Cardano’s price pumps 32% in 7 days – Will profit taking break the prediction?

- ADA’s bounce above $0.6 was viewed with optimism by technical analysts.

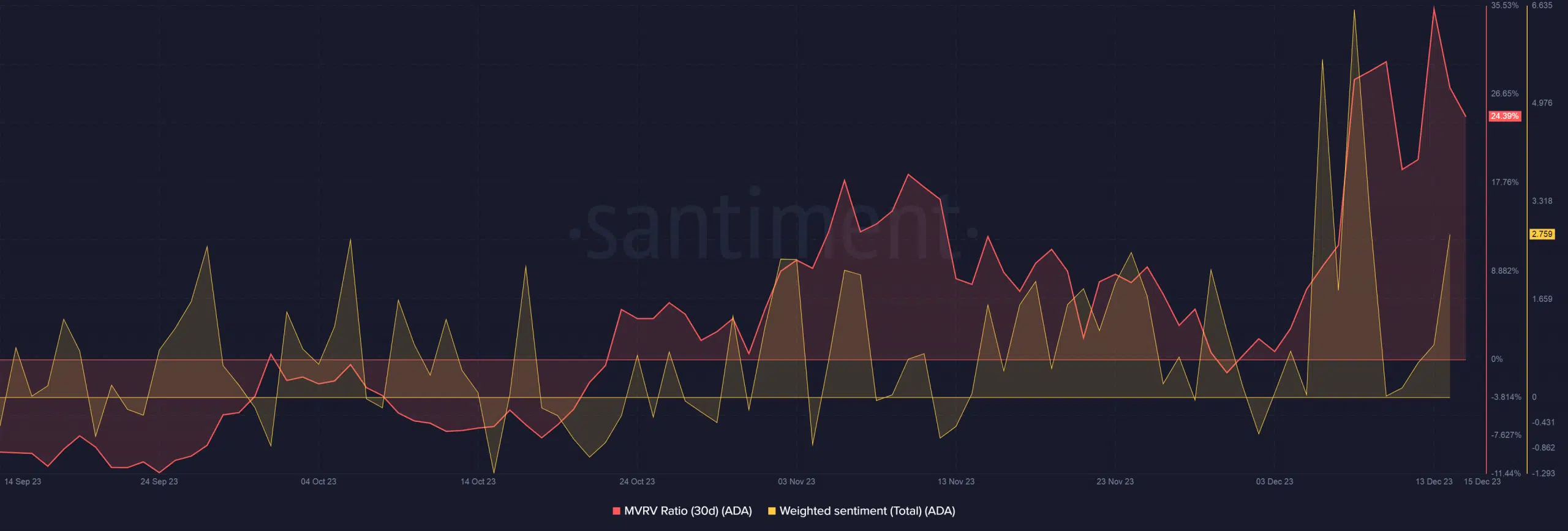

- ADA’s current price was nearly 25% higher than the average price at which all coins were acquired.

Cardano [ADA] emerged as one of the best-performing large-cap cryptocurrencies lately, with impressive gains of 32% over the last week, according to CoinMarketCap.

After remaining largely contained while the rest of the market was rising, the eighth-largest digital asset found its groove in December, gaining 65% month-to-date (MTD).

A lot to cheer for ADA bulls

During the course, ADA jumped above the key level of $0.6, last visited in June 2022. This was construed as a strong bullish signal by popular technical analyst Ali Martinez.

Martinez predicted,

“With no significant resistance barriers in sight, the path looks clear for ADA to move higher.”

He cited $0.8-$1 as the next big challenge, breaching which would further give credibility to ADA’s bullish narrative.

Whales not very confident but…

Interestingly, ADA’s rally caused a dramatic spike in whale activity. As per AMBCrypto’s scrutiny of Santiment data, transactions worth more than $100,000 increased as the coin moved north.

Interestingly, most of the transactions leaned towards selling. After methodically accumulating coins while the prices were low, whales dumped their holdings at the first sign of profits.

Indeed, addresses holding between 1,000 – 1 million coins witnessed a dip since the 5th of December.

These liquidations indicated that whales were not very confident about ADA’s short to medium-term prospects.

AMBCrypto’s scrutiny of Hyblock Capital’s Whale vs Retail Delta (WRD) indicator painted a similar story.

Negative values showed that whales had lower long exposure than retail investors, meaning that they weren’t bullish on ADA in the derivatives market.

However, despite the value being negative, the WRD was seen increasing over the past month and a half. This suggested that whales were increasing their long exposure which was a healthy sign.

Will holders resist temptations?

Meanwhile, most ADA holders were tempted to book profits.

The current price was nearly 25% higher than the average price at which all coins were acquired, AMBCrypto’s analysis of Santiment’s MVRV indicator revealed.

Read ADA’s Price Prediction 2023-24

Increased profit-taking had the potential to apply brakes on ADA’s momentum.

Having said that, the weighted sentiment continued to move into the positive territory. An optimistic view could restrict investors, allowing ADA to ride higher.