Cardano

Cardano in June: Is a bullish turnaround likely for ADA?

Cardano’s price is set to surge to $0.49 with the metrics signaling an accumulating bullish momentum.

- Cardano price to surge to $0.49 resistance zone from the building bullish momentum.

- Metrics indicate a growing bullish trend from increased whale activity and social volumes.

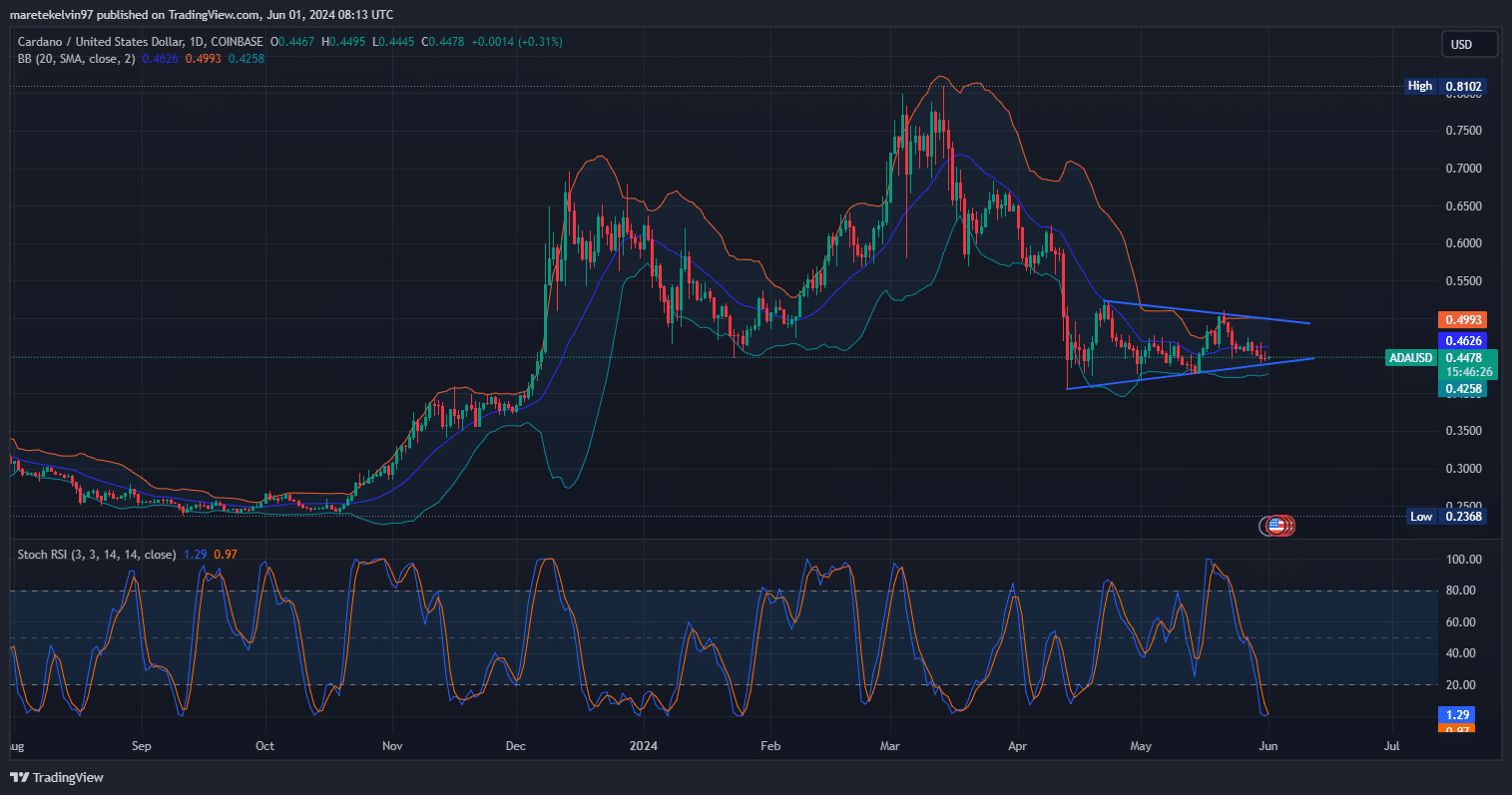

Cardano [ADA] price has been consolidating in a symmetric pattern in the last three months. The price is currently at a key support level at around $0.44 and the buyers are trying to push the price up at this key level to stop the price from further drops.

If the buying pressure is enough to hike the Cardano

price above the Bollinger band moving average line, then a surge to the symmetric triangle resistance level that has been tested twice in the past three months is likely.However, if the buying pressure is not enough to surge the price above the moving average, the bearish pressure is likely to breakdown the support level at around $0.44 and drop further to retest the next resistance in line at around $0.42.

The Stochastic RSI at 1.9 indicates an oversold in the market signaling a bullish momentum.

As of this writing, according to coinmarketcap, Cardano is currently priced at $0.44 indicating a 0.04% increase in the last 24 hours and a 3.44% decrease in the last 7 days.

The market volume stands at 35.7 billions ADA a 1.62% increase in the last 24 hours.

Cardano whales move in

According to AMBCypto’s analysis of Santiment data, ADA’s social volume had several spikes in early June, late March, mid April and late May.

These peaks indicate periods of heightened ADA social interest activity which may lead to a surge in ADA prices.

The Total Supply on Profit indicates a descending trends for the last three months. The Total Supply held by Whales with more than $5 million increased steadily for the last three months.

This suggests a strategic whales’ position for future buy options.

The increasing spikes in the social activities, decreasing profit of ADA holders and increasing accumulation of large investors over the past three months confluences for a buying zone that could accumate a buying pressure to the symmetric triangle resistance level.

Read Cardano (ADA) Price Prediction 2024-25

AMBCrypto further analyzed Long/Short Ratio data from Coinglass and data indicated a significant volatile market with frequent shifts in the market sentiment.

The Investors are actively buying and selling with neither taking control. Although, the whale activities may shift the market up from the building bullish momentum.