Cardano declines by 21% in a week: Is a drop to $0.7 inevitable now?

- ADA declined by 21.78% over the past week.

- Cardano has seen a shift in market sentiment to bearish as sellers dominate.

Since hitting a recent high of $1.3 a week ago, Cardano [ADA] has experienced a sharp decline to hit a low of $0.911.

In fact, as of this writing, Cardano was trading at $1.02. This marked a 12.25% decline in daily charts. Prior to this, the altcoin was on an upward trajectory, hiking by 75.91% on monthly charts.

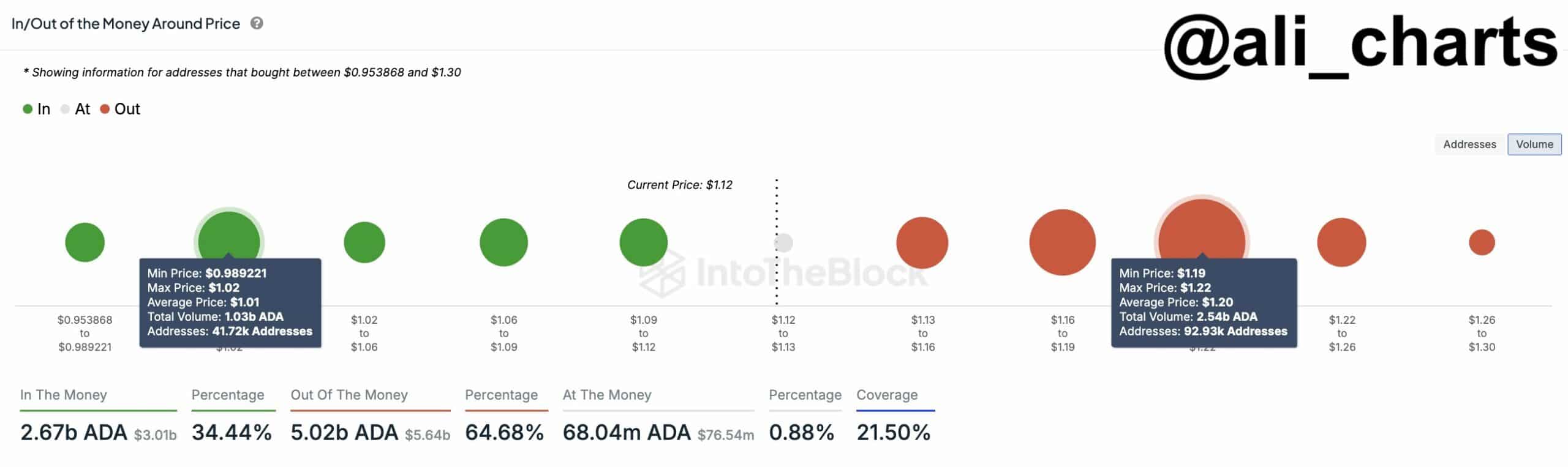

The recent market conditions have left analysts talking. One of them is Ali Martinez who sees $1.2 as the critical support level.

Analyzing market sentiment

In his analysis, Martinez talks about Cardano’s support level around $1.2 where 93,000 addresses hold 2.54 billion ADA tokens.

According to him, a drop below this level risks the altcoin dropping below $1 until when it finds another upward momentum.

However, the analyst pointed out ADA is repeating the 2020 cycle. During this time, Cardano saw a strong rally from $0.141 to $1.547.

Therefore, the dip could create a buying opportunity, resulting in recovery. Martinez argued that a recovery will see ADA hit between $4 and $6.

What ADA charts say

With a sharp decline over the past week, AMBCrypto’s analysis suggests that Cardano has experienced a change in sentiment from bullish to bearish as sellers dominate the market.

This dominance among sellers was well evidenced by a drop in ADA’s Relative Strength Index (RSI) as it dropped from 79 to 53. This suggested higher selling pressure in the market.

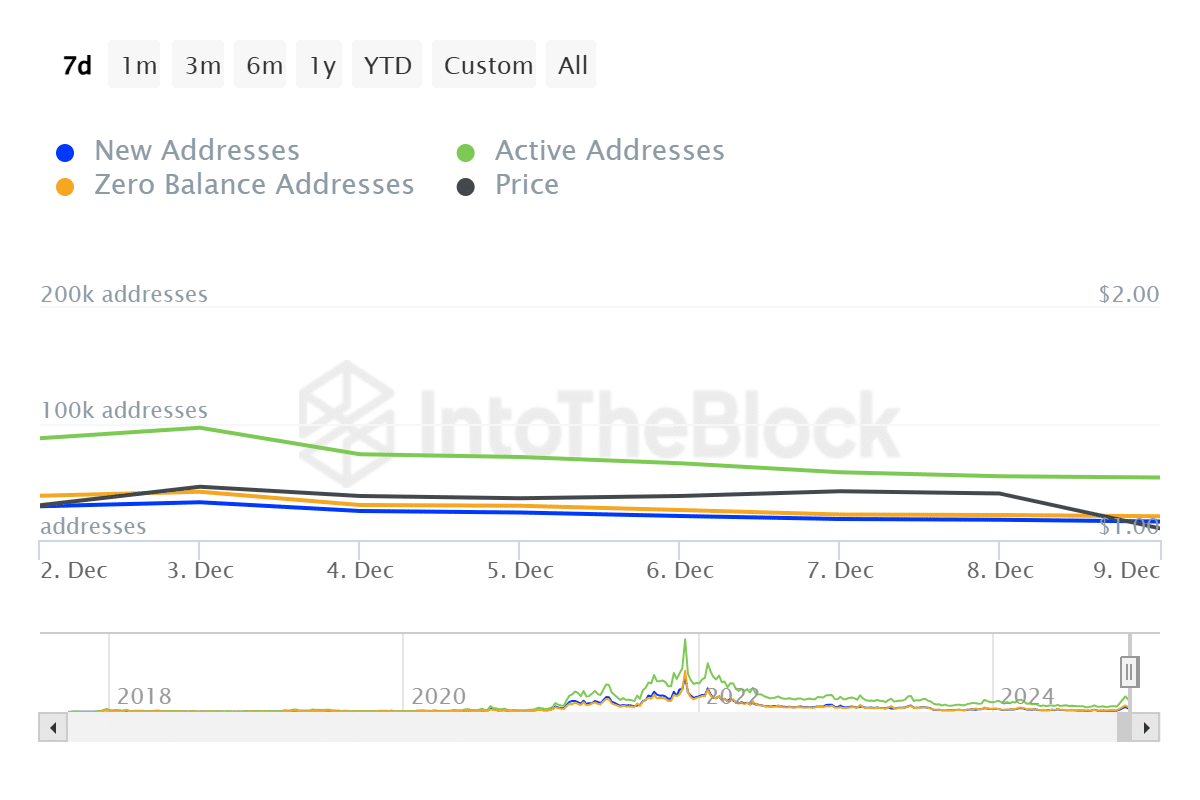

Additionally, Cardano’s active addresses have declined from 170.83k to 90.36k. When active users decline, it shows a reduction in network usage, adoption, demand, and interest among investors.

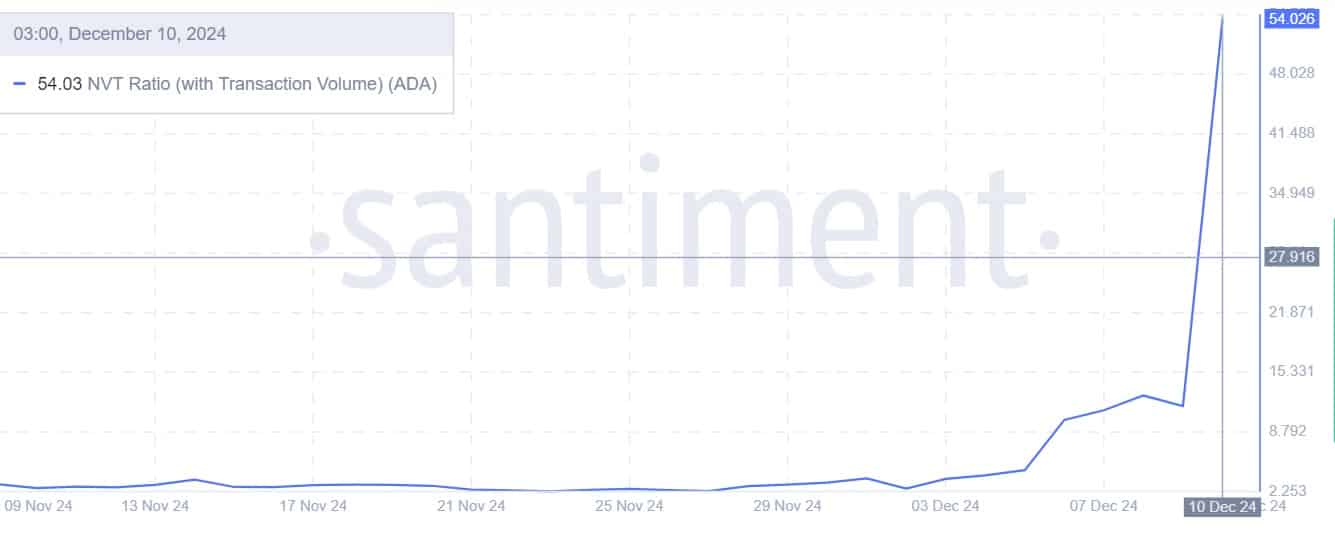

This drop in network usage is further witnessed with the recent spike in NVT ratio (with transaction volume). The altcoin’s NVT ratio has surged from 11.63 to 54.03 indicating the altcoin’s market cap is rising faster than its transaction volume.

Historically, high NVT ratios are associated with market tops or overbought conditions. Thus, if transaction volume fails to catch up, prices decline as market speculation wanes.

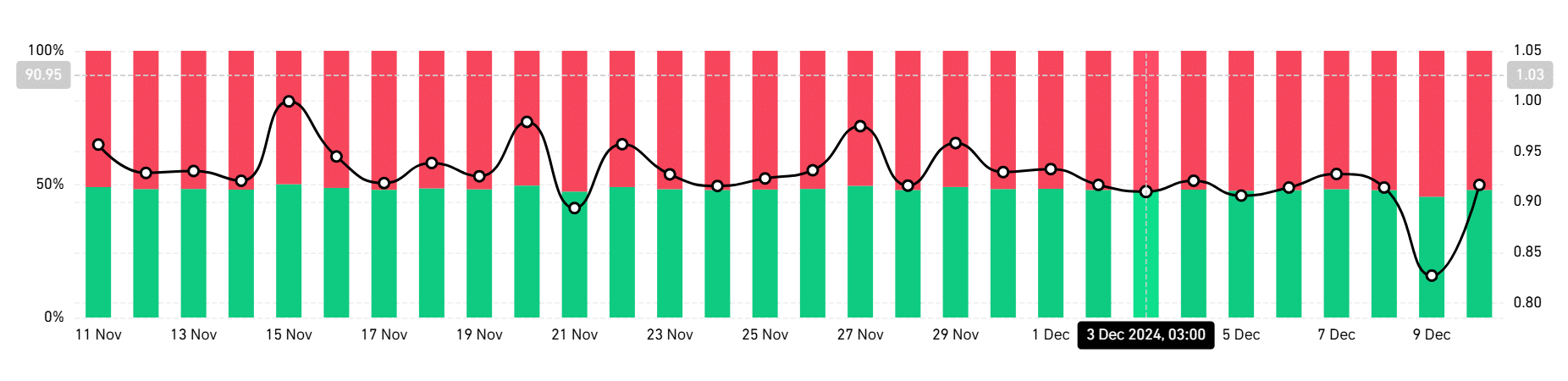

Source: Coinglass

Finally, the shift in market sentiment is witnessed as more investors continue to take short positions. According to Coinglass’s long/short ratio, short position holders hold 52% of the total. This suggests that most investors are betting prices to decline.

Read Cardano [ADA] Price Prediction 2024-2025

Simply put, Cardano is currently in a corrective wave and could see the altcoin face further decline. If these negative sentiments hold, ADA will drop to $0.9 and bearish sentiments could push it down to $0.77.

However, a trend reversal will see ADA reclaim $1.2 levels.