Cardano

Cardano price prediction: Assessing the impact of $0.88 on ADA’s trajectory

ADA’s price remains at a critical juncture, testing key support with mixed market signals.

- ADA’s $0.88 support level remains pivotal as technical indicators hint at a potential rebound.

- Market sentiment shows indecision, but a breakout above $0.88 could ignite bullish momentum.

Cardano [ADA] continues to face volatile market conditions, leaving traders on edge about its future trajectory. At press time, ADA was trading at $0.8811, down 1.12% in the last 24 hours.

This decline highlights the importance of key metrics and technical levels in shaping its next move.

ADA price action analysis

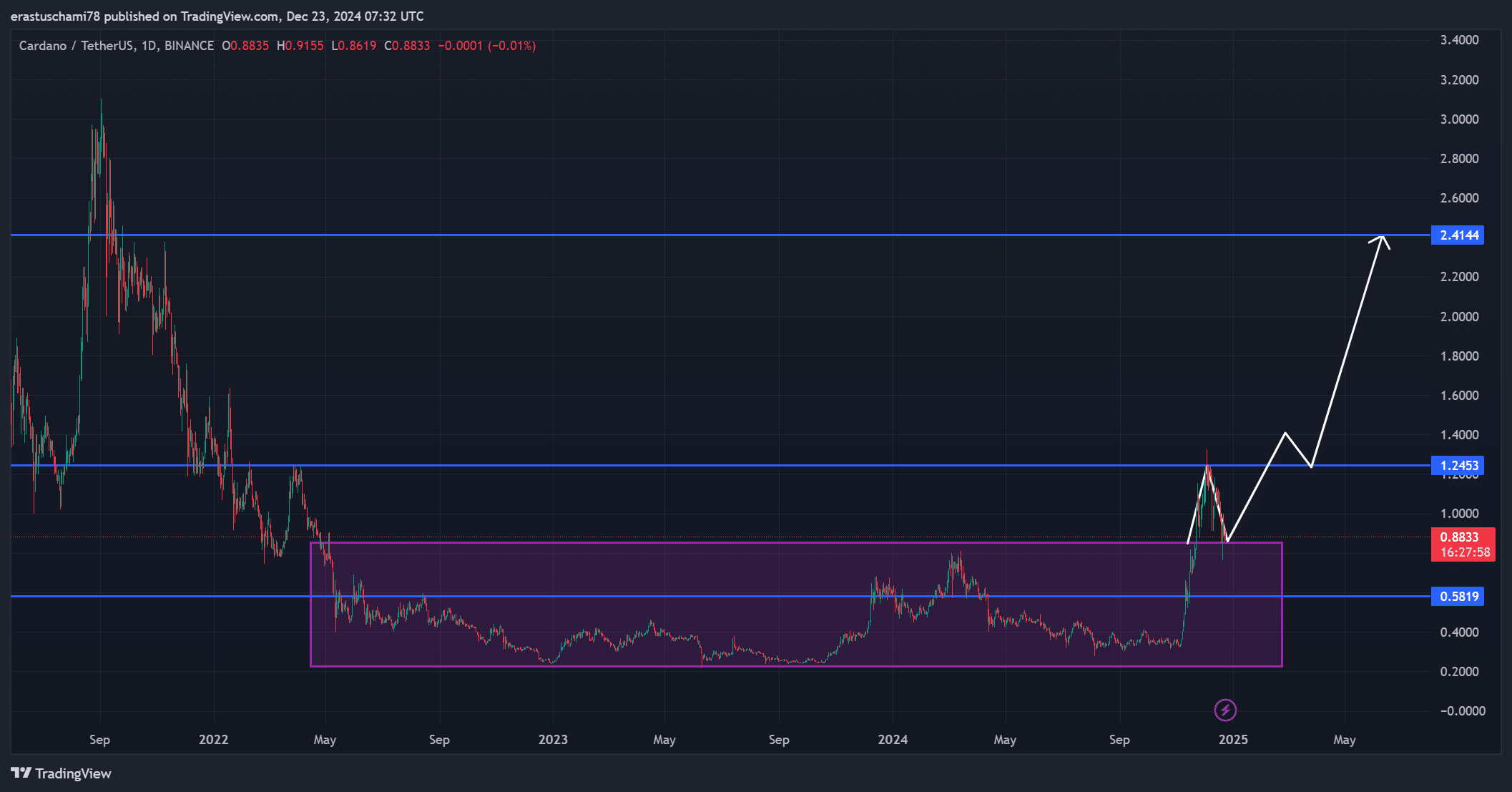

Cardano’s price shows a critical interplay between consolidation and breakout phases. After spending much of 2023 within the $0.58-$0.88 range, ADA surged toward $1.25 earlier this year, only to face rejection at this resistance.

Now back near $0.88, this level serves as a vital support zone. If ADA holds here, it could stage a recovery toward $1.25, eventually targeting the $2.41 mark if momentum builds.

However, a failure to sustain this level might lead to a pullback to the $0.58 range. Therefore, ADA’s ability to maintain support at $0.88 will be pivotal for its price direction.

Analyzing ADA’s social metrics

ADA’s social dominance shows a slight uptick, rising to 1.08%. While not a massive increase, it reflects growing interest and discussions around Cardano among the crypto community.

Historically, higher social engagement often correlates with price movements. Additionally, consistent social dominance could signal renewed investor confidence, further aiding price action.

Technical indicators hint at potential reversal

The RSI currently reads 41.29, indicating ADA is nearing oversold territory. This metric often signals an upcoming price rebound, as selling pressure eases and buyers regain control.

Meanwhile, the MACD shows bearish momentum, but its histogram suggests the bearish trend could be weakening. A potential crossover in the MACD lines might further confirm a shift to bullish sentiment. Therefore, close monitoring of these indicators will be essential.

ADA long/short ratio and market sentiment

The long/short ratio for ADA sits at 0.9936, with short positions slightly edging out longs at 50.16%. This near-equal distribution reflects market indecision.

However, any break above $0.88 could see long positions increase as traders anticipate a bullish breakout. Conversely, failure to maintain support could strengthen bearish sentiment.

Read Cardano’s [ADA] Price Prediction 2023-24

ADA’s future hinges on its ability to hold the $0.88 support level. If it does, a bounce toward $1.25 is likely, with the potential to reach $2.41 in the coming months. However, a breakdown could see it retest $0.58, delaying any bullish recovery.

For now, Cardano remains in a critical phase where patience and key level monitoring are essential.