Cardano: Assessing ADA’s performance of Q1 2023 and its road to Q2

![Cardano [ADA] witnessed massive surge in metrics in Q1; will this growth trajectory continue?](https://ambcrypto.com/wp-content/uploads/2023/04/ADA-2-e1681911188741.png)

- Cardano’s TVL increased considerably, but NFT transactions declined.

- At press time, ADA was undergoing a price correction as it was down 5%.

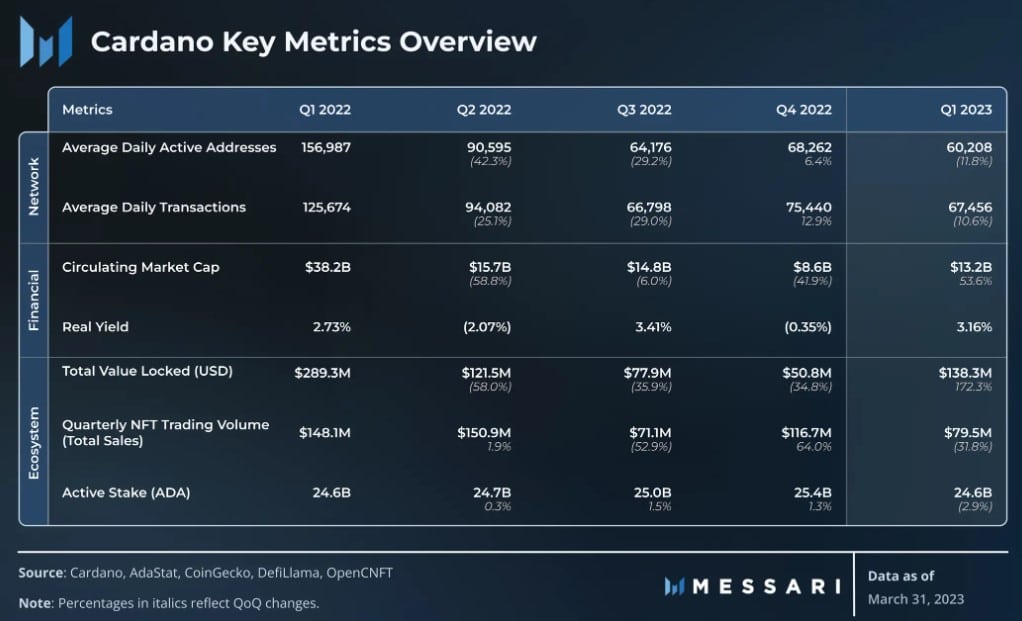

Messari published a report on Cardano [ADA] on 19 April highlighting its state in the first quarter of 2023. Right off the bat, one of the most notable updates was that Cardano’s market cap increased by more than 50% quarter on quarter, from $8.6 billion to $13.2 billion.

This growth also helped Cardano reach the 7th spot in the list of cryptos by market capitalization.

— Messari (@MessariCrypto) April 18, 2023

Read Cardano’s [ADA] Price Prediction 2023-24

Performance analysis of Q1

Messari’s report mentioned that despite a massive uptick in market cap, the Cardano network failed to attract new users. New addresses and average daily transactions decreased QoQ by 71.5% and 10.6%, respectively.

Cardano’s transaction fee increased in the last quarter but was still less than what it was in Q3 2022. The possible reasons behind the decrease in transaction fees could be due to network traffic being more consistent in Q1 than in Q3.

Cardano’s DeFi space flourished

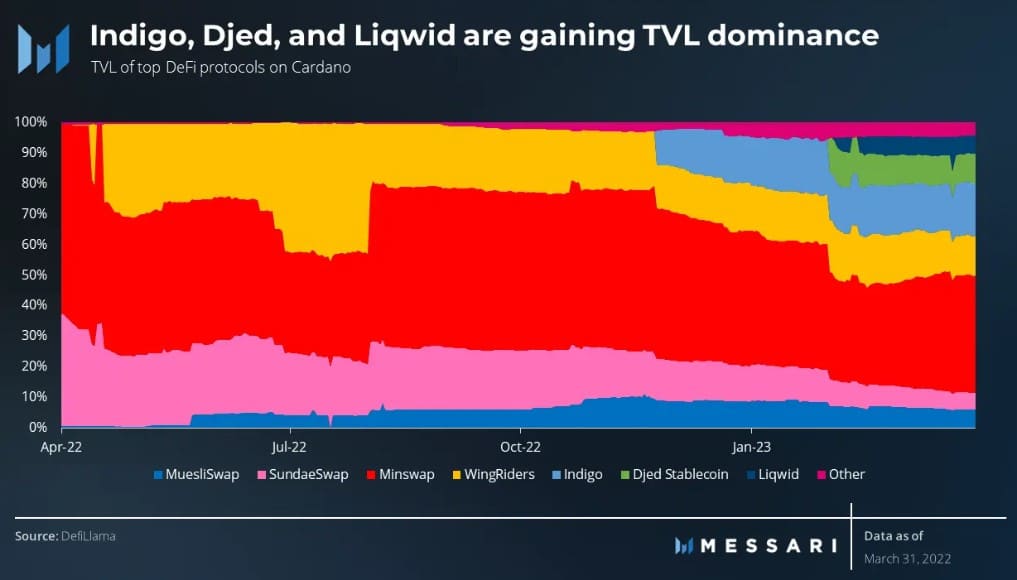

Cardano’s performance in the DeFi space was commendable, as it registered an increase of more than 172% QoQ. The blockchain’s total value locked (TVL) went from $50.8 million to $138.3 million.

Messari’s report also mentioned that this massive boost in DeFi performance could be attributed to the adoption of Djed stablecoin in the network. The stablecoin debuted in Q1 2023 with day one’s minting amounting to $1.8 million.

A look at Cardano’s state in the NFT space

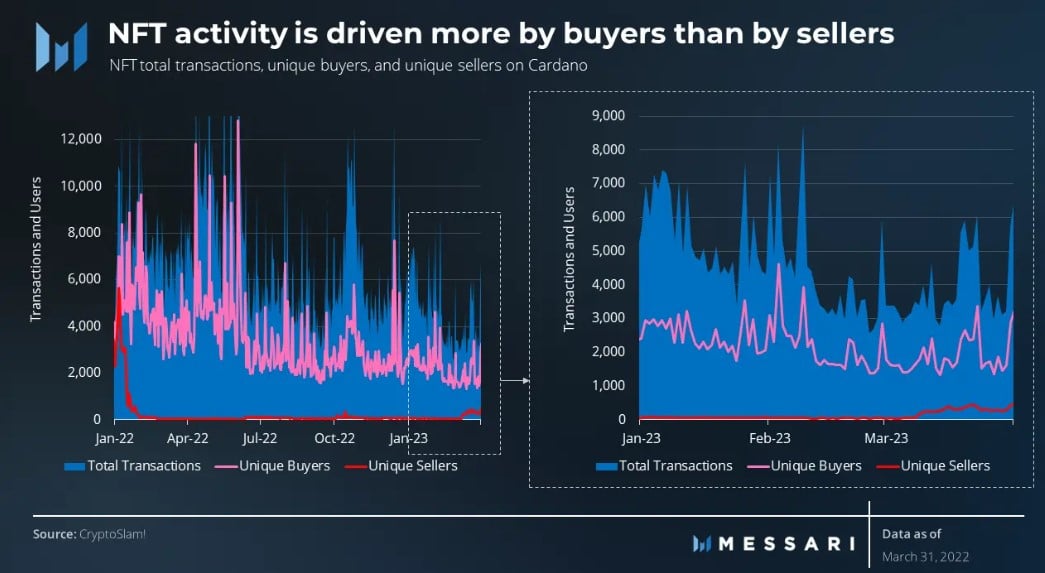

Cardano’s performance in the NFT space met with a few roadblocks. For instance, daily NFT transactions declined by 27% in the last quarter.

Additionally, daily unique buyers also followed a similar route and declined by 23%. Interestingly, the number of unique buyers in Q1 greatly exceeded the number of unique sellers. There was a total of 8,900 verified NFT projects on Cardano.

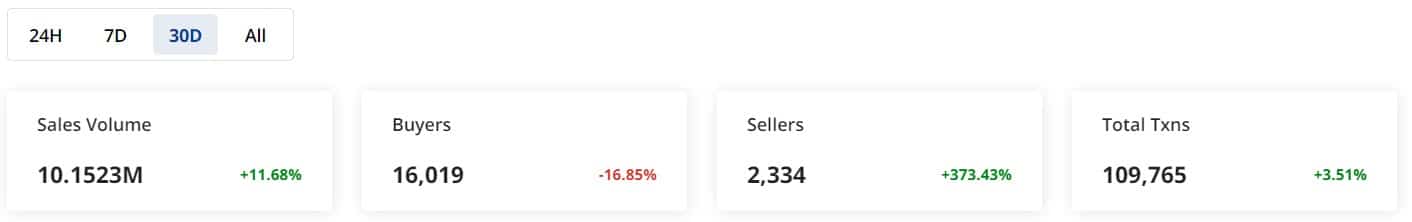

Cardano NFTs in Q2 2023

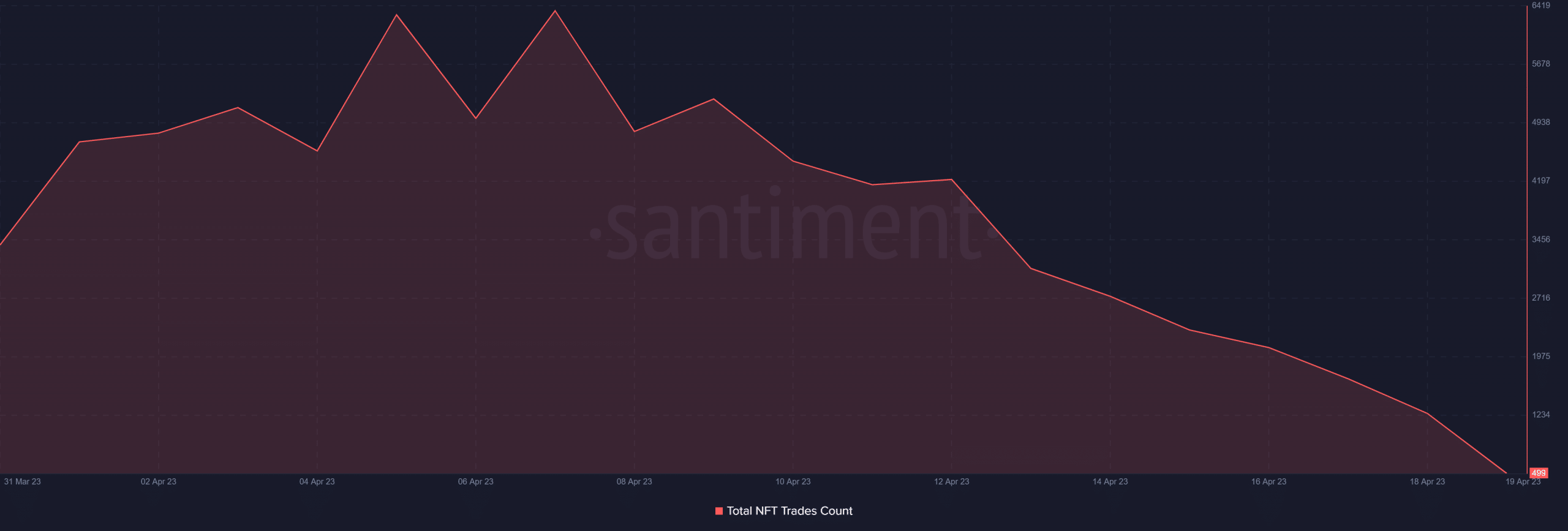

Data from Santiment revealed that the total number of NFT trade counts declined since the beginning of the new quarter.

It was also interesting to see that on one hand, the number of unique sellers increased by more than 300%, while on the other, the number of unique buyers declined in the last 30 days. Nonetheless, Cardano’s NFT sales volume registered an uptick, which was optimistic.

Realistic or not, here’s ADA market cap in BTC‘s terms

ADA’s future looks bright

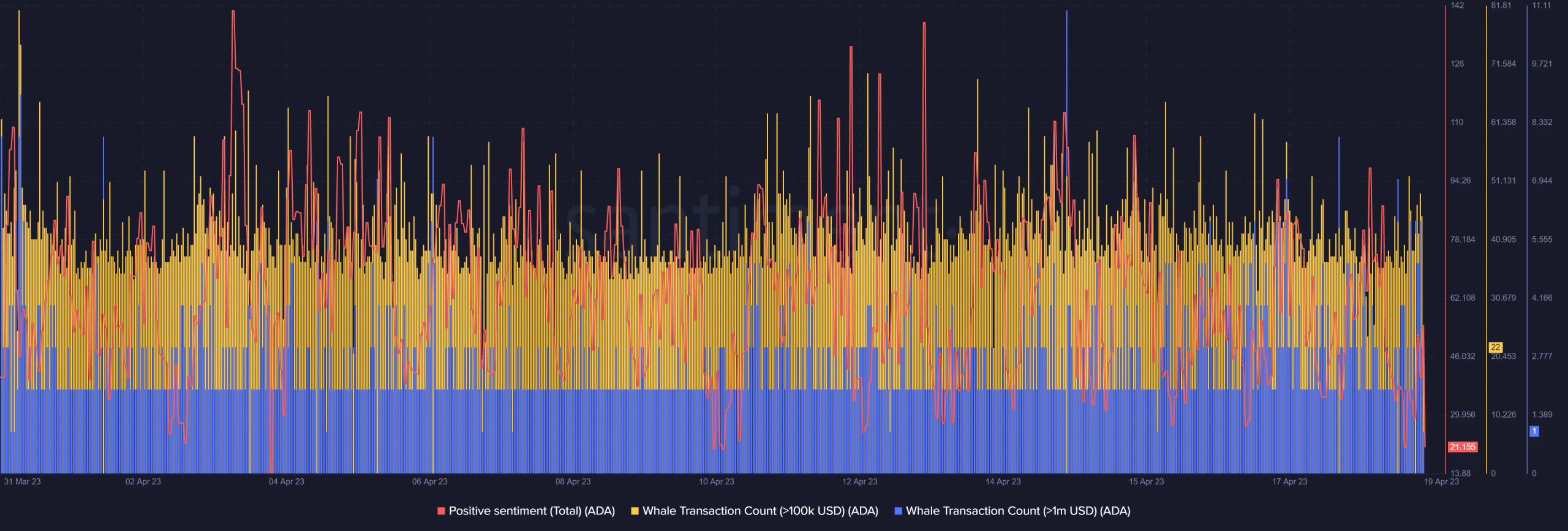

The whales were highly confident about the state of ADA since the beginning of Q2. This was quite evident from the high whale transaction count. Not only that, but positive sentiments around ADA also spiked of late, reflecting the crypto community’s trust in the token.

However, at the time of writing, ADA was facing pressure as its price declined by more than 5% in the last 24 hours. The token was trading at $0.4174 with a market capitalization of $14.5 billion. The direction Cardano heads in this quarter will be interesting to analyze.

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://ambcrypto.com/wp-content/uploads/2025/07/XLM-Featured-400x240.webp)