Cardano price prediction: Why ADA can drop 30% to $0.3

- Cardano has a strongly bearish market structure

- The technical indicators projected a deep price drop could arrive soon

Cardano [ADA] formed a bullish chart pattern that could see the token reach $1 in the coming weeks. Its social metrics have also improved as sentiment strengthened. However, the price action was not inspiring.

The price was below the January 2024 lows, and the technical indicators showed the bulls were weak. The Fibonacci levels projected how deep the next ADA drop could be.

Here’s what investors need to be prepared for.

The chances of a 30% plunge

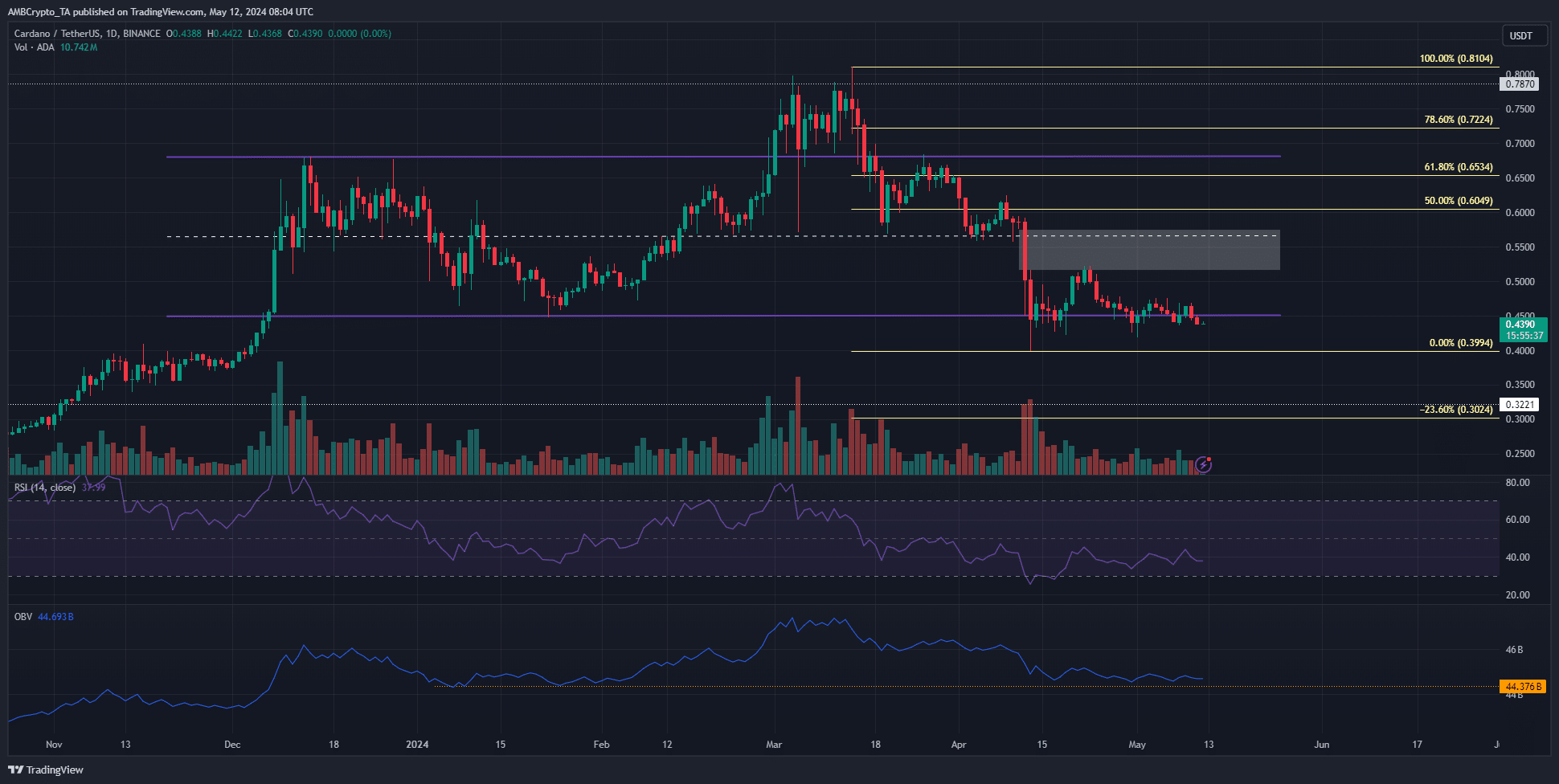

Throughout 2024, ADA has mostly traded within a range (purple) that reached from $0.447 to $0.678. In the past month, the prices have consistently hovered at or just below the range lows.

Additionally, in early April, the mid-range support level at $0.567 was breached and a sizeable imbalance (white) was left on the chart. This region was retested as resistance in mid-April.

Since then, the buying pressure has been insufficient for bulls to reclaim the $0.5 level.

This was reflected in the OBV which was back at a support level from earlier this year. Until buying volume and the OBV trends higher, more losses would be likely.

The RSI on the daily chart was also below neutral 50 to reflect downward momentum.

The Fibonacci levels (pale yellow) plotted based on the move down from $0.81 in March showed that the 23.6% southward extension at $0.3 was the next bearish target.

Short-selling was a popular route

Source: Coinalyze

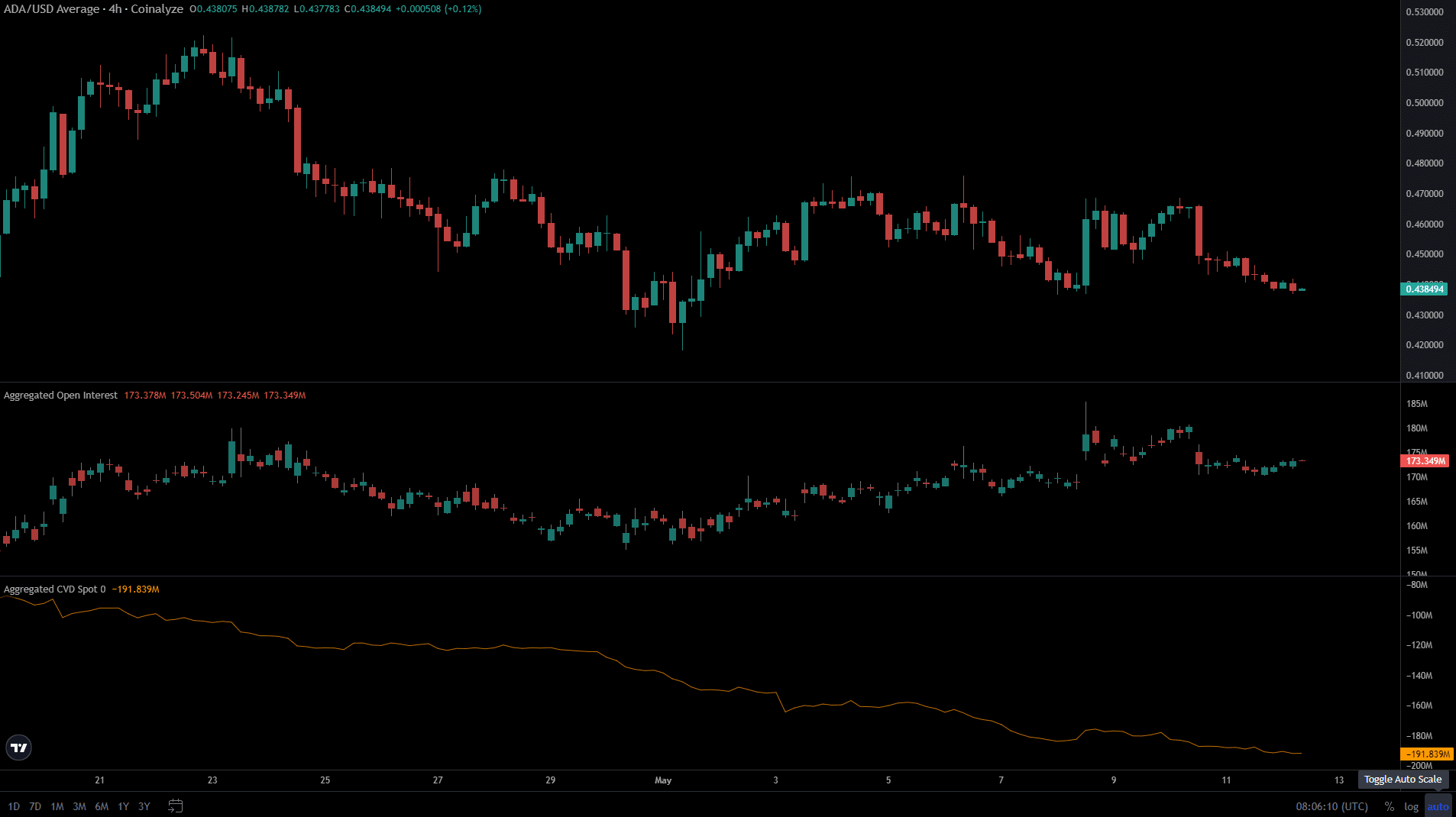

On the 11th and the 12th of May, the price of Cardano fell by 2% but the Open Interest rose slightly by $3 million. This showed that short-sellers were entering the market and outlined bearish sentiment.

The spot CVD also continued its downtrend, showing a lack of buying.

Read Cardano’s [ADA] Price Prediction 2024-25

The 30% drop projected by the Fibonacci levels could become a reality if the bulls do not step in and halt the consistent selling pressure.

They have not shown any signs of strength and were desperately fighting to defend the long-term range lows.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.