Cardano bulls force large, swift gains as bears put up scant resistance

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ADA retains a strongly bullish outlook for November.

- A pullback was a likelihood, although it might be shallow due to the bullish pressure that was present.

Cardano [ADA] has performed extraordinarily well in the market recently. It was one of the best-performing crypto assets in the top ten by market capitalization, and registered gains of 32% to reach $0.3757 from $0.2845.

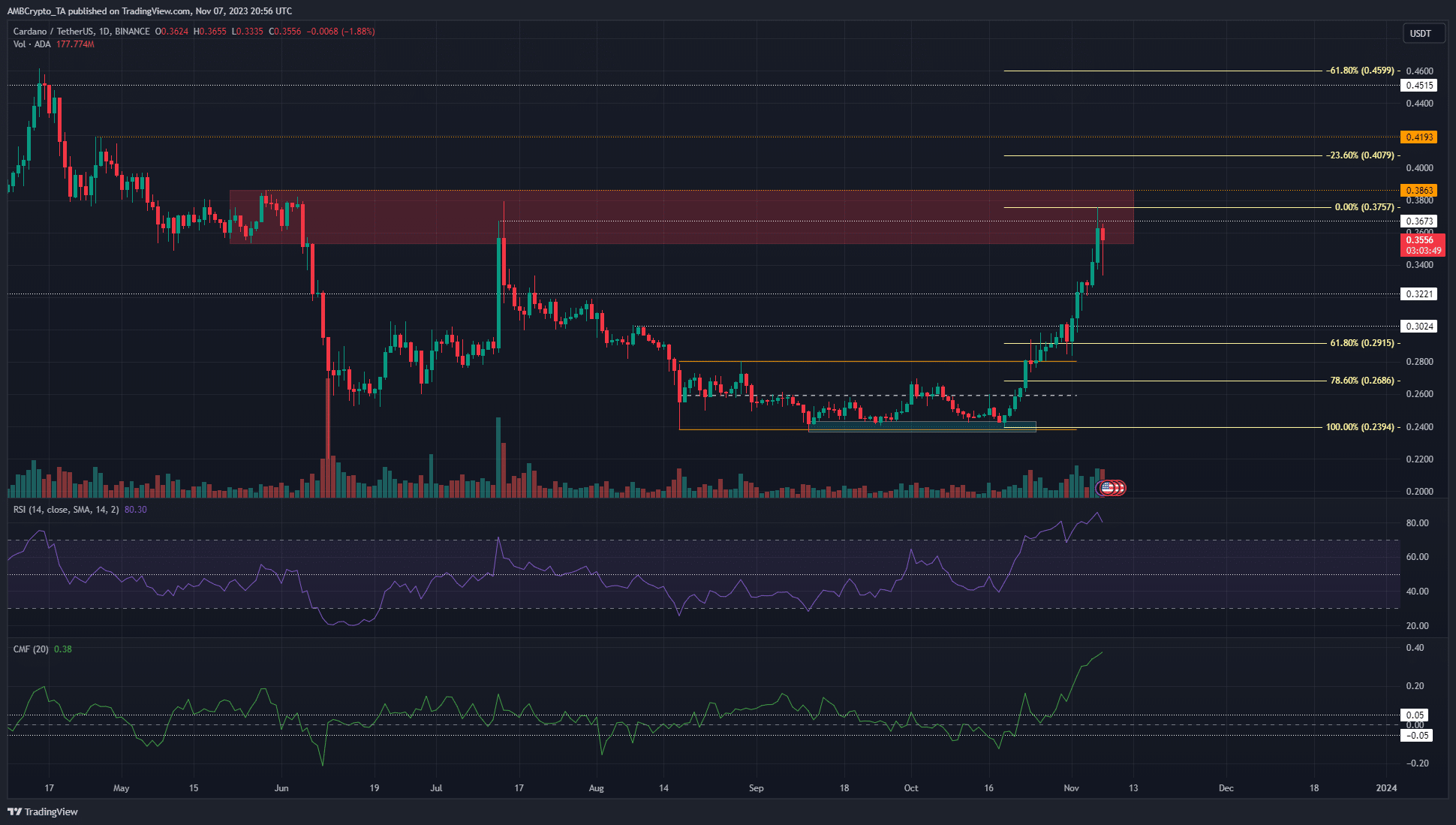

ADA receded to $0.35 in recent hours of trading but retained its strong bullish outlook. AMBCrypto’s recent report highlighted the lack of resistance in the $0.3-$0.39 region. This idea was pretty close to what transpired, with ADA reaching the $0.375 mark.

A weekly bearish order block saw bulls beaten back for now

The $0.322 level was flipped from resistance to support on the 3rd of November and ADA continued to climb higher. As noted earlier, above the $0.3 resistance, the $0.322 and $0.386 were the next significant resistance levels a week ago.

The $0.354-$0.386 zone (red box) represented a bearish order block from the one-week timeframe. Therefore, it was a stiff resistance zone that the bulls could take a while to break. The chances of a pullback were also good.

The Chaikin Money Flow (CMF) read +0.38 to underline enormous capital flow into the market in the form of buyers. The RSI was at 80 to reflect intense bullish momentum even on the daily chart.

On-chain data showed some metrics could have overheated

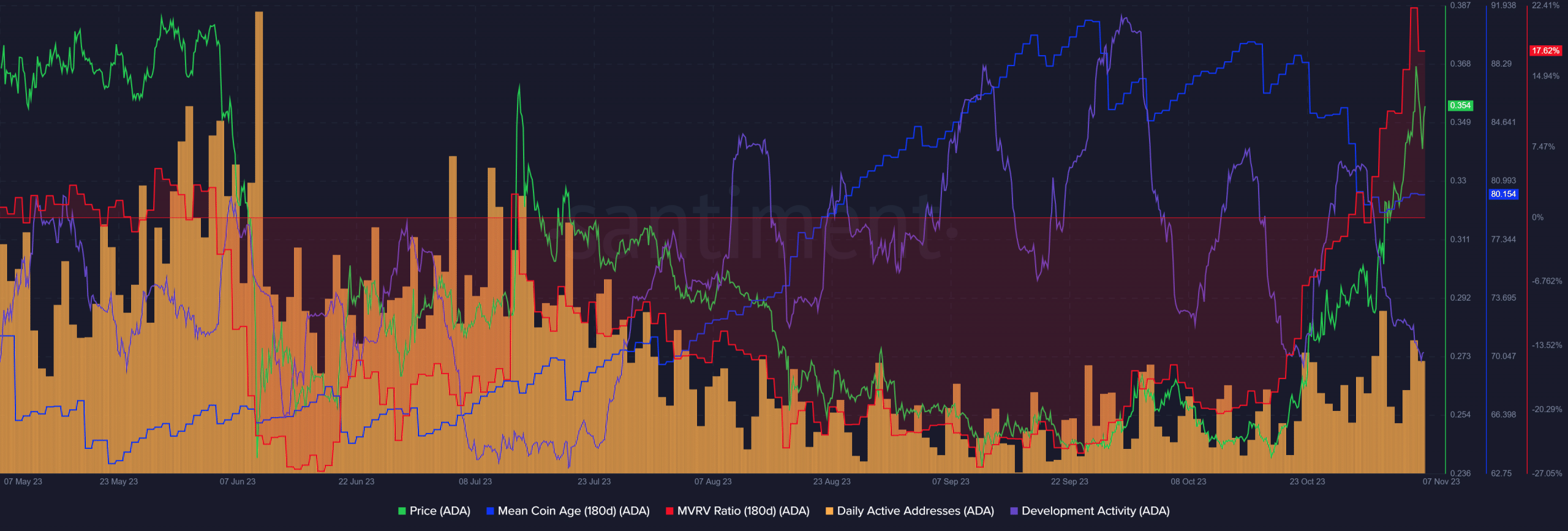

Source: Santiment

The daily active addresses slowly trended higher since mid-September to denote rising demand for the token. However, the mean coin age of ADA has dropped in the past two weeks.

At the same time, the MVRV ratio shot higher by a large margin to reach highs not touched since April 2023.

The mean coin age suggested addresses were moving their tokens and the MVRV outlined the possibility of profit-taking by ADA holders. Development activity saw a decline in the past two months but long-term investors have no reason to worry about this dip.

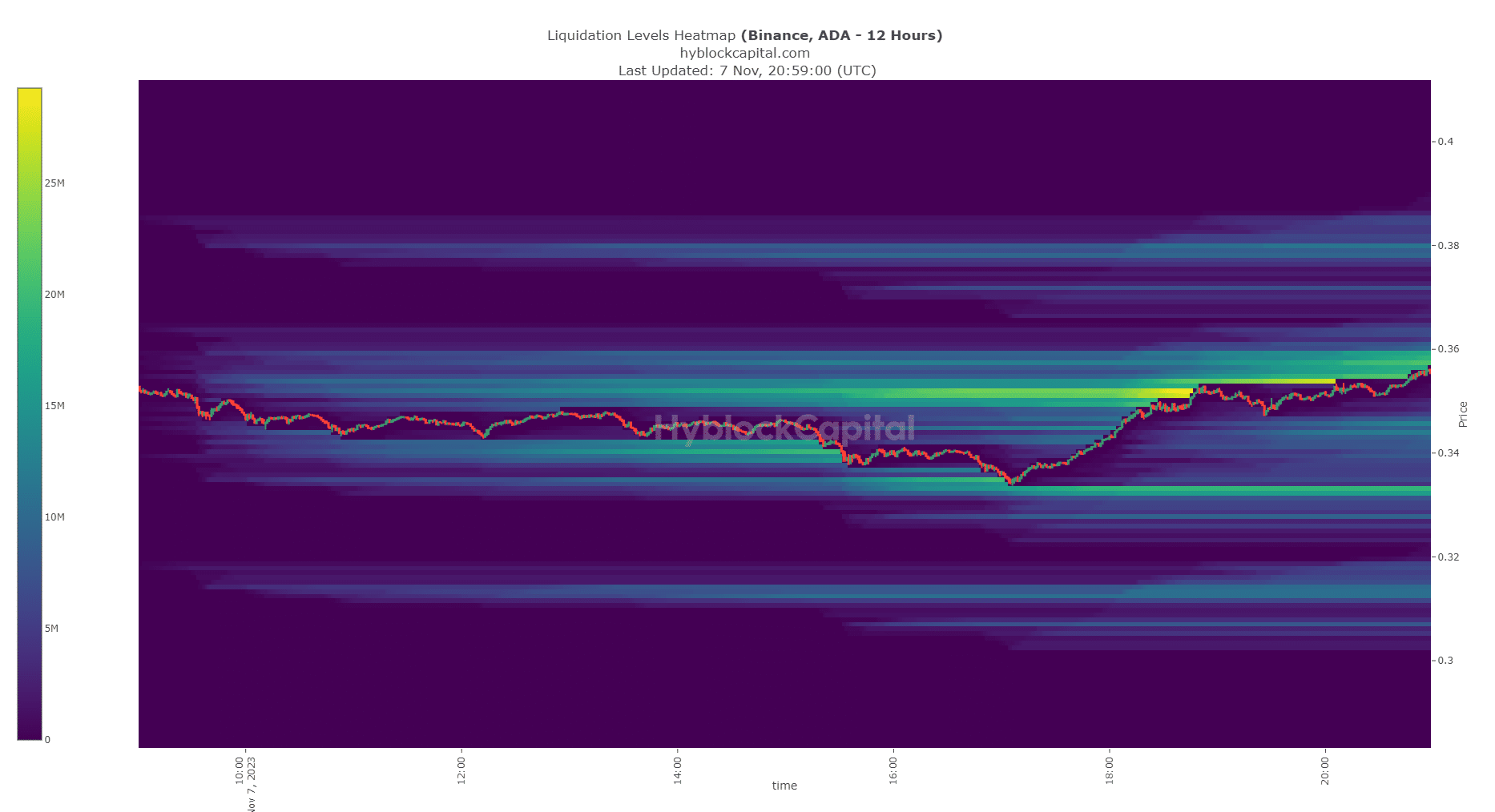

Source: Hyblock

Is your portfolio green? Check the Cardano Profit Calculator

The liquidation levels heatmap with a lookback period of 12 hours showed what the short-term price action could look like. There was a good pocket of liquidity at $0.36, and another at $0.334.

Hence, in the next day or two, another bounce to $0.36 followed by a dip toward $0.334 was a possibility. Over the next week, a retest of $0.322 could offer a buying opportunity.