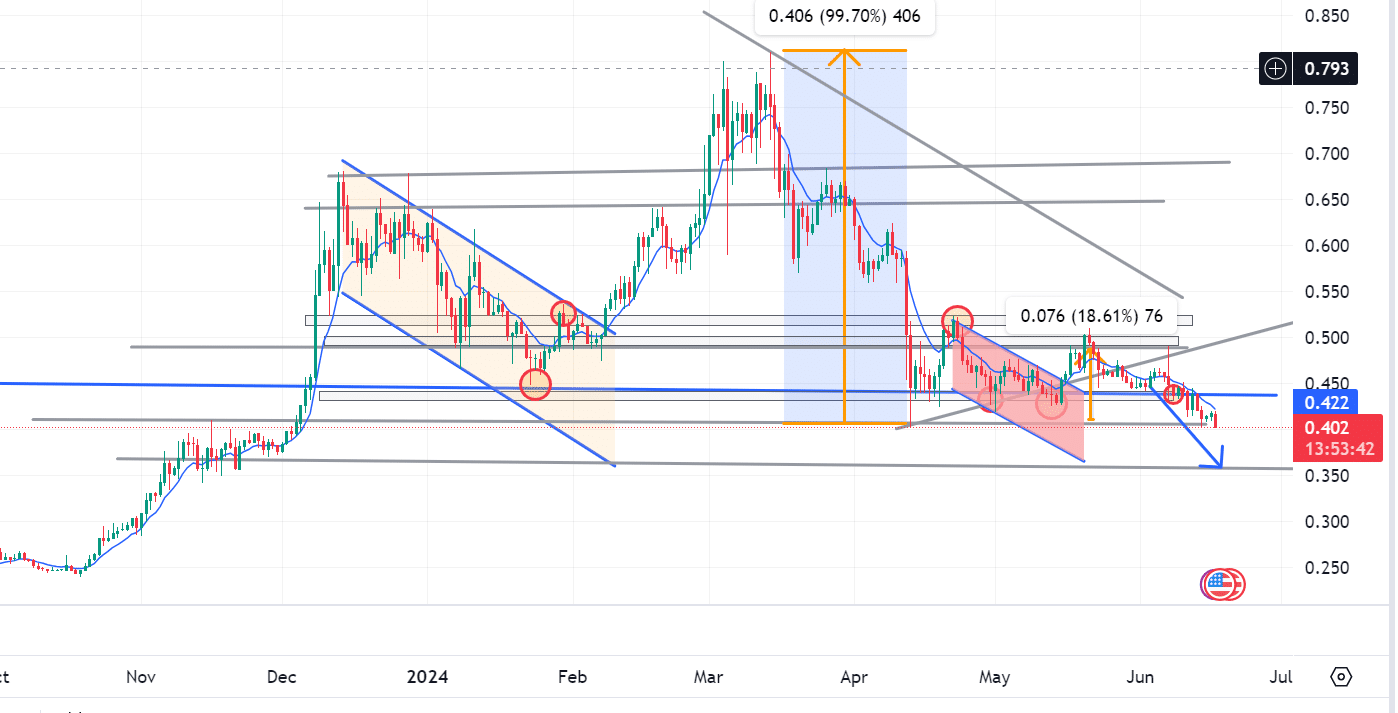

Cardano: Is ADA setting up for further decline below $0.406?

- ADA declines with 7.43% in & days With a strong bearish trend.

- Key indicators suggest a continued bearish bias as ADA attempts to create another support level.

Cardano [ADA] has been reporting a decline in the last 30 days. Over the last seven days, it has reported a 7.43% price decline. ADA was trading at $0.4074 at press time with a 24-hour volume increase of 15.32% to $213 million.

According to coinmarketcap, ADA has a market cap of $14.5b, a 1.13% increase in 24 hrs.

AMBcrypto’s analysis showed that ADA is set to breakdown. The move below $0.406 will create another support level.

A bearish bias will persist until the structure changes or another strong support is established. Thus, the current trade shows the market has a sustained bearish bias, which will remain until a support downward emerges at around $0.356.

If a reversal occurs at $0.403, the shift will drive prices to $0.487. However, the current market trend is bearish and seems sustained to continue.

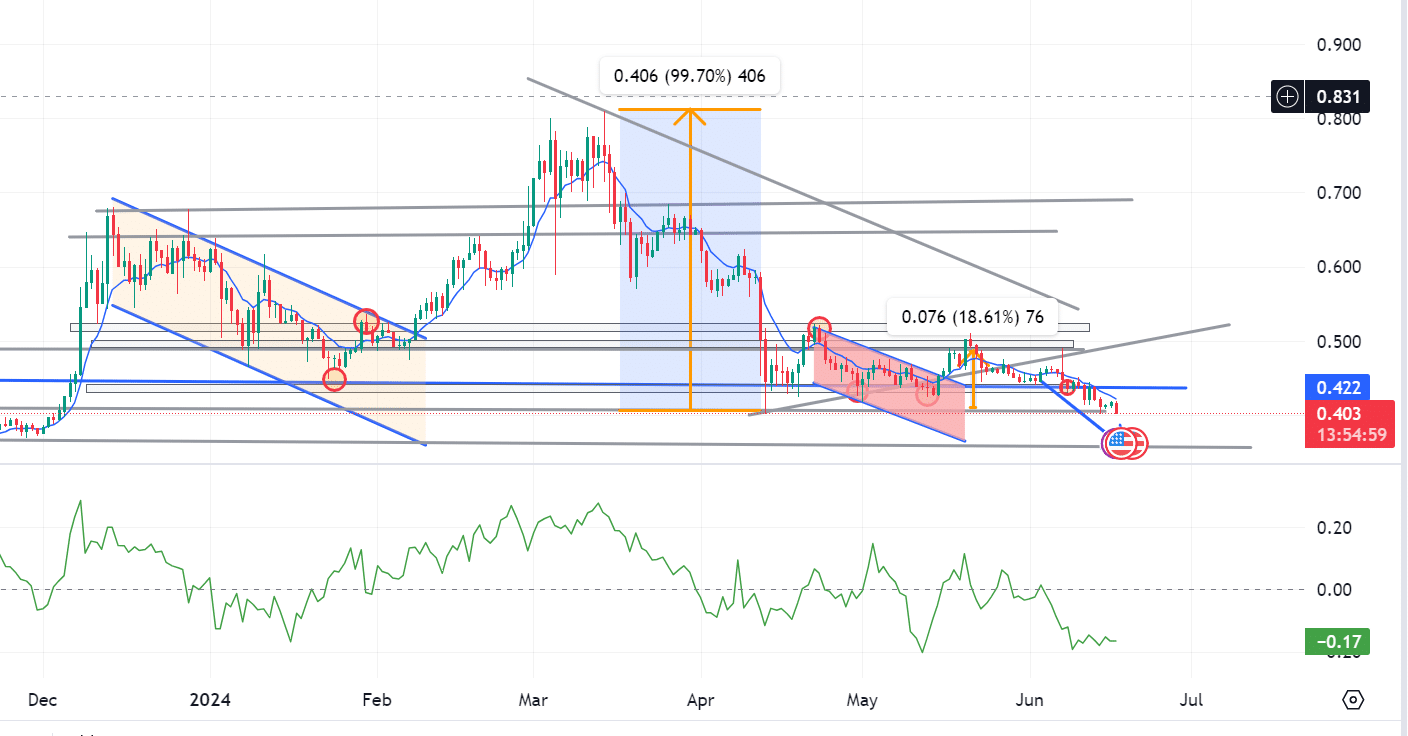

In fact, ADA has a negative CMf of -0.15 at press time, showing increased selling pressure. Generally, when there is a negative CMF, it implies a solid bearish trend that might continue.

With a higher selling pressure, prices decrease as there are more sell-offs than buying.

ADA market sentiments

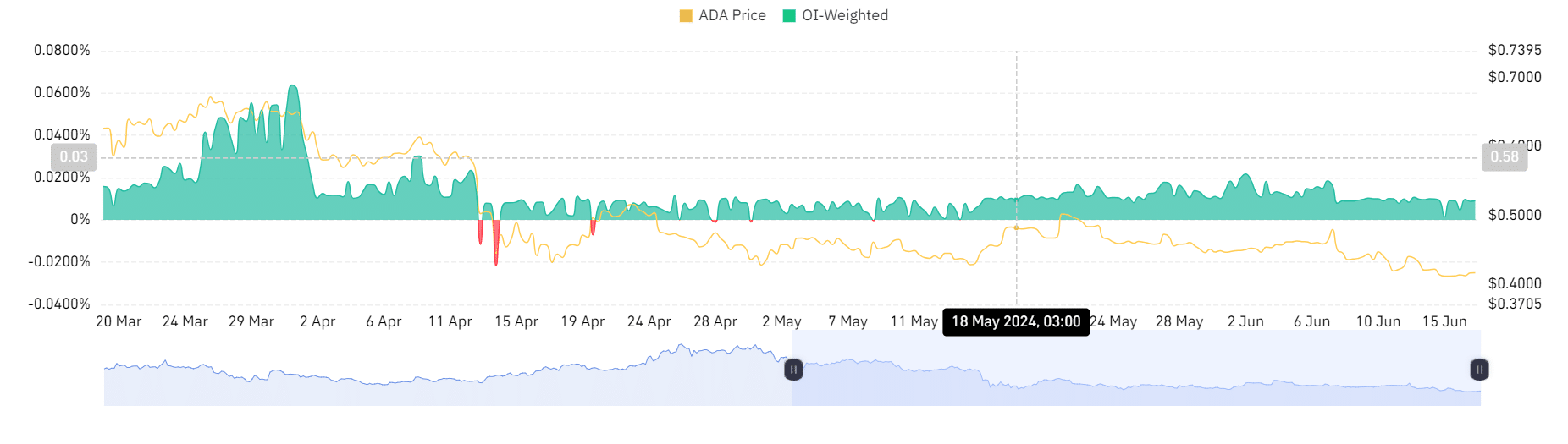

According to Coinglass, there is a reduced ADA-weighted funding rate. Generally, lower funding rates imply that shorts pay long positions, suggesting a bearish trend and sentiment.

When futures are trading at a discount to the spot, it puts downward pressure on prices.

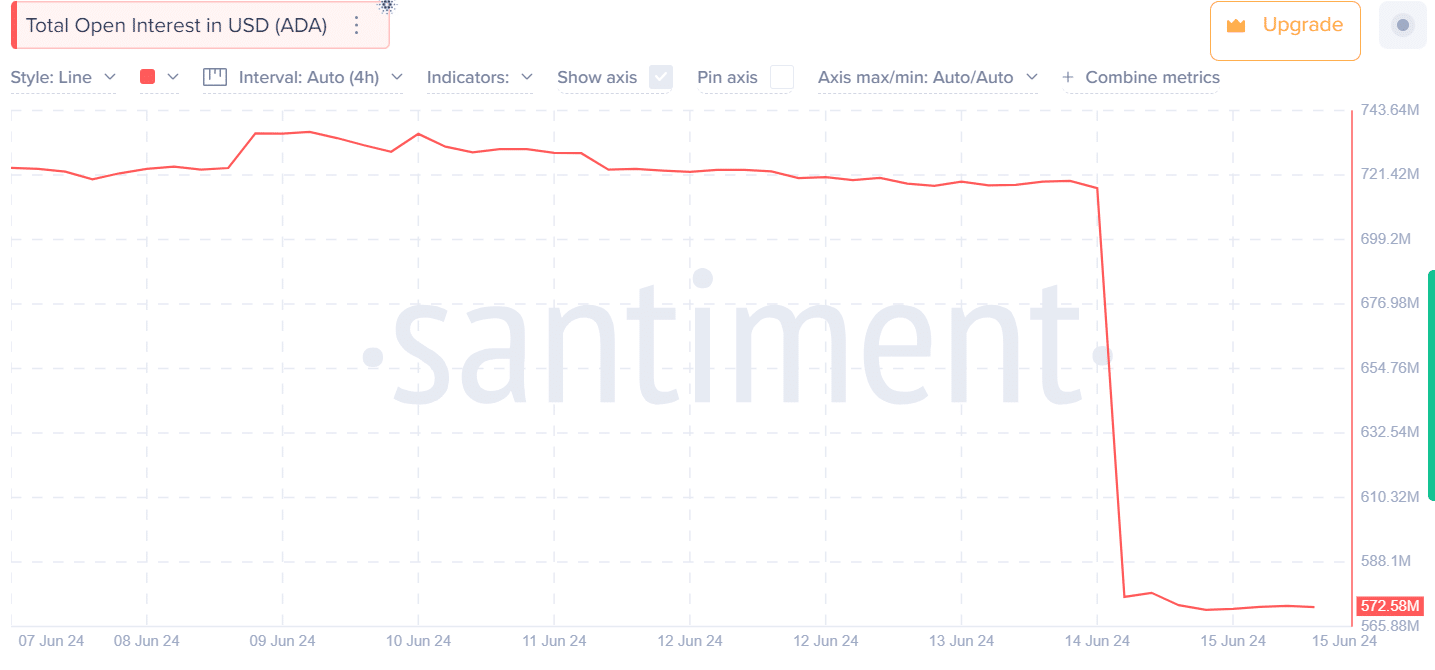

Equally, Santiment’s data on ADA”s total open interest in USD indicates reduced trading activity. Decreased open interest shows fewer trades in future markets, leading to thin order books.

Such a change in market sentiment leads to increased volatility in trading volumes. These changes imply a bearish trend as there’s forced liquidation.

How far can ADA fall?

Various indicators show that ADA is on a strong bearish trend. The breakdown below the local weak support level of $0.403 will cause the bearish bias to persist.

Is your portfolio green? Check out the ADA Profit Calculator

However, with a structure change or establishment of a new level, the market will experience a reversal.

In this sense, a potential reversal can push the market to $0.489 while creating a new resistance level of $0.505. However, until the structure changes, the trend will remain bearish.