Analysis

Cardano: Why a 10% hike is NOT impossible for ADA

Indicators point towards the possibility of increased demand for ADA in the coming weeks.

- Cardano fell beneath the $0.5 support on 8th January.

- The bulls were quick to drive a recovery, and some more gains are possible.

Cardano [ADA] has a strong bullish outlook on the lower timeframe price charts. Its recovery from the $0.48 area and the retest of the same as a demand zone was impressive. It set the token up for a rally toward the range highs.

In other news, the launch of the Cardano USDM stablecoin has been postponed. This development could hurt the credibility and value of the project in the eyes of investors.

The H4 order block saw a resounding bullish reaction

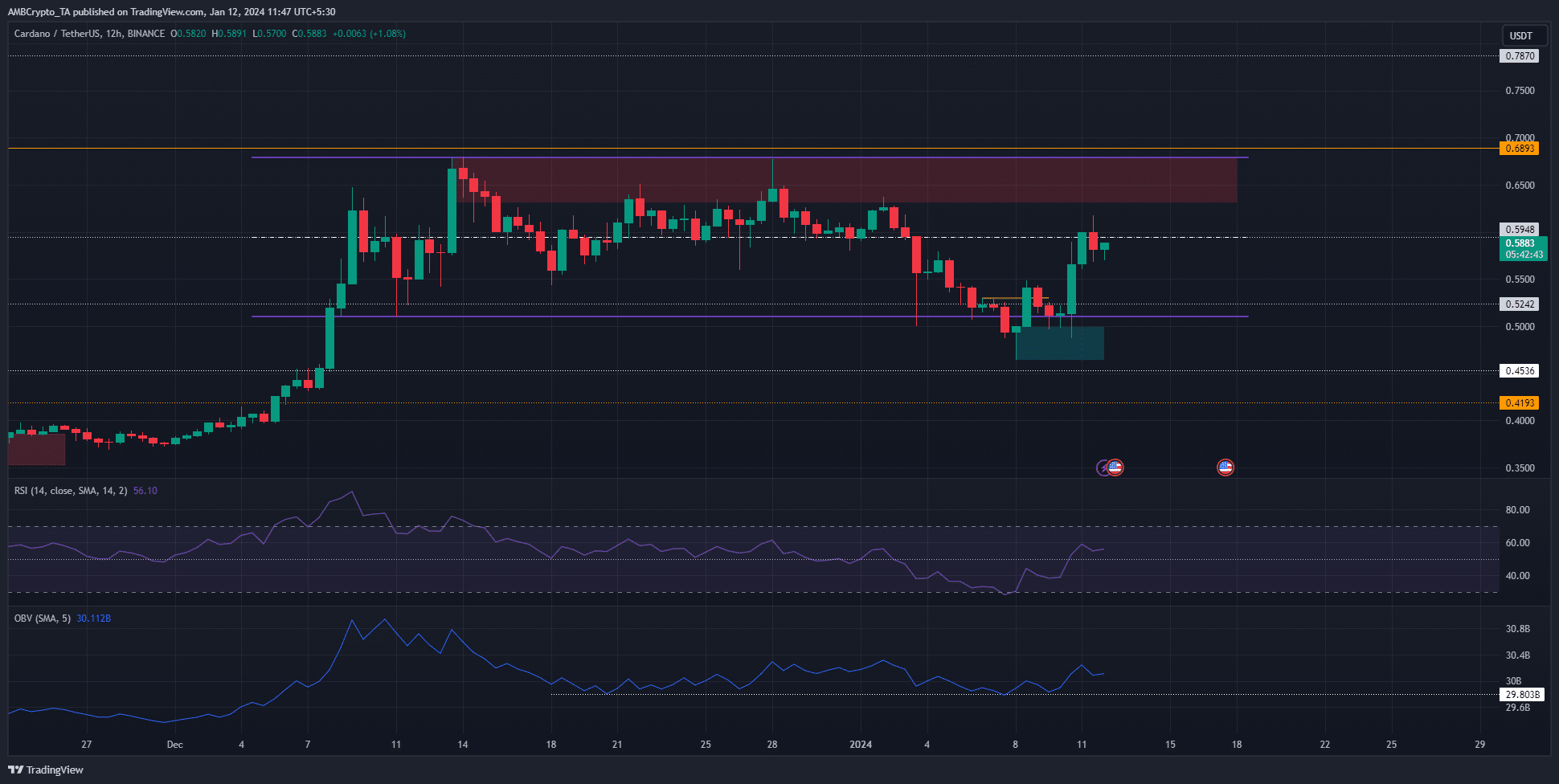

The 12-hour chart above showed that the market structure was bullish. It broke the previous bearish structure on 8th January when prices climbed above $0.5298.

Additionally, ADA continued to trade within the range (purple) that extended from $0.511 to $0.679.

AMBCrypto looked at the 4-hour chart to understand the impulse move from the $0.48-$0.5 zone. The H4 chart showed a bullish order block in the $0.464-$0.5 zone. After the market structure break, ADA retested this block on 10th January.

The prices proceeded to rally 26% after the retest and fell slightly over the past 20 hours. Just above the mid-range mark at $0.595 is a large supply zone that ADA bulls struggled with since 20th December.

Therefore, bulls expecting a retest of the range highs must be cautious. Traders can look to take partial profits above the mid-range mark. They could exit their long positions upon a move into the $0.65 bearish order block.

The daily active addresses resumed its uptrend

Source: Santiment

The development activity has ticked higher again after the festive season. The realized market cap also remained high, which suggested that there would be significant resistance to downward price pressure. This was evidenced during the bounce from the $0.48 area too.

Is your portfolio green? Check the ADA Profit Calculator

The MVRV ratio fell to near zero and highlighted that selling pressure from profit-taking activity could be minor going forward.

The daily active addresses trended lower in the latter half of December but resumed their ascent in January. This pointed toward the likelihood of increased demand for ADA.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.