Altcoin

Cardano: Network activity rises while ADA plummets – what next?

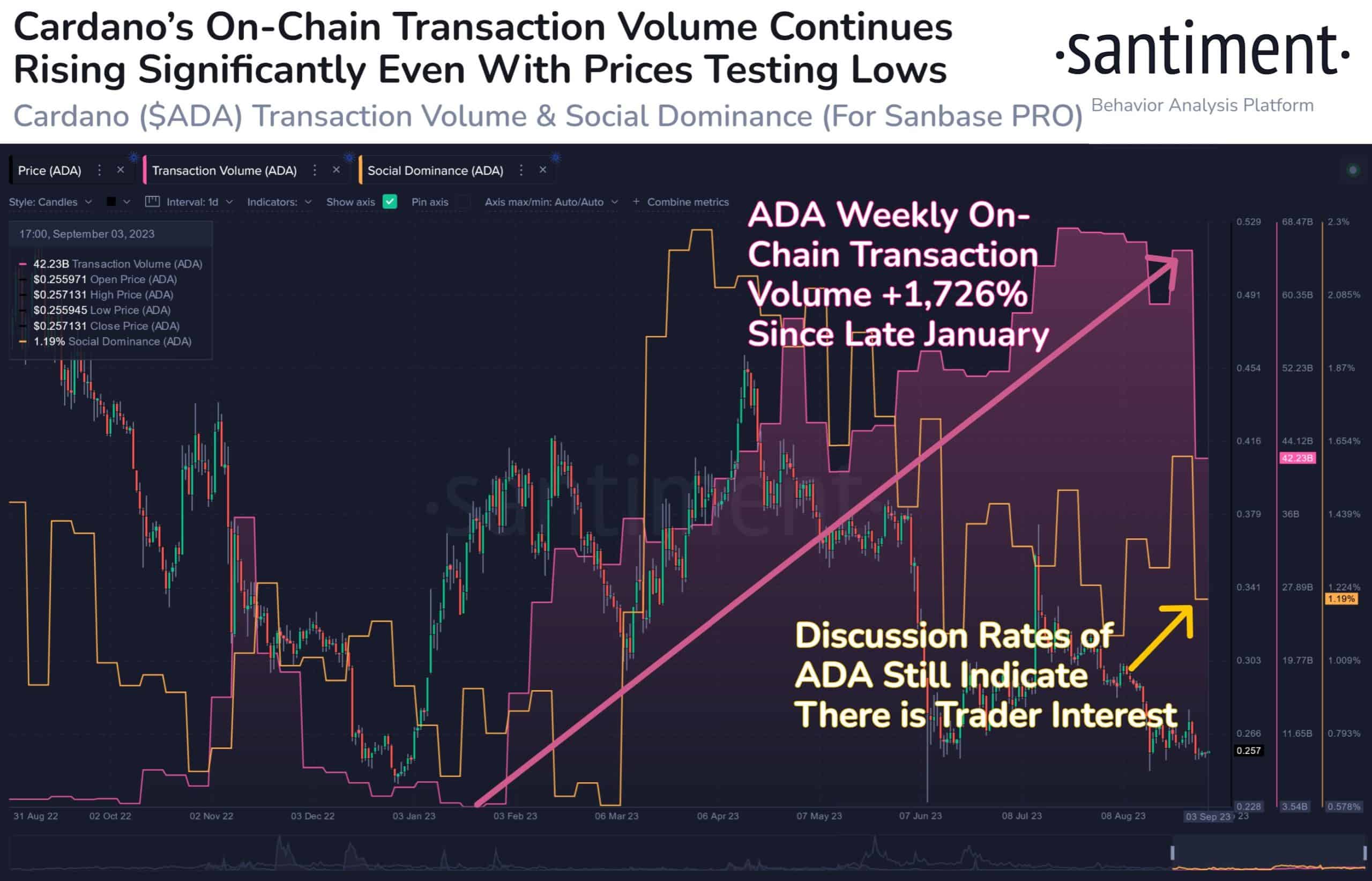

Despite Cardano’s sharp retracement from April peaks, the network’s transaction volume continued to push to new highs.

- Cardano’s weekly transaction volume exploded 1,726% since late January.

- Despite these developments, the network was highly overvalued.

While the bout of volatility in the crypto market was welcomed, there were more tears than cheers for participants looking to profit from price increases.

Read Cardano’s [ADA] Price Prediction 2023-24

Much like the rest of the market, Cardano [ADA] shed a considerable chunk of its value over the past month. At the time of writing, ADA exchanged hands at $0.2565, representing a monthly drop of 12.6%, per CoinMarketCap

data.On a slightly longer timeframe, things looked grimmer. From its yearly peak of $0.45 in mid-April, ADA has almost halved. Interestingly, the decline in market value didn’t restrict ADA’s network activity.

Transaction volume shows promise

According to on-chain analytics firm Santiment, ADA’s on-chain transaction volume witnessed parabolic moves in 2023. The weekly volume has exploded 1,726% since late January, indicative of the network’s increasing utility.

Industry experts have maintained that mainstream crypto adoption in the future would hinge around network activity. So, even though ADA’s value being underwhelming was a concern, the impressive transaction activity was a good sign for decentralized finance (DeFi) and non-fungible token (NFT) investments.

Additionally, the proof-of-stake (PoS) token generated a substantial amount of social buzz, as evidenced by the rising social dominance. For the uninitiated, social dominance compares a coin’s mentions on cryptocurrency-focused social media to the top 50 most-talked about projects.

Is ADA still overvalued?

During its life span, Cardano has been often accused of being an overvalued network, or worst a “ghost chain” where nothing is happening. A better idea could be gained by looking at the Network Value-to-Transaction (NVT) ratio. The ratio is obtained by dividing the market cap by the unique ADA exchanged on the chain daily.

As per Santiment, ADA’s NVT ratio has been charging upwards over the last month. A higher value implied that ADA was overvalued relative to its on-chain transactions. This could prove to be a bummer for certain investors who prefer to bet on projects that are undervalued.

How much are 1,10,100 ADAs worth today?

Moreover, when compared to other L1 chains, Cardano’s total value locked (TVL) was abysmally low at $190.23, according to DeFiLlama. Since Cardano was one of the top assets in terms of market cap, the resultant market cap to TVL ratio was extremely high, indicating that the asset was severely overvalued.