Cardano & ADA – Do fees suggest they are not in demand anymore?

- Cardano’s user activity has declined.

- ADA selling pressure has rallied.

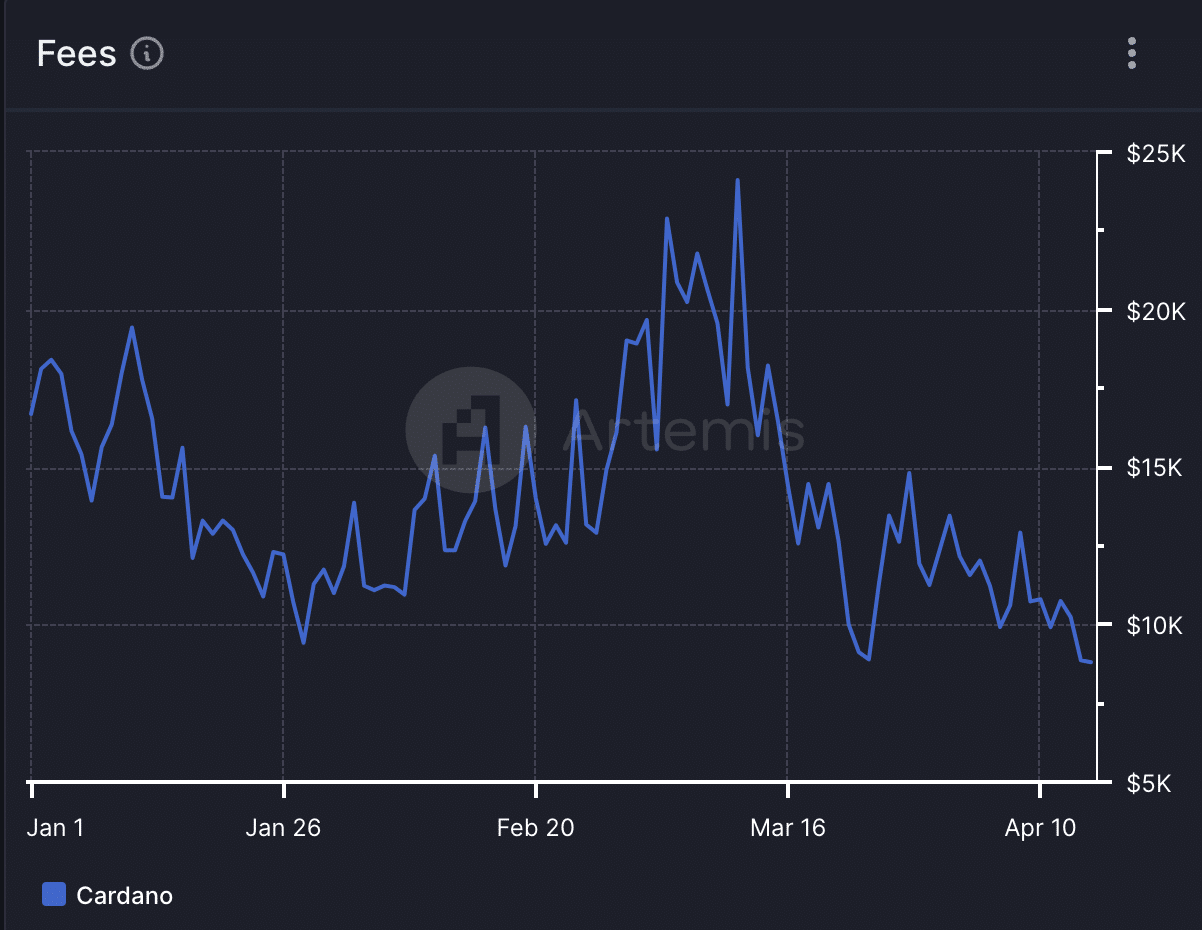

Cardano’s [ADA] daily network fees have dropped to a year-to-date (YTD) low as user activity on Layer 1 (L1) blockchain decreases, according to Artemis’ data.

As of the 15th of April, transaction fees paid by Cardano users totaled $9,000. This marked over a 90% decline from the $17,000 it recorded in fees on the 1st of January.

Data from Artemis showed that Cardano’s daily transaction fees peaked at $24,000 on the 11th of March and have since trended downward.

The decline in daily transaction fees on Cardano is due to the decrease in user activity on the network.

On-chain data showed that the daily count of unique wallet addresses interacting with Cardano reached a YTD high of 71,300 on the 6th of March and initiated a decline.

At 38,000 as of 14th April, Cardano’s daily active address count has since plummeted by 47%.

As the number of daily active addresses on the chain fell, the count of transactions completed on Cardano daily also dropped. Per Artemis, this has also decreased by 47% in the last month.

DeFi and NFT ecosystems suffer

The decline in Cardano’s user activity in the past few weeks has impacted its decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

Data from DefiLlama showed that the total value of assets locked (TVL) across the DeFi protocols housed within Cardano has fallen to a three-month low. At press time, this was $306 million.

The network’s TVL reached a YTD peak of $456 million on 15th March and has since declined by 33%.

Regarding its NFT sector, Cardano has witnessed a similar decline.

Per CryptoSlam, the network’s NFT sales volume has cratered by 39% in the last month, and total NFT sales transactions completed have dropped 46%.

Low demand for ADA as well

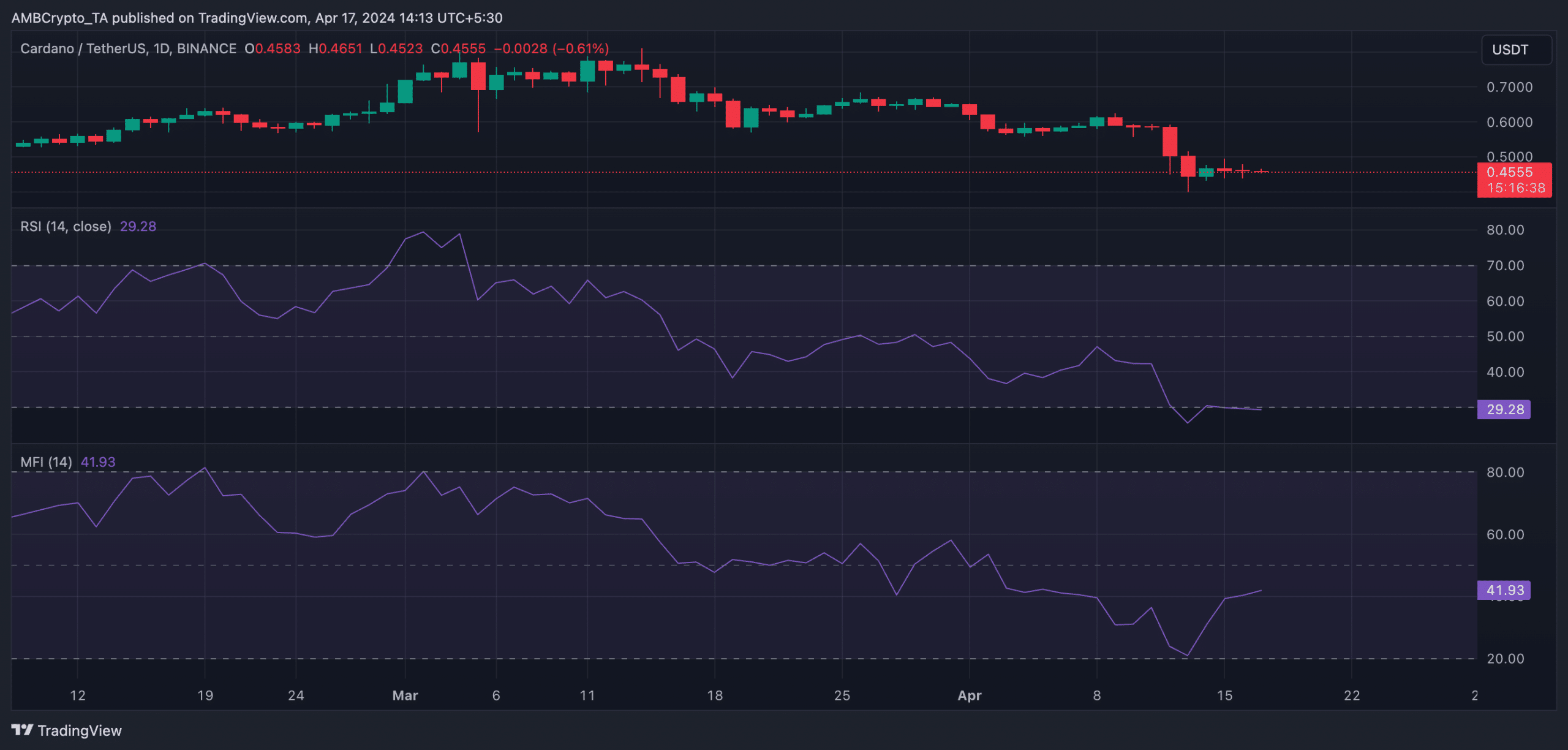

The network’s native coin, ADA, has not been spared from the decline. Exchanging hands at $0.45, the coin’s price has decreased by 21% in the last seven days.

The altcoin’s key momentum indicators, observed on a daily chart, revealed a significant decline. At press time, its Relative Strength Index (RSI) was 29.51, showing that it was oversold.

Read Cardano’s [ADA] Price Prediction 2024-25

Likewise, its Money Flow Index (MFI) trended downward at 41.94.

At these values, these indicators showed that selling activity outpaced coin accumulation.