Cardano and MATIC’s latest buy opportunity – Will Bitcoin have a say?

- Bitcoin’s halving event could tarnish bullish expectations

- Cardano and MATIC are expected to rally, but investors should be prepared for short-term losses

Bitcoin’s [BTC] halving is around ten days away, and this event will reduce the block reward to 3.125 BTC. Since everybody knows when it is coming, it might be priced in, but there are so many other factors that are not.

In fact, the demand for ETFs is not, and Bitcoin has been consolidating above the $60k level since the first week of March. While it did set a new ATH at $73.7k, the cryptocurrency was quick to recede on the charts. What is the effect of the halving going to be this time, and how will altcoins like Cardano [ADA] and MATIC] be affected?

Comparing the current price action to the 2020 and 2016 halvings

The previous BTC halvings occurred on 11 May 2020 and 9 July 2016. In May 2020, Bitcoin formed a range that extended from $8,500 to $10,000. The preceding month saw the cryptocurrency rally from $6,000 to $9,400.

In 2016, May and June saw Bitcoin rally from $440 to $785. In July, around the halving, the price action was severely muted and prices stayed within the $630-$680 band for nearly a month.

The price action over the past two months was closer to 2016, than 2020. The similarities are a rally in the months preceding the halving, followed by a range formation. A deep retracement to $500 happened in August 2016 – If the similarities continue to hold, it could see Bitcoin retreat towards $50k in May.

What should Cardano and MATIC investors expect?

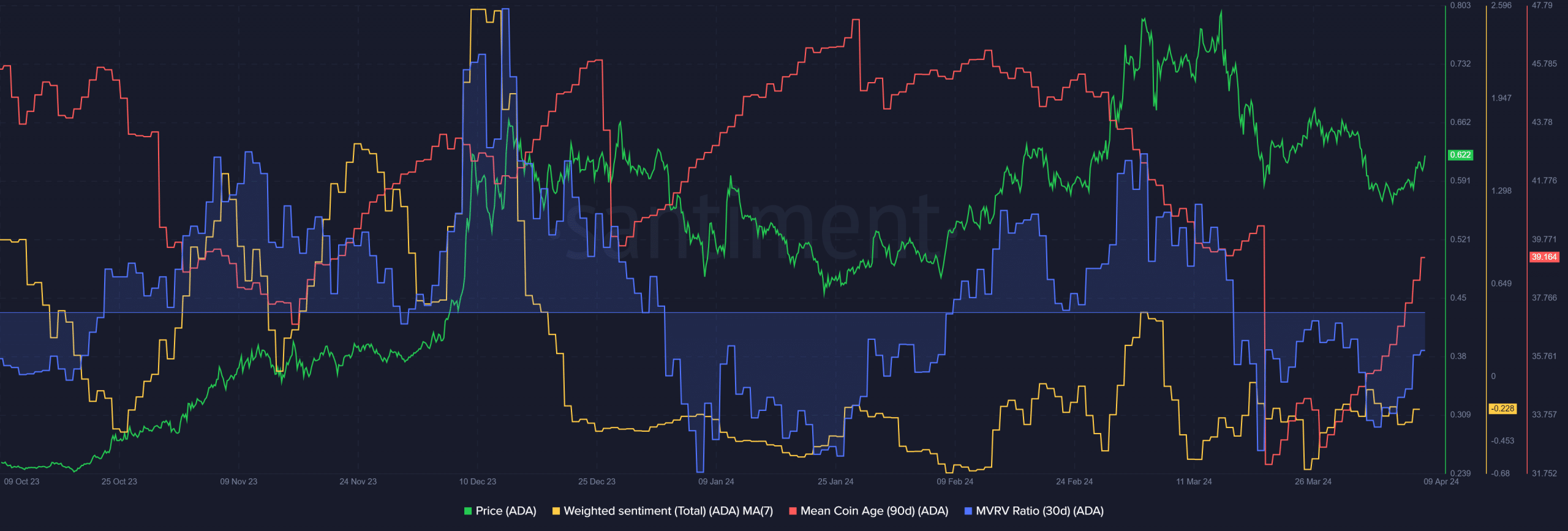

Source: Santiment

AMBCrypto analyzed the on-chain metrics of the two altcoins to assess investor confidence in recent weeks. The 30-day MVRV of Cardano was strongly negative since 17 March. I. fact, it has not yet climbed into positive territory – A sign that holders were at a loss.

At the same time, the mean coin age began to trend firmly higher. This can be seen as a strong buy signal as it is a sign of accumulation, despite the recent selling pressure. Meanwhile, the weighted sentiment seemed tepid.

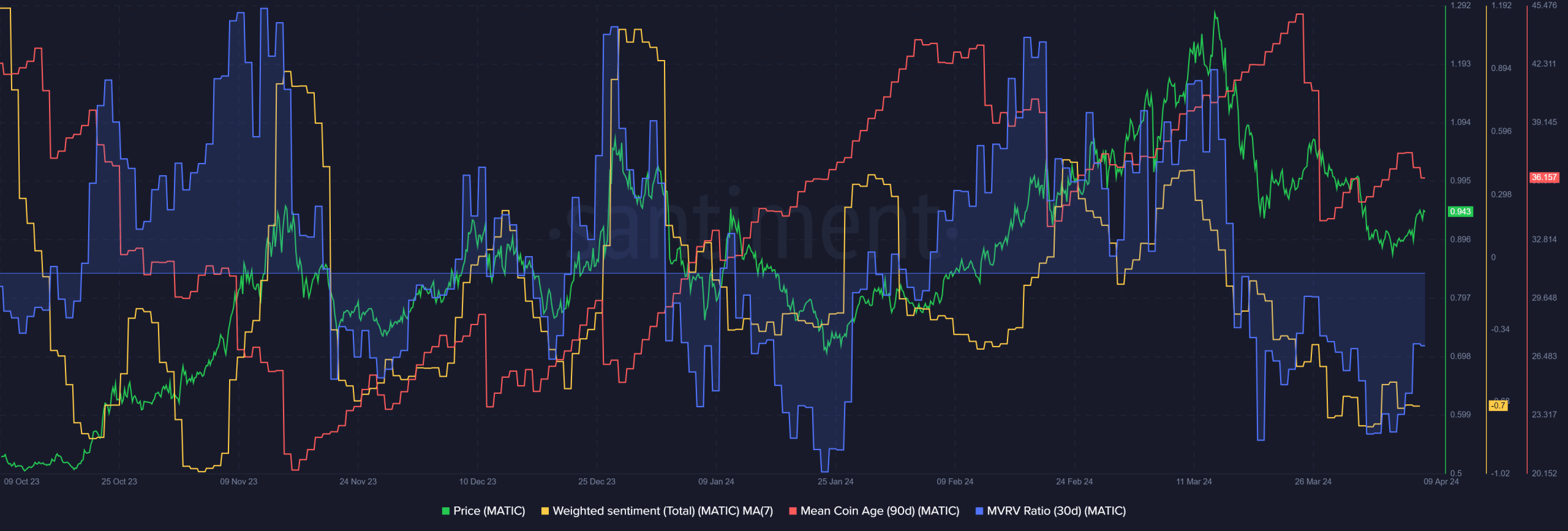

Source: Santiment

MATIC seemed to be in a similar position too. The weighted sentiment has been negative recently, reflecting bearish social media engagement. However, the mean coin age appeared to begin an uptrend, although it was not as strong as ADA’s.

Read Polygon’s [MATIC] Price Prediction 2024-25

The 30-day MVRV ratio was also negative, like Cardano. Once more, another strong buy signal. However, investors should beware of a large wave of selling that might occur for Bitcoin in the coming weeks. They should be prepared to buy the potentially deep dip if we get one.