Analysis

Cardano bounces, but here’s why a price dip is likely before the weekend

The liquidation levels data showed that a move beyond $0.38 might be unlikely over the next 24-48 hours.

- The Cardano market structure was bullish on the daily chart after the move above $0.355.

- AMBCrypto found that there’s a good chance of a price dip for ADA before the weekend.

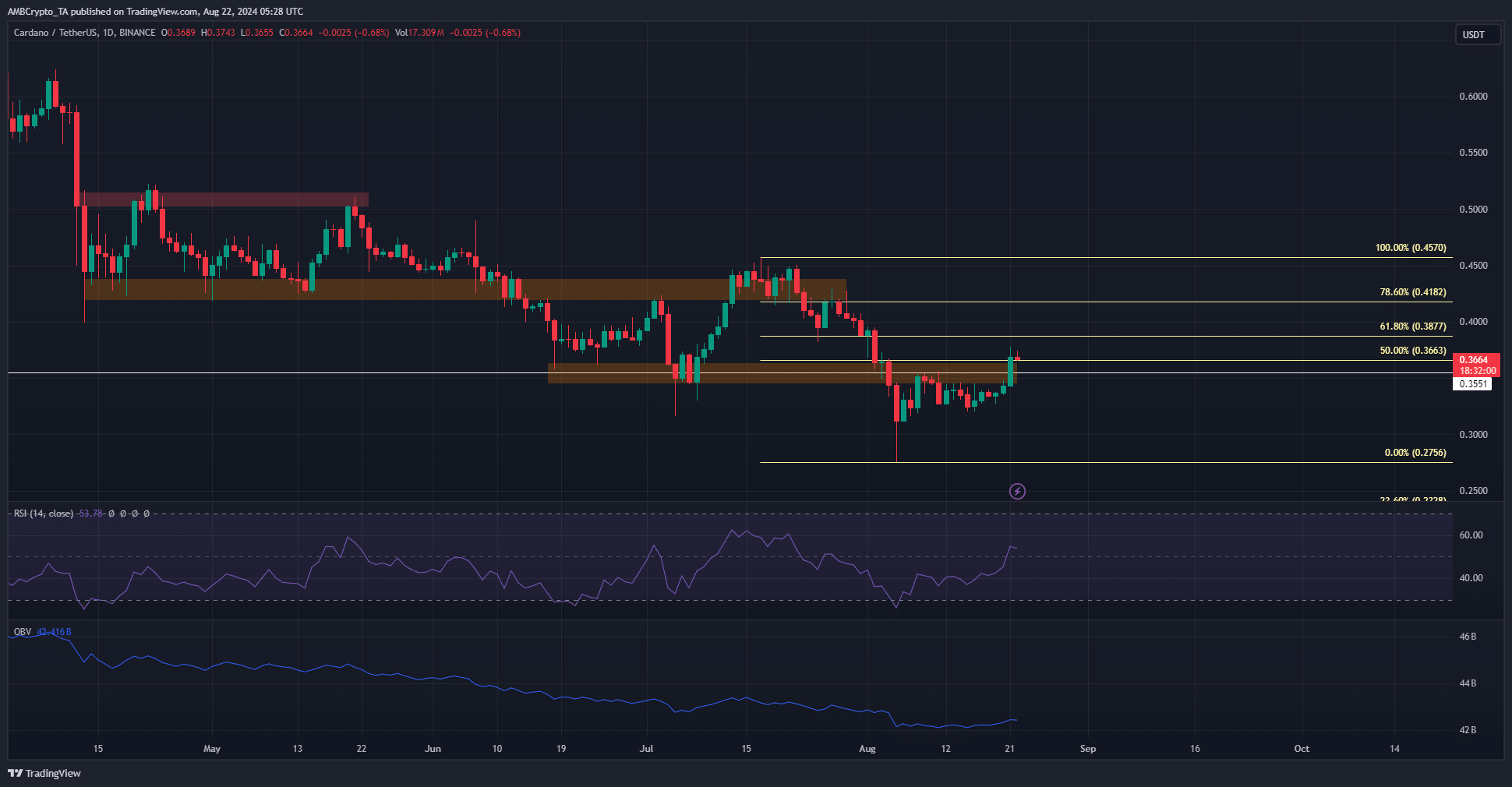

Cardano [ADA] saw a 14.4% bounce from last week’s low at $0.32. This has encouraged short-term buyers, but the token was trading in a resistance zone once again. A recent report had anticipated this bounce.

Should traders be cautious or go long with the $0.42 being the next key resistance? AMBCrypto’s analysis found that caution was warranted and the bears were still the dominant side.

Cardano approaches the 61.8% resistance level

The liquidity pockets at $0.36 and $0.42 were the closest significant resistance zone, as per the report mentioned earlier. They lined up well with the Fibonacci retracement levels.

At press time, ADA was at the 50% level at $0.366. The RSI rose above neutral 50 to signal a bullish momentum shift. However, the OBV was unable to set a new high, revealing a lack of buying pressure despite the price bounce.

Therefore, the higher timeframe downtrend is likely to persist even though the daily structure was bearish. A move to $0.388 and $0.418 could see a bearish reversal.

Swing traders can wait for a rejection from these levels before looking to go short. The local lows at $0.3-$0.312 would be the bearish target.

A price move downward appeared imminent

Source: Hyblock

The liquidation levels data showed that a move beyond $0.38 might be unlikely over the next 24-48 hours.

Read Cardano’s [ADA] Price Prediction 2024-25

The cumulative liq levels delta was highly positive. In turn, a price dip could catch these overeager bulls offside.

The $0.353 and $0.345 regions could be a target in the near term. Bitcoin [BTC] volatility could also influence the short-term Cardano trend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion