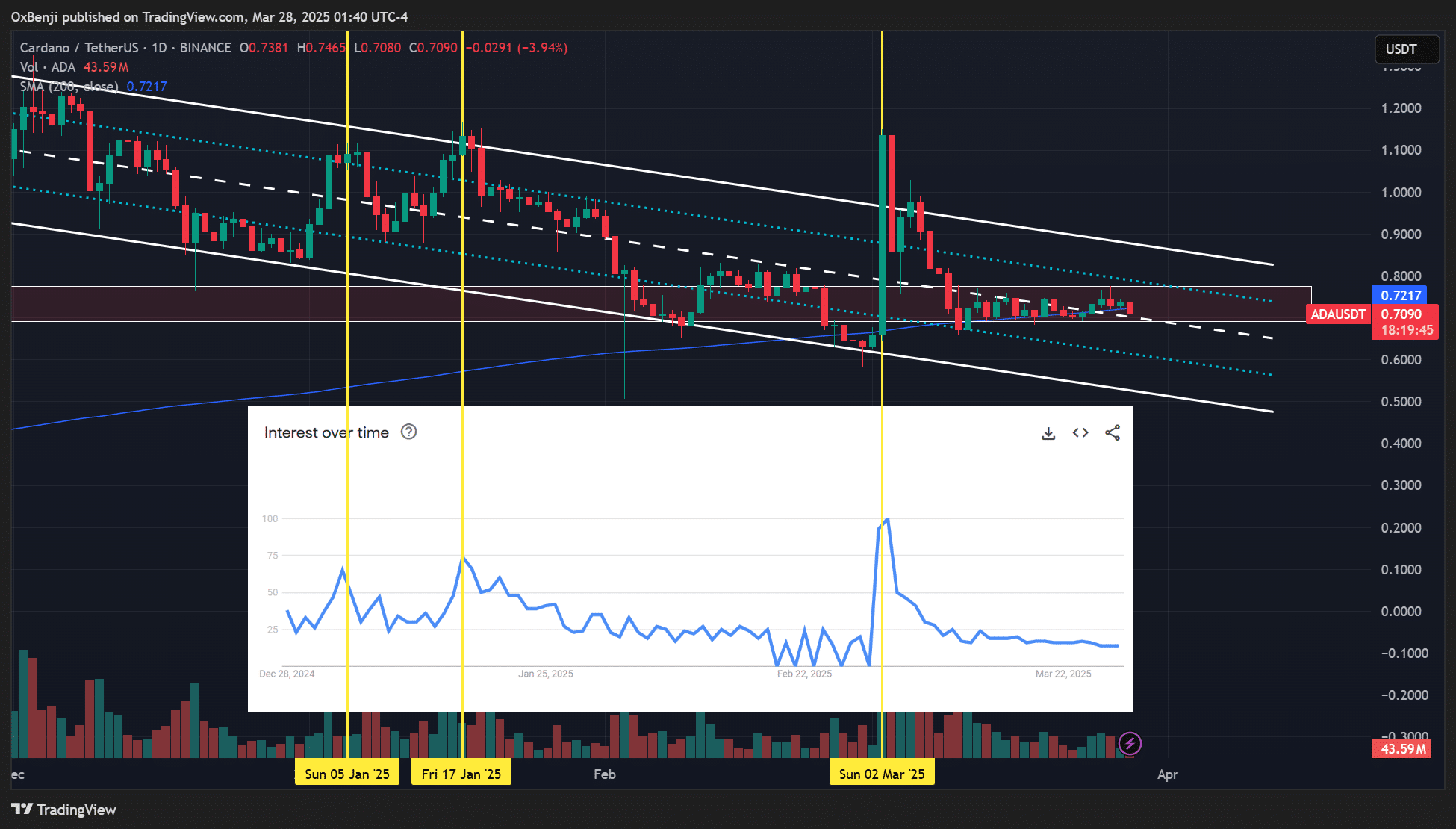

Another analyst noted that ‘Cardano price prediction’ searches on Google jumped over 170% in the past seven trading days. According to him, this reinforced the growing interest in the altcoin.

AMBCrypto found that the weekly search interest spiked; however, ADA price was more correlated when adjusted on a 90-day timeframe for Google searches.

As shown in the attached chart, spikes in ‘Cardano price prediction’ searches matched recoveries in January and March (yellow lines). However, the search for the term trended downwards later in March, similar to ADA’s price action.

Simply put, there wasn’t as much interest in the altcoin to boost ADA prices as the analyst claimed, at least as of this writing.

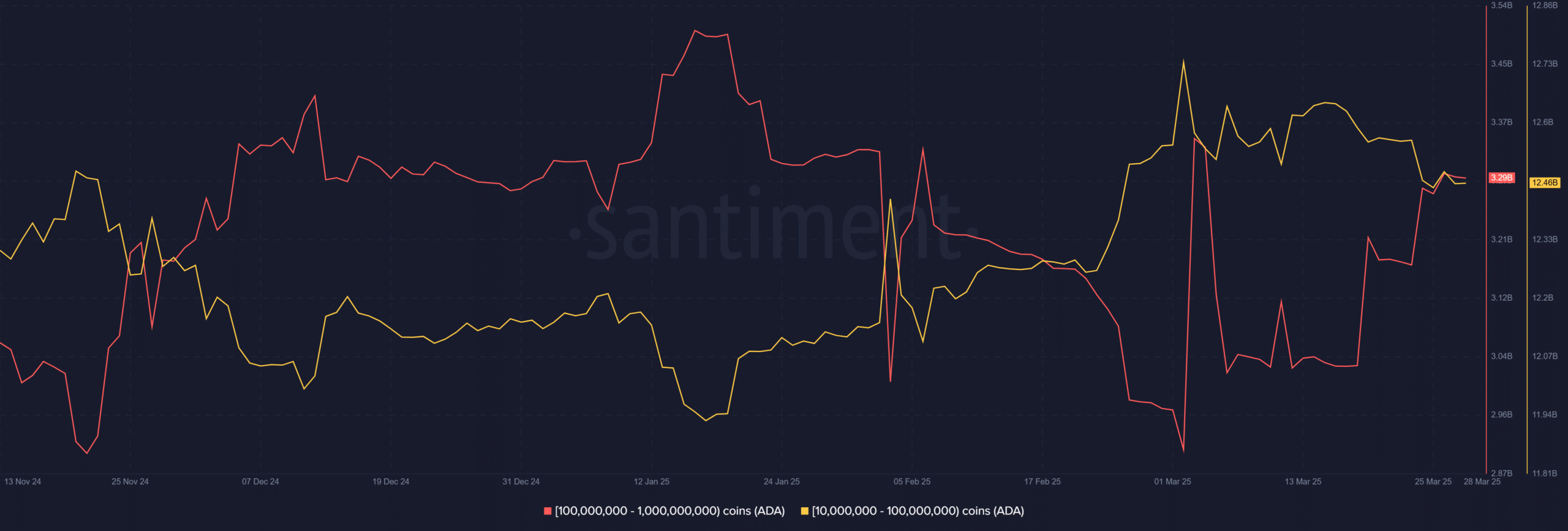

From the large players’ perspective, the most dominant whale wallets were those holding 10 million to 100 million ADA tokens (yellow). They collectively had 12.46 billion ADA holdings, worth $8.8 billion, and the altcoin’s price was very sensitive to their movements.

ADA’s price decline in March coincided with a large player’s sell-off, reducing holdings from 12.74 billion to 12.46 billion tokens.

This whale cohort might offer valuable insights into ADA’s next price movement and is worth monitoring closely.

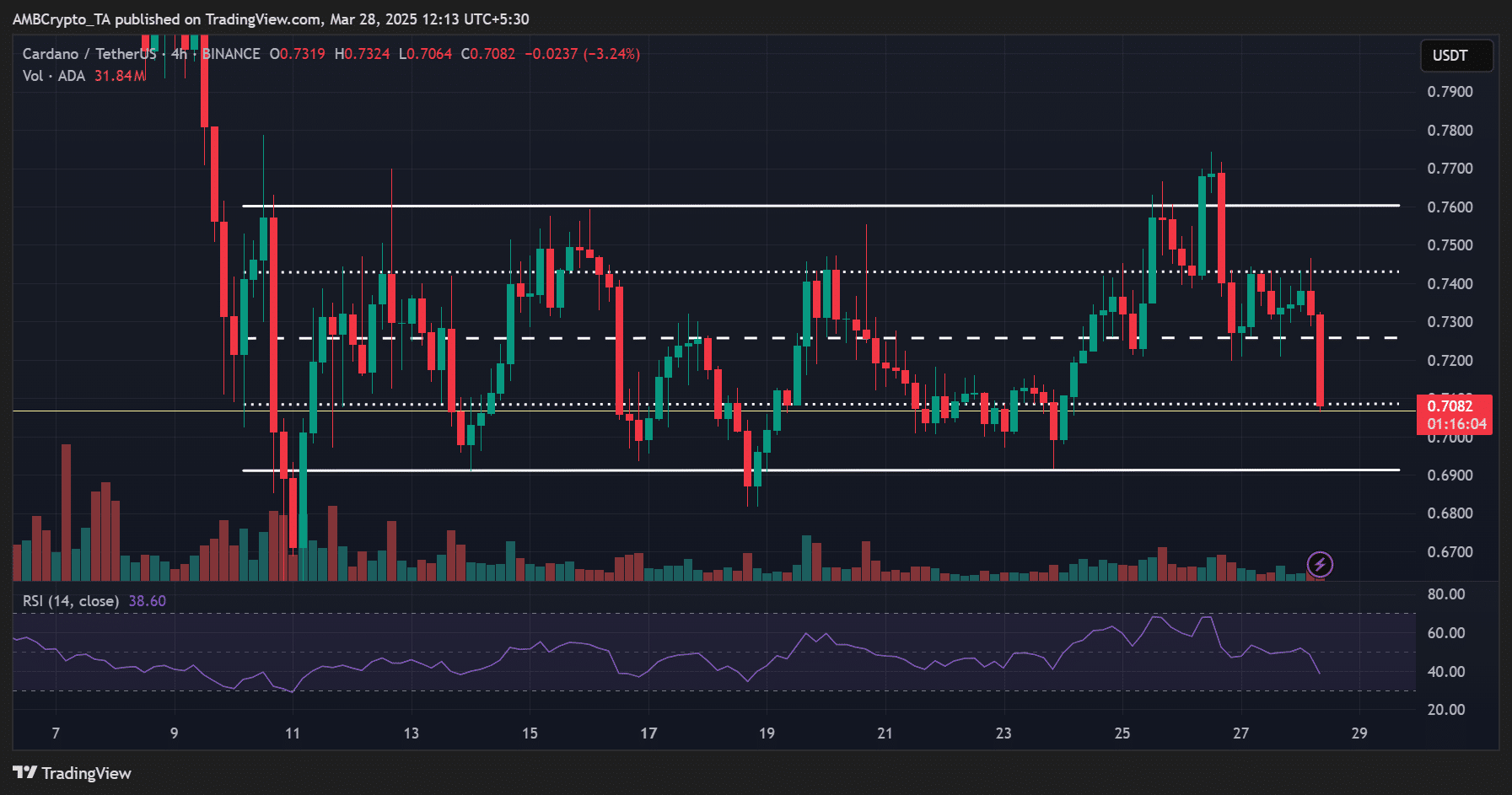

That said, ADA was stuck in a tight consolidation between $0.70 and $0.77 in the second half of March. A breakout on either side was dependent on Bitcoin’s [BTC] next price direction.