Cardano price prediction – Mapping altcoin’s road to $1.5

- ADA’s price chalked a bullish rising triangle pattern on the 4-hour chart

- A considerable liquidity pool at $1.0 suggested ADA could slide before pumping

After rallying by 200% in November, Cardano [ADA] has been cooling off. However, it could still soar towards $1.5.

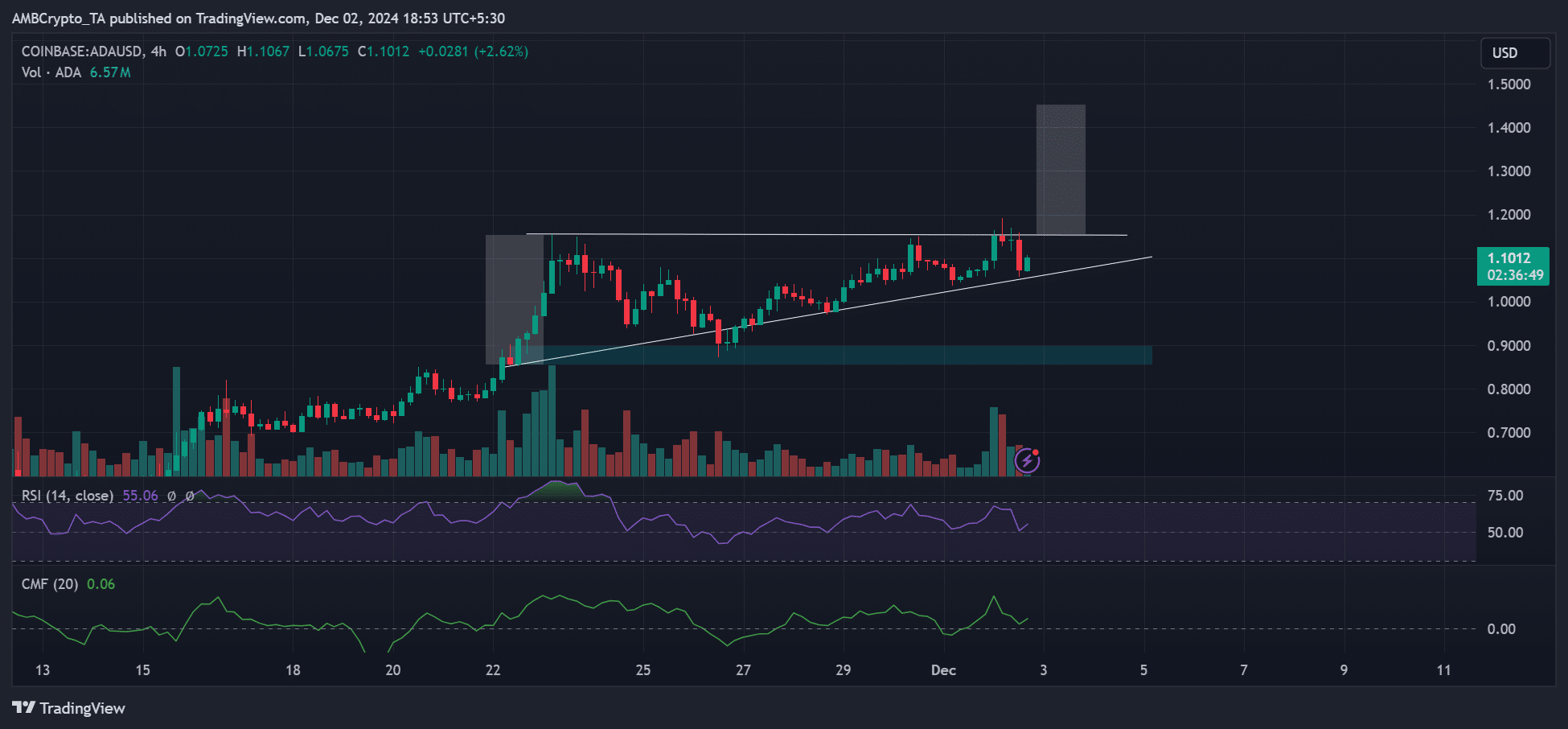

In fact, on the 4-hour chart, price action chalked an ascending triangle – A bullish formation that could be validated if the overall bullish market sentiment persists over the next few days.

ADA’s $1.5 prospects

In most cases, a breakout rally from rising triangles leads to an upside swing similar to the triangle’s height (white zone). If the patterns play out, that would push ADA to $1.45 – A 25% potential gain.

The technical chart indicators, CMF (Chaikin Money Flow) and OBV (On Balance Volume), were above average levels at press time, indicating that ADA bull still had a shot at eyeing $1.5.

However, a drop below the triangle would invalidate the bullish projection. In such a case, the pullback could extend to the bearish order block (OB) and support at $0.9 (cyan).

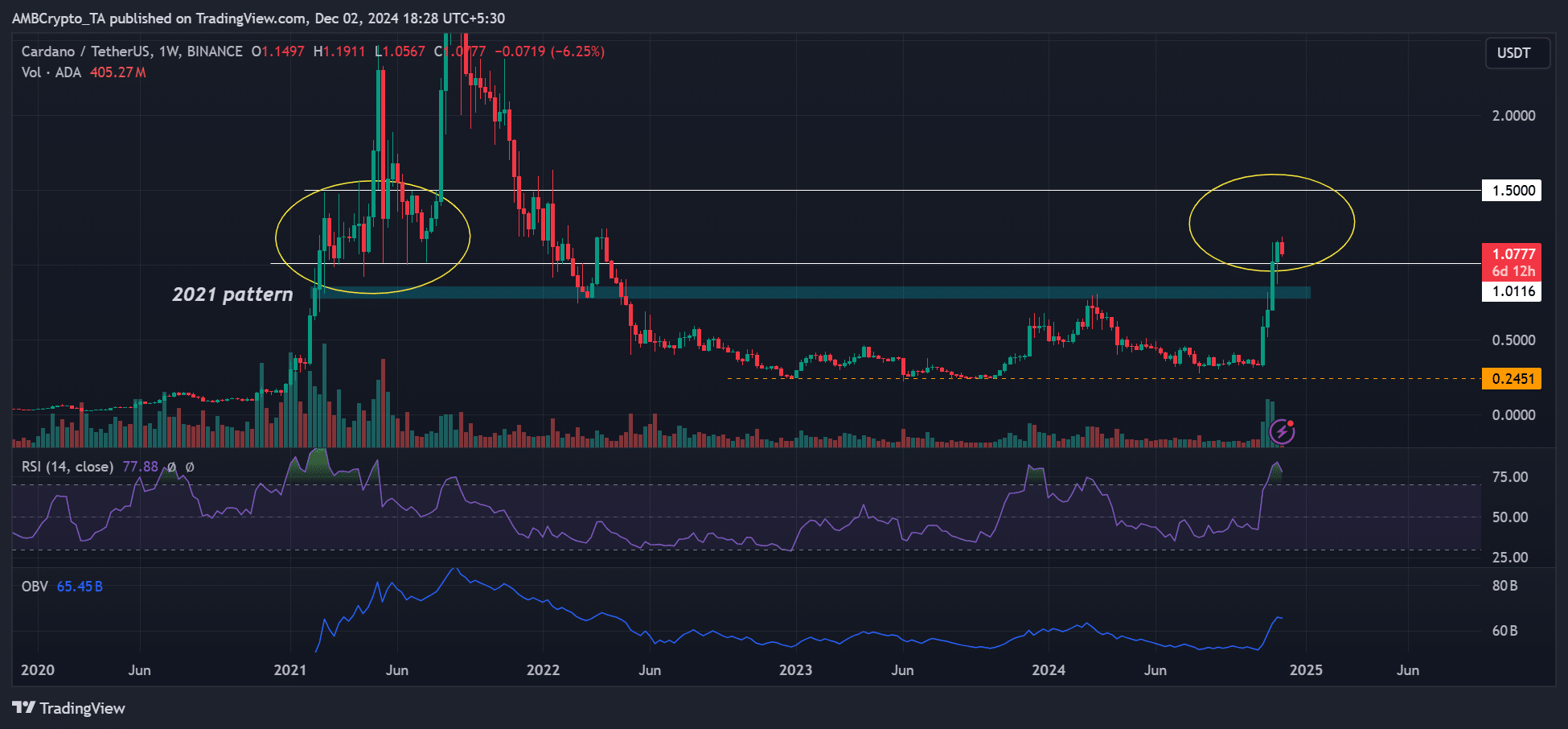

However, when zoomed out on the weekly charts, ADA seemed to be back in the price range seen in 2021. If the pattern repeats itself, a $1.5 range-high could be reachable within the next few days or weeks.

Key levels to track

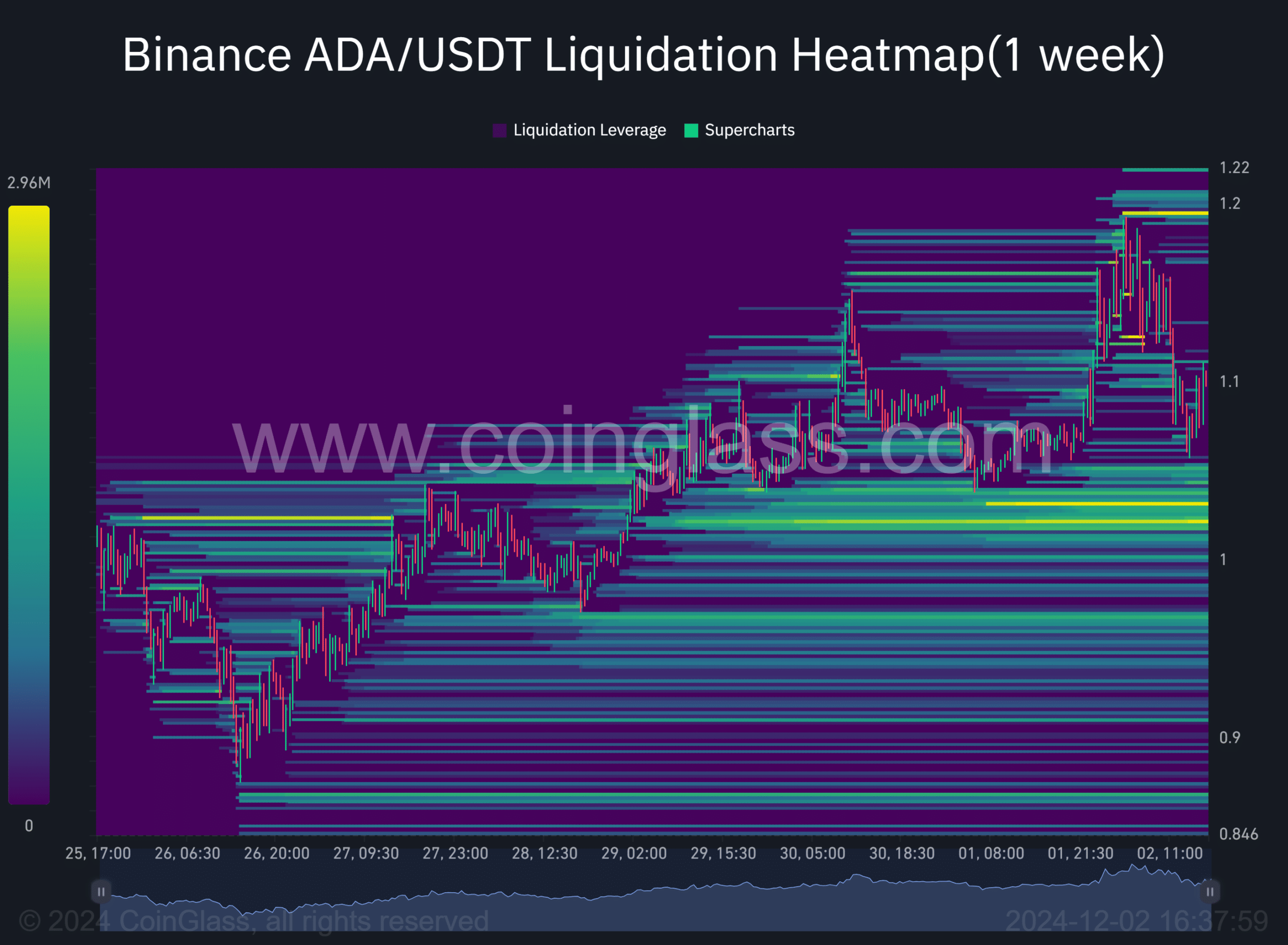

Based on the liquidation maps, there may be still considerable long-leveraged positions around $1 (bright oranges).

Additionally, a pool of liquidity from short-sellers piled at $1.2 and above. For context, market makers tend to influence the market based on the liquidity zones.

In short, market makers could show their hands by eyeing these liquidity zones and influencing the price action.

Read Cardano [ADA] Price Prediction 2024-2025

So, the price could still drop to $1.0 before soaring to above $1.2. However, a drop below $1 could signal a bearish market shift for the altcoin.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion