Cardano [ADA] buyers must consider this before opening a long position

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Cardano flipped the $0.438 support to immediate resistance on the 4H chart.

- Binance funding rate for ADA turned positive

After plateauing at the $0.51-resistance September, Cardano [ADA] undertook a southbound journey for the last three weeks. Consequently, this descent entailed a trendline resistance (white, dashed) that persistently triggered selling rallies.

With the price action struggling to break the shackles of its 50 EMA (cyan) resistance, the near-term trend seemingly exhibited bearishness.

A reversal from its newly-found resistance could pose a downside risk in the coming sessions. At press time, ADA was trading at $0.433.

The 4H chart unveiled the bearish edge as sellers find renewed pressure

As the 20 EMA (red) and the 50 EMA (cyan) kept looking south over the last few weeks, the near-term narrative took a bearish inclination.

The descending triangle setup highlighted the expedited selling advantage as the sellers kept lowering the peaks while the buyers strived to protect the $0.438-mark. The resultant breakdown resulted in the bears flipping this mark from support to immediate resistance.

Then, ADA marked a compression in the $0.438-0.4301 range for over three days. This trajectory entailed a rectangle-bottom-like structure. The coin could see a low-volatility phase in the next few sessions before a plausible breakout.

This structure usually leads to a downtrend after the patterned breach. Thus, a close below the $0.43-support could trigger a selling signal.

In this case, the buyers would look to re-enter the market in the $0.416-zone. Any growth above the 50 EMA and the 3-week trendline resistance would hint at a bearish invalidation.

The Chaikin Money Flow (CMF) saw a break above the zero mark and hinted at a bullish edge. But its higher peaks chalk out a bearish divergence with the price action.

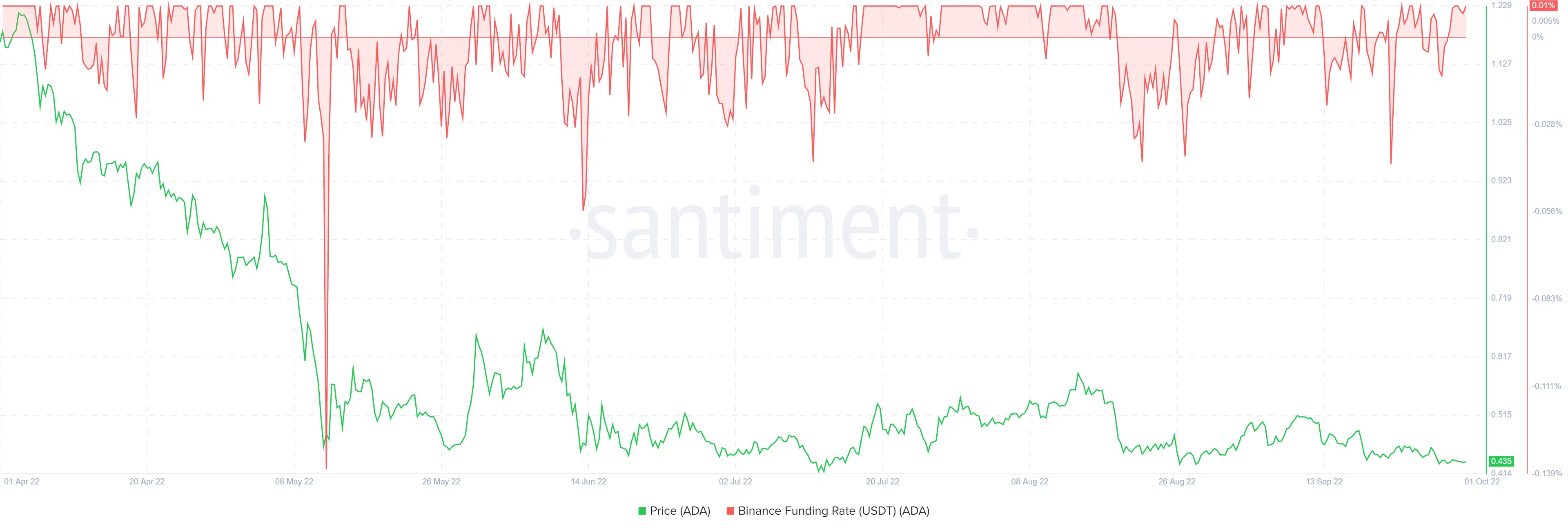

The funding rates witness an uptick

The funding rates were positive on Binance for the last two days, according to data from Santiment. This reading entailed that long positions were paying the short positions funding fee [Interval: 8H].

Simply put, the metric implied that most traders were slightly bullish on the futures market. Contrarily, the price action was yet to reflect this sentiment.

All in all, ADA stood at a critical juncture. But the selling triggers and targets would remain the same as discussed above. The traders should factor in Bitcoin’s movement and its effects on the wider market to make a profitable move.