Cardano is in a strong uptrend – Can the bulls push it to May highs?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ADA has a strongly bullish market structure.

- The move above $0.3 was a sign that further gains were likely, with the next major resistance zone near $0.4.

Cardano [ADA] noted a lackluster performance on-chain in Q3 2023. A decline in active addresses and transaction count meant the network revenue decreased by 30%. Investors can take heart in the fact that development activity was the highest among crypto projects in October.

Read Cardano’s [ADA] Price Prediction 2023-24

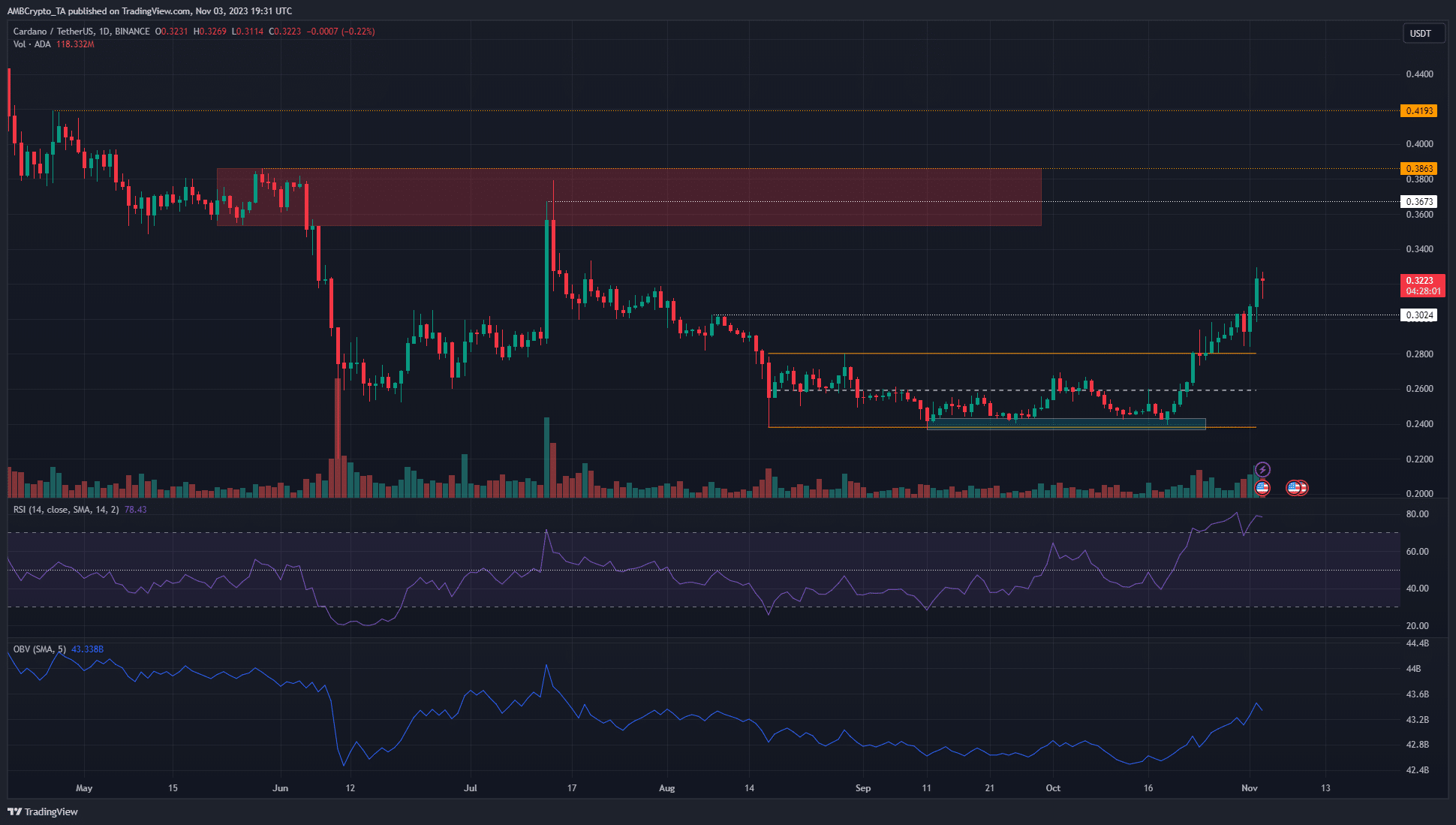

The price chart of ADA revealed a breakout past a lower timeframe range and a subsequent retest as support. This was at $0.28, and the price stood at $0.322 at press time.

The space between $0.3 and $0.39 could be quickly traversed

The one-day chart of ADA showed that the $0.3 level was a vital resistance level since June. It was temporarily flipped to support in mid-July but the bears won it back in August.

Over the past few days, the $0.3 zone has been flipped to support once more.

The market structure was bullish and the RSI reflected strong upward momentum with a reading of 78. The On-Balance Volume has been on the rise in the past three weeks as well.

To the north, there was a bearish order block (red) at $0.38 from the one-week timeframe.

The $0.3-$0.32 was also a resistance zone but ADA bulls have shifted it to a demand zone. Therefore, the next week or two could see the token climb to the aforementioned resistance zone.

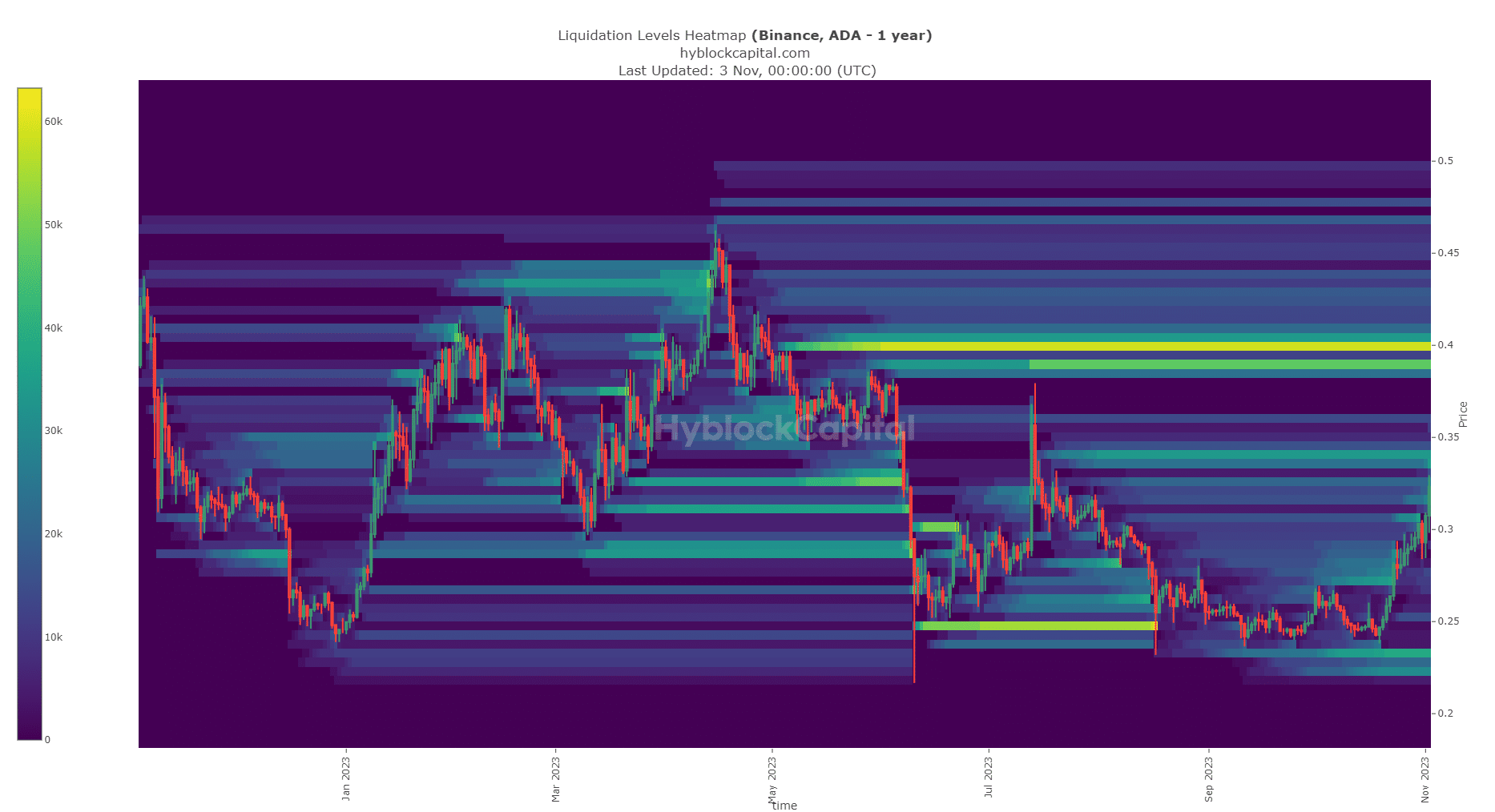

The liquidation levels heatmap lined up with the order block and the lower timeframe sentiment remained bullish

Source: Hyblock

The liquidation levels heatmap highlighted the $0.34, $0.39, and $0.4 levels as places where a large number of liquidations could be hit. The $0.42 level was also a point of interest. ADA had tested it as support multiple times in 2022.

Is your portfolio green? Check the ADA Profit Calculator

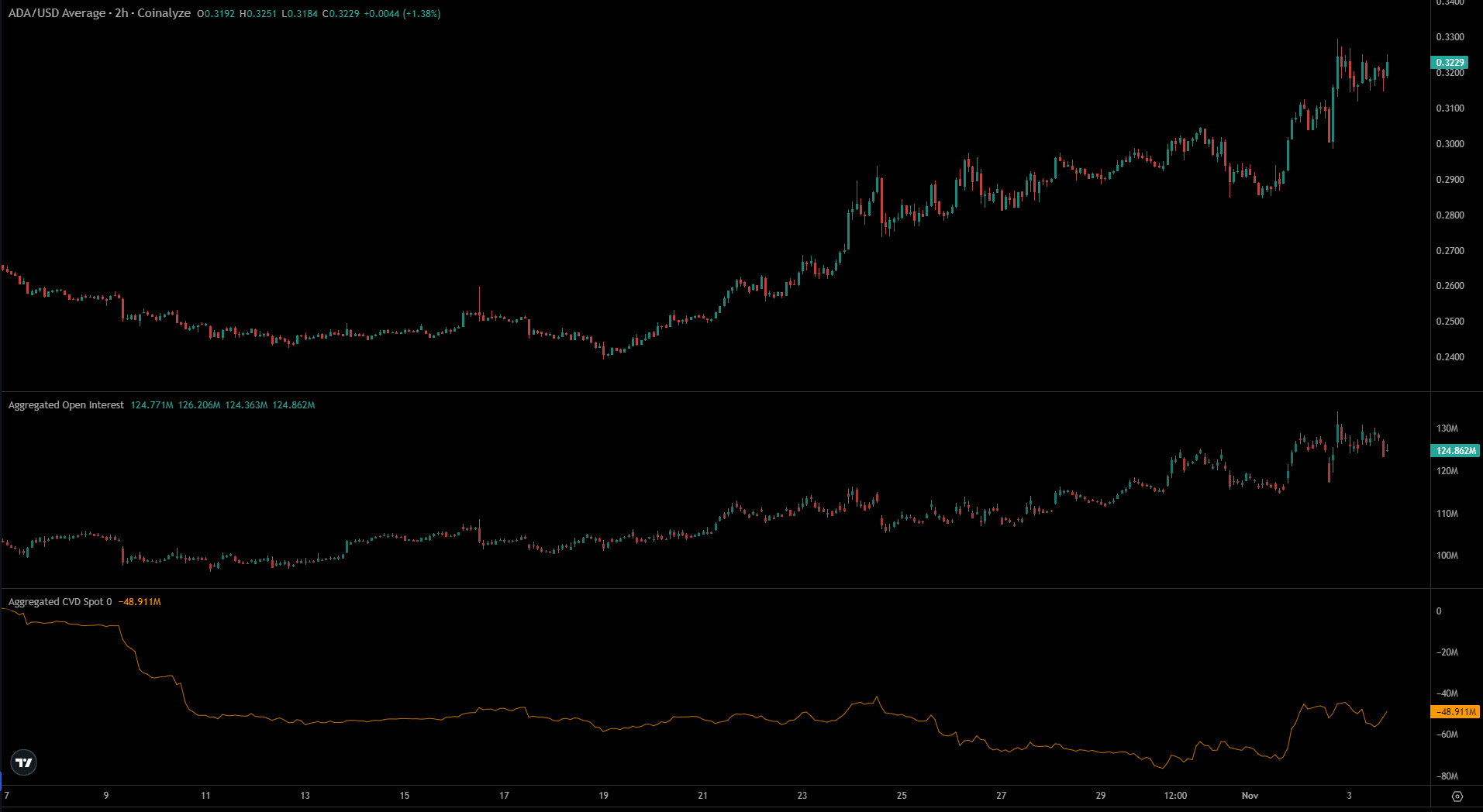

Source: Coinalyze

The Open Interest (OI) trended higher over the past week, although it did see large dips due to the price volatility. Overall, the price and OI trended higher to indicate bullish sentiment amongst speculators.

The spot CVD also jumped higher in November to signal increased demand for ADA in the market. Therefore, the lower timeframe bias was bullish and a move toward $0.38 was feasible.