Analysis

Cardano price prediction: Is a $0.5 rally still possible for ADA in July?

Since the $0.39-$0.4 liquidity cluster has been swept, and liquidity attracts prices, a bullish move from here on was possible.

- Cardano has a short-term bearish structure after falling below the $0.4 level.

- Despite mounting sell pressure, there’s a chance of a price move toward $0.5 in the coming weeks.

Cardano [ADA] fell below a key support zone as highlighted in a recent analysis. In doing so, they revealed what the sentiment was like and that the bears were likely dominant. But just how dominant?

AMBCrypto looked closer at the price action and liquidity pools to assess where ADA is likely headed next. Here’s what we found, and what traders can use to plan their next moves.

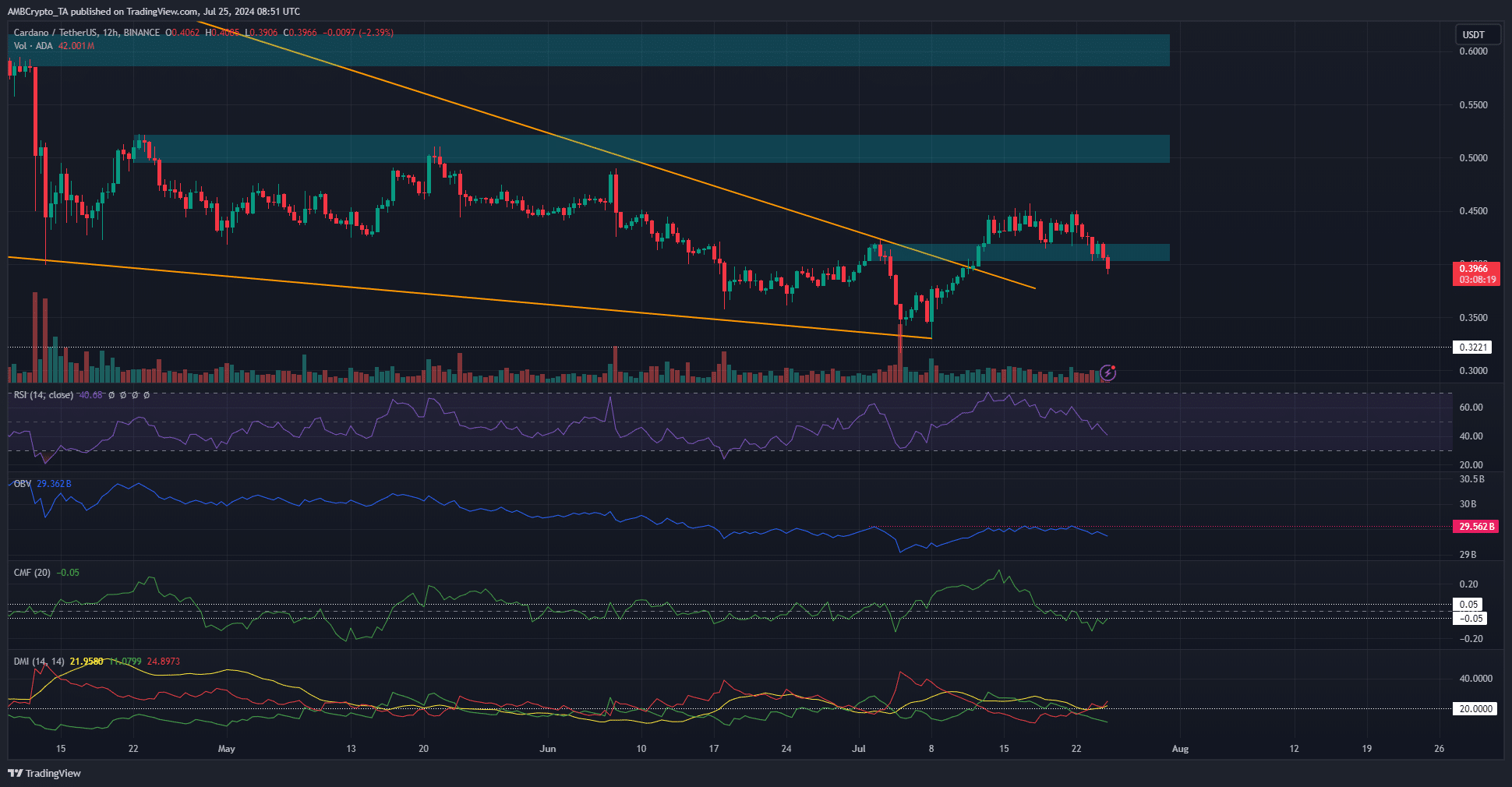

Daily breaker block fails to halt the sellers

At the $0.4 zone, a bullish breaker block was identified as a demand zone for ADA. In the past few days of trading, it held briefly as support but has given way at press time.

A daily session close below $0.402 will be a bearish signal.

This came after the breakout past a long-term falling wedge formation. The expectations for the Cardano price was a strong uptrend, but the DMI showed that a strong bearish trend was underway, with both the -DI and ADX below 20.

The OBV was unable to breach a local resistance and the CMF was below -0.05 to reflect heavy capital flow out of the markets. The RSI was below neutral 50 to indicate bearish momentum was rising.

An argument for the bearish trend to reverse

Source: Hyblock

The technical indicators and price action outlined little hope, but the liquidation heatmap offered some. The magnetic zone of liquidation levels at the $0.46-$0.48 region could attract prices toward them.

Is your portfolio green? Check the Cardano Profit Calculator

Since the $0.39-$0.4 liquidity cluster has been swept, and liquidity attracts prices, a bullish move from here on makes sense.

However, the buyers will have to battle against a lack of social media hype and weakened demand to achieve this.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.