Cardano – Mapping ADA’s road to $1.40 on the charts

- Cardano’s breakout and bullish patterns target $1.40, with resistance at $1.20 crucial.

- Market sentiment and rising active addresses reinforce $ADA’s bullish momentum and sustained growth.

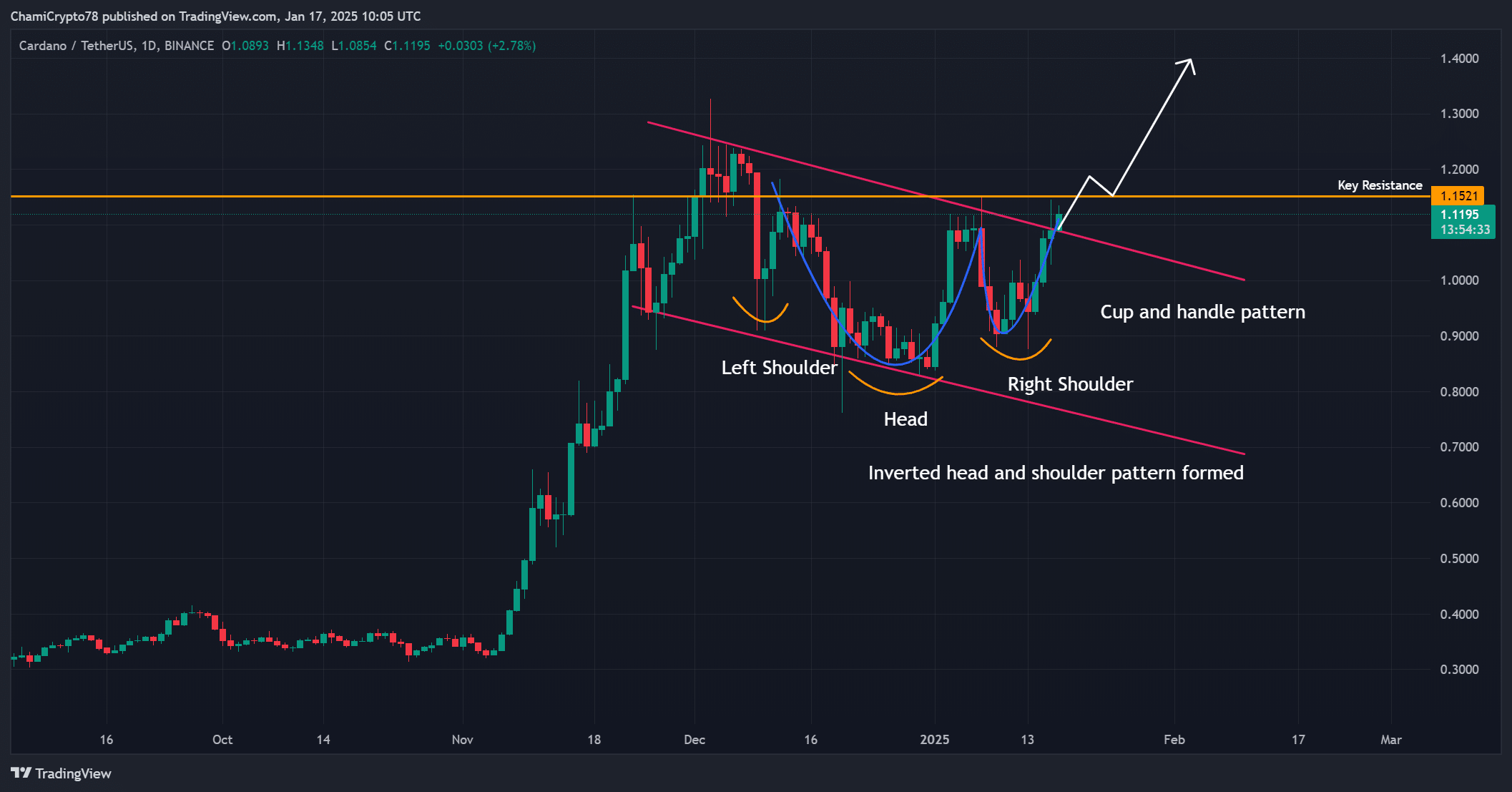

Cardano [ADA] has recently broken out of a bullish flag pattern on the daily timeframe, signaling the potential for further gains. At press time, ADA was trading at $1.12, reflecting an impressive 7.11% increase over the last 24 hours.

The chart shows additional bullish patterns, such as a cup-and-handle and an inverted head-and-shoulders formation. These patterns further support the possibility of an extended rally.

If ADA manages to surpass the $1.20 resistance level, it could set its sights on $1.40, a key psychological milestone.

Is Ripple’s stablecoin partnership driving ADA’s momentum?

The announcement of a potential Ripple RLUSD stablecoin partnership with Cardano has stirred optimism among investors.

Charles Hoskinson, Cardano’s founder, emphasized the importance of stablecoins in the ecosystem, referring to ongoing discussions about integrating RLUSD.

XRP’s most recent rally in the market may be fueling this sentiment, indirectly supporting Cardano’s price action. Additionally, this partnership, if confirmed, could significantly enhance Cardano’s DeFi capabilities and attract even more interest from developers and users alike.

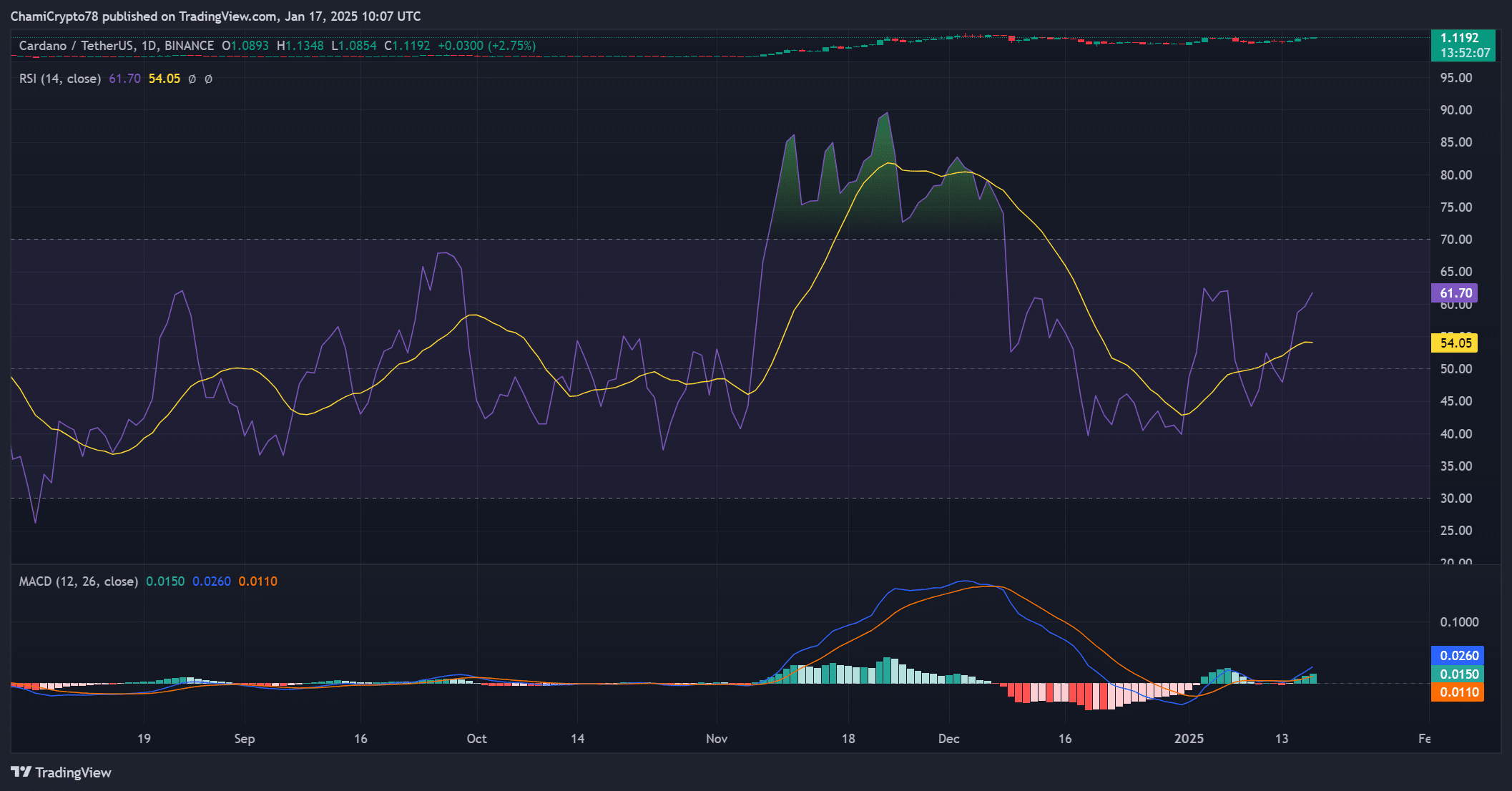

Technical indicators suggest further upside potential

Key technical indicators boost confidence in Cardano’s bullish outlook. The RSI stood at 61.7, showing strong upward momentum while staying below overbought levels.

Additionally, the MACD showed a bullish crossover, confirming growing buying pressure. These indicators align with breakout patterns, suggesting ADA’s rally could persist in the coming days.

If the momentum continues, surpassing $1.20 could pave the way for a significant price surge.

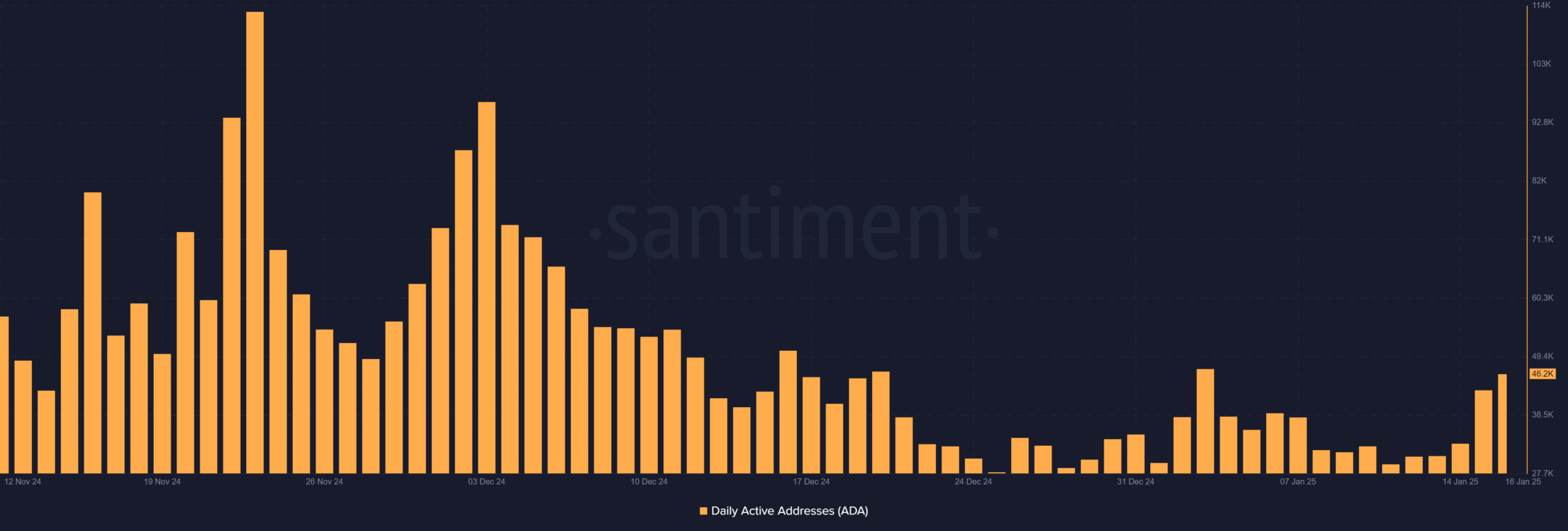

ADA rising active addresses highlight network growth

Cardano’s on-chain activity is another bullish signal, as daily active addresses have steadily increased. On the 16th of January, over 46,000 active addresses were recorded, reflecting heightened network usage.

This steady rise in participation demonstrates increasing confidence in Cardano’s ecosystem and its potential to deliver long-term value.

Therefore, network growth could serve as a crucial driver of price sustainability in the ongoing rally.

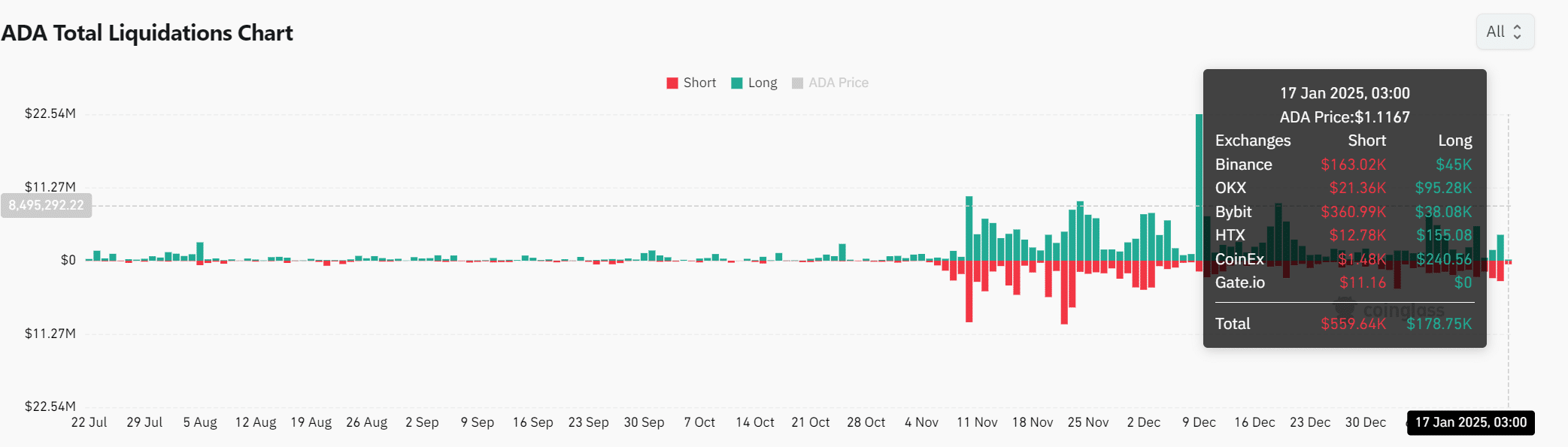

Market sentiment points to a bullish conviction

Read Cardano’s [ADA] Price Prediction 2023-24

Will Cardano hit $1.40?

Cardano’s breakout, coupled with bullish technical indicators and rising on-chain activity, suggests the rally has strong momentum. Additionally, the potential Ripple partnership adds further credibility to its long-term prospects.

Therefore, $ADA appears well-positioned to reach $1.40, provided it clears the $1.20 resistance in the coming days.