Cardano’s price in crisis – Are whales REALLY buying the dip?

- ADA’s unrealized loss widened to 15.71% as of this writing.

- Whales weren’t buying ADA’s dip.

Cardano [ADA] had one of the biggest percentage of holders in losses among leading layer-1 (L1) networks, spurring concerns about its demand in the near term.

ADA under water

According to a recent X post by on-chain analytics firm IntoTheBlock, just about 35% of ADA’s holders were in profit, compared to 86% and 81% for Bitcoin [BTC] and Ethereum [ETH] respectively.

Ranked as the 10th largest cryptocurrency by market cap as of this writing, ADA has been rather lackluster on the price charts lately. The coin tanked 28% over the last month, and nearly 22% on a year-to-date (YTD) basis, according to CoinMarketCap.

ADA’s below par performance contributed to its steady slide in market rankings. Over the last month, it was surpassed by coins such as Dogecoin [DOGE] and Toncoin [TON] in valuation.

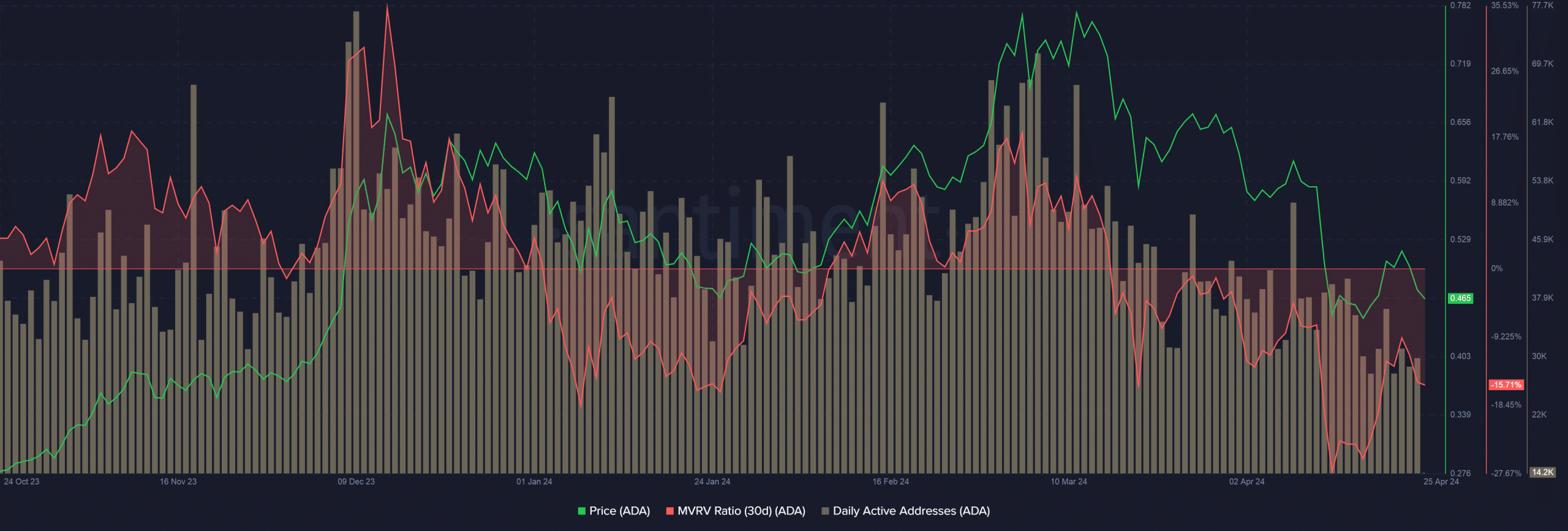

ADA hit an yearly peak of $0.77 around mid May but has trended lower since then. The slump caused the network’s average unrealized loss to widen to 15.71% at press time, AMBCrypto spotted using Santiment’s data.

Put simply, ADA holders on average would incur losses of 15.71% if they were to sell their coins at prevailing prices.

Another factor to note was that how the price decline impacted ADA’s on-chain activity. The daily active addresses plunged to 30,000, from more than 70,000 seen during the price peak.

Good time to stockpile ADA?

On a different note, subdued prices and low profitability may present opportunities for accumulation, as opposed to other coins which were seeing increased profit-taking.

But were investors really interested in buying ADA’s dip?

Read ADA’s Price Prediction 2024-25

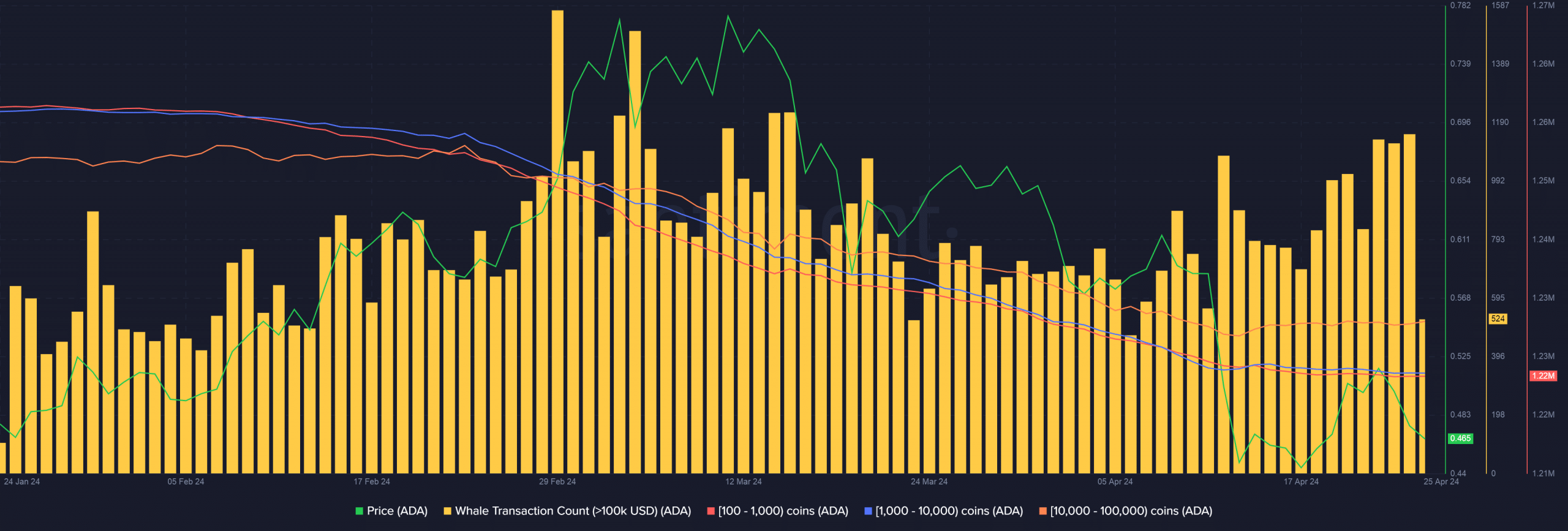

According to AMBCrypto’s analysis of Santiment’s data, the holdings of whale cohorts have consistently declined in the last 2-3 months, suggesting that they were net selling their ADA coins.

But if you’re a bullish ADA holder, you might take heart from ADA’s super cycle a year after the 2020 Bitcoin halving. If history gets repeated, ADA might challenge its all-time high (ATH) levels in 2025.