Cardano: Assessing impact of 190M whale action on ADA’s price

- Following the slight gains, Cardano whales raised the amount accumulated to 190M ADA in a day.

- Cardano’s price action continued to be in a tight range between $0.65 and $0.75 for the last ten days.

Whales made substantial Cardano [ADA] purchases from the 16th to the 19th of March 2025. ADA fluctuated between $0.65 and $0.75 before making its top at $0.779 then was followed by a fall to $0.669.

The whale community purchased 50 million ADA within two days, as of press time, as ADA price consolidated.

Following ADA price rising slightly to $0.716, whales executed aggressive buying activity that totaled 190 million ADA within a day and raised the price to $0.78.

The synchronized whale buying activity depicted deep whale confidence, which powered ADA’s price rise.

This was due to increased market demand, while further upside potential price rise depended on the sustainability of this accumulation trend.

How will the price react to the consolidation?

Cardano‘s daily price range fluctuated between $0.65 and $0.75 during a ten-day consolidation phase. This phase followed intense selling pressure at the descending trendline resistance.

Although the price initially broke out of the trendline, it resulted in a false breakout before resuming a steep downtrend. The trendline ultimately acted as a strong resistance level after the price rejection.

ADA maintained a confined range, forming lower swing highs and increasing swing lows within a flat trend. A price rise beyond $0.75 could signal bullish momentum, targeting the next resistance zone between $0.90 and $1.00 if the upward trend remains strong.

If ADA fails to hold above the $0.65 level, it may test support levels below $0.58. This is attributed to the MACD’s negative reading, reflecting weak momentum through its descending signal line and declining histogram bars.

A clear breakout is essential, as current market conditions do not signal immediate bullish momentum. The market structure would shift only if ADA achieves a bullish breakout from its 10-day range.

Staying below $0.65 reduces the likelihood of an uptrend, indicating further bearish trends following the descending channel pattern.

ADA’s sentiment from participants

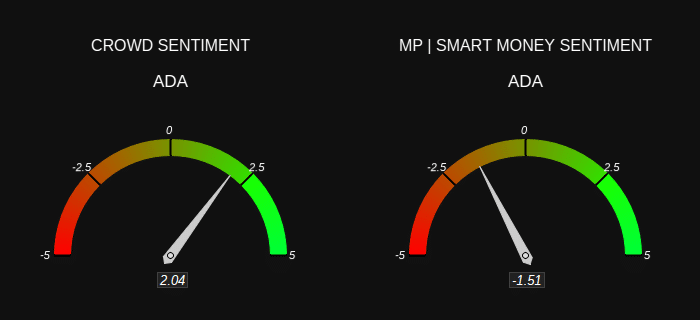

In other observations, Smart Money sentiment stood at -1.51 while the Crowd Sentiment showed 2.04. This revealed that retail investors strongly believed in ADA’s bullishness, but institutions had a negative outlook on the asset.

The current disconnected state between popular investment sentiment and expert investment evaluations indicated prices were rising because of retail demand.

However, institutional investors showed concerns that the uptrend might be short-lived.

The price of ADA could experience pressure from selling if smart money sentiment fails to match retail investor sentiment. However, broader market trends and large investor movements may prevent such a price decline