Cardano: Most ADA transactions result in losses because…

- Nearly all ADA transactions were realized losses since 22nd April.

- Entries for the cryptocurrencies stood between $0.40 and $0.44.

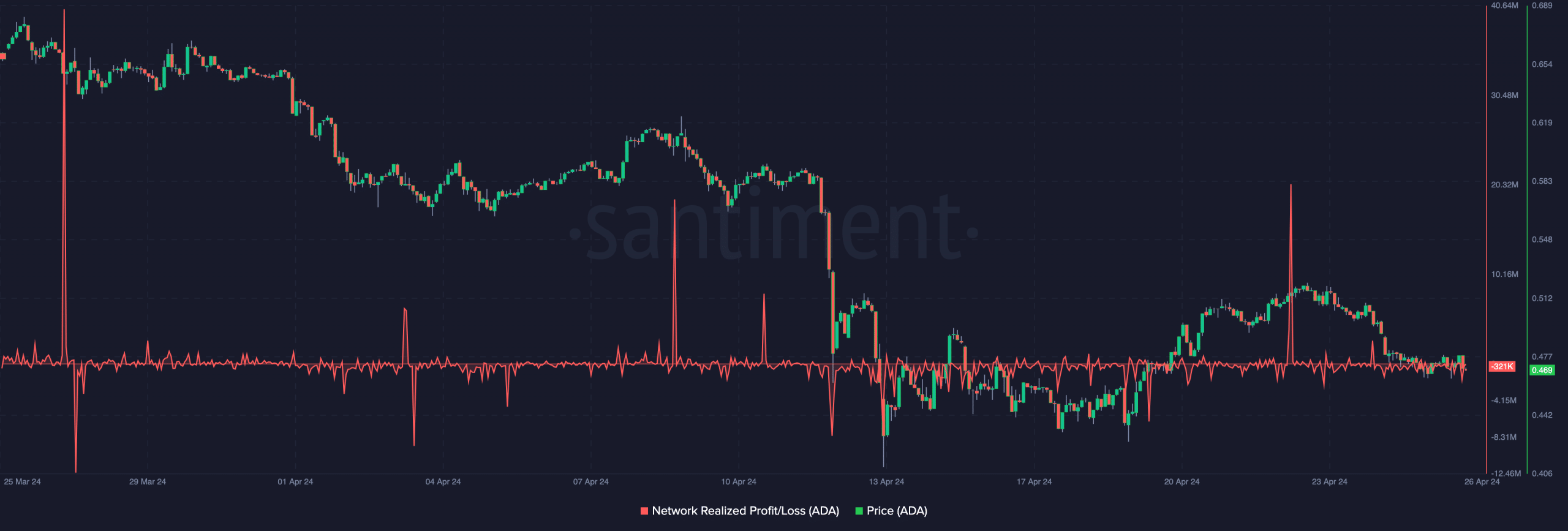

This week, almost all Cardano [ADA] transactions ended up with participants realizing losses, AMBCrypto confirmed. Before this conclusion, we looked at the Network Realized Profit/Loss.

This metric measures the USD value of transactions in gains or otherwise within a specific period. From our analysis, the last time ADA made participants a good amount of money was on 22nd April. At that time, $19.78 million worth of the token did not have to be sold at a loss.

But as of this writing, ADA tokens, valued at $321,000, had realized losses within the last month. This action was a reflection of the cryptocurrency’s price action.

No money for now

Five days ago, Cardano’s price was $0.52. At press time, that value had decreased to $0.46, indicating that it was challenging to make profits off spot trading the token.

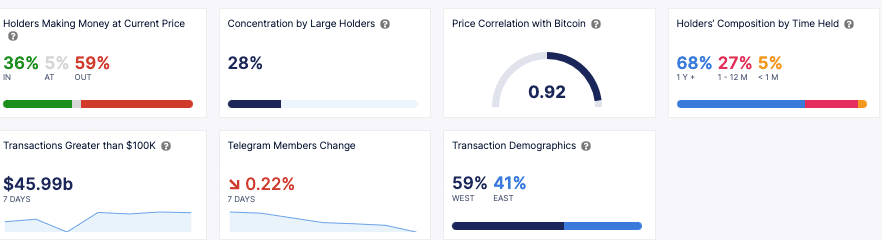

However, short-term holders are not the only ones affected by ADA’s movement. A few weeks ago, less than 50% of holders were at a loss. According to press time data from IntoTheBlock, 59% of the total holders were out of the money.

On the broader spectrum, this could suggest a buying opportunity considering that many holders might not want to liquidate their holdings without any profit.

If this is the case, more accumulation might take place, and this might leave Cardano with a potential upside. On the other hand, if a part of the holders decide to forfeit what was left, ADA’s price might fall to $0.44.

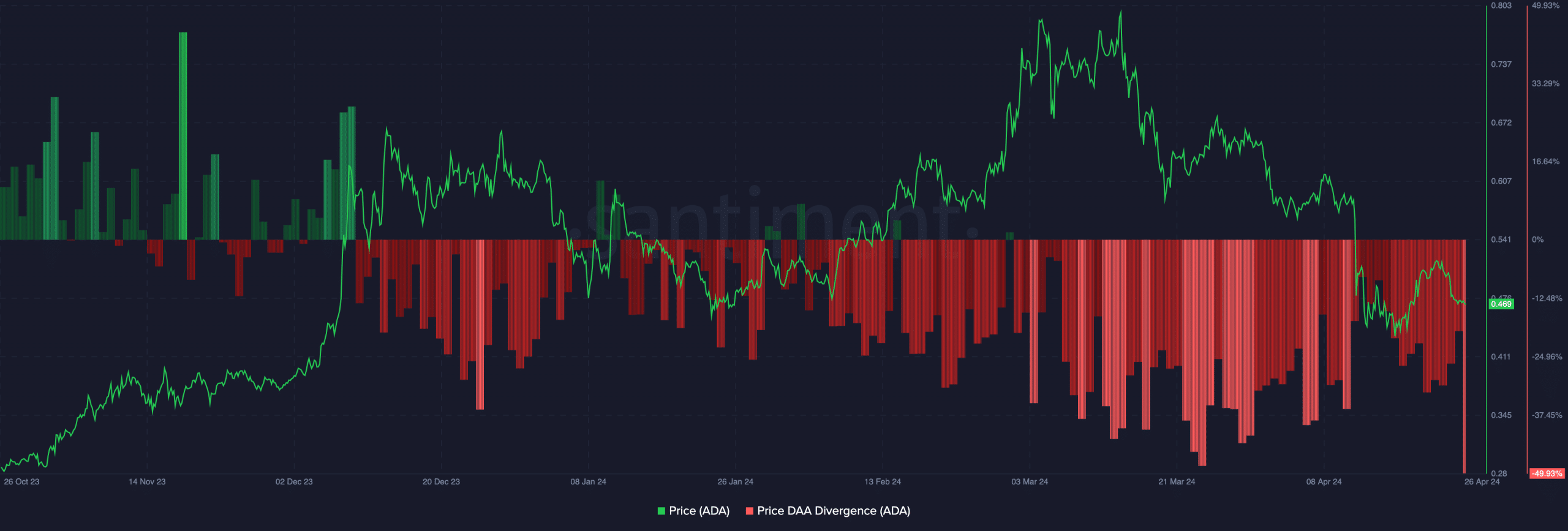

But is this a good time to consider buying ADA? Well, AMBCrypto’s analysis of the price-DAA divergence gives an idea of that. For the unfamiliar, DAA is an acronym for Daily Active Addresses. It shows the daily level of user activity on a blockchain.

Signal screams: Prepare for another exit!

Using Santiment’s data, we observed that the price-DAA divergence was -49.99%. With the metric, traders can develop a trading strategy that has proven to be valid historically.

In past cycles, if the price grows more than the DAA, it means it is time to buy. On the other hand, a strong exit sign appears if the price declines more than the DAA.

One thing we noticed was that Cardano’s DAA jumped within the last few days ADA’s price decreased. Therefore, one can conclude that a solid buying opportunity has not appeared yet.

Concerning the price, ADA might drop below the $0.45 psychological support in the short term. Should this be the case, market participants might need to find other entry spots between $0.40 and $0.44.

Is your portfolio green? Check the Cardano Profit Calculator

Despite the potential drawdown, Cardano’s rebound might still be possible in the mid-term. But that would depend on altcoin’s performance.

Should the prices of the cryptocurrencies bounce around the same period, ADA might rise and break $0.60 one more time.