Cardano seeks renewed rally, bounces off key support

- ADA bulls show up, but this could be the start of more bullish momentum ahead.

- ADA’s latest rally has mostly been propagated by whales.

Cardano [ADA] has finally experienced a resurgence of bullish demand. While this is not the first time it has done so in the last few months, there were signs that ADA might attempt a substantial rally this time.

How many are 1,10,100 ADAs worth today?

ADA’s latest bullish attempt may spell excitement for holders, and for one major reason. The cryptocurrency recently bottomed out at $0.23 on 19 October, which is the lowest price that the digital coin has achieved so far this month.

The same price range is noteworthy because it marks the same bottom range where the price marks long-term support.

ADA is already off to a healthy bullish attempt, judging by its $0.26 press time price, which represented an 8% rally from the support level. As for its indicator, we observed a surge in relative strength in the last few days, accompanied by a spike in liquidity inflows as indicated by the MFI.

Assessing why ADA may bulls may show their strength in the coming days

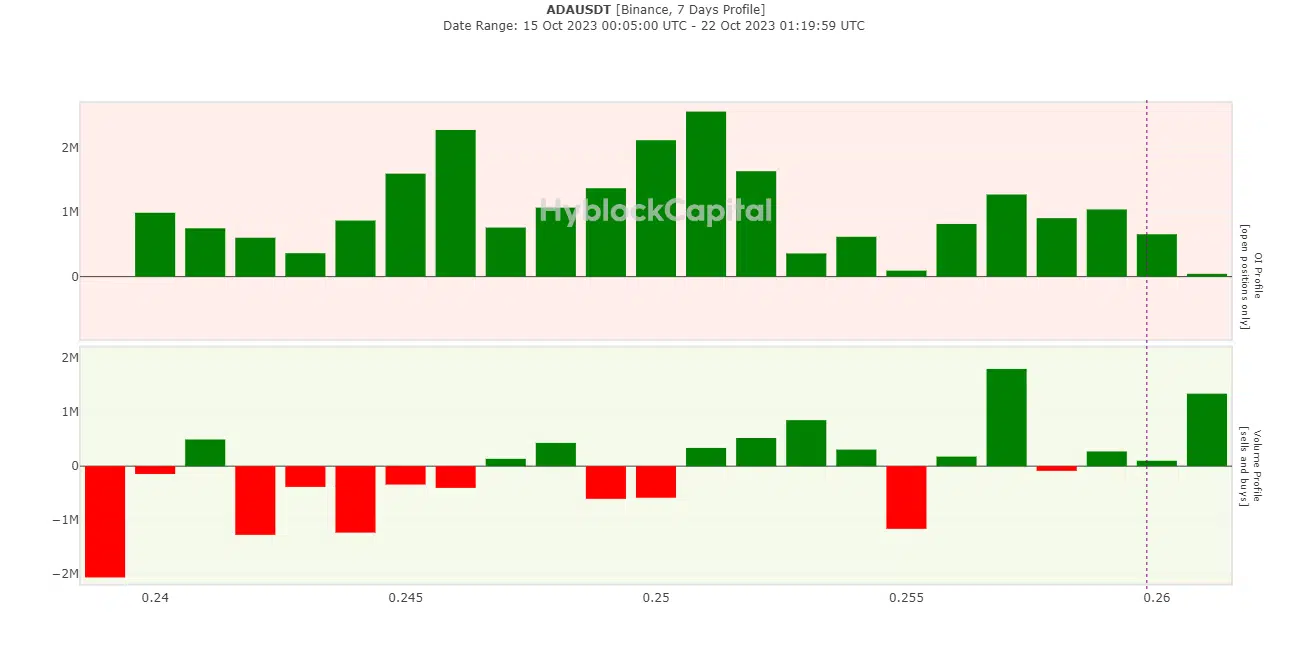

ADA’s metrics reveal a substantial shift in demand for ADA. For example, its performance in the derivatives segment revealed that it has maintained healthy Open Interest.

However, the same on-chain data from Hyblock revealed a slowdown in ADA derivatives demand.

Despite the noteworthy dip in open interest, on-chain data also reveals that buying activity has been more dominant in the last few days. ADA’s on-chain data, especially its supply distribution, reveals a net gain in some whale addresses.

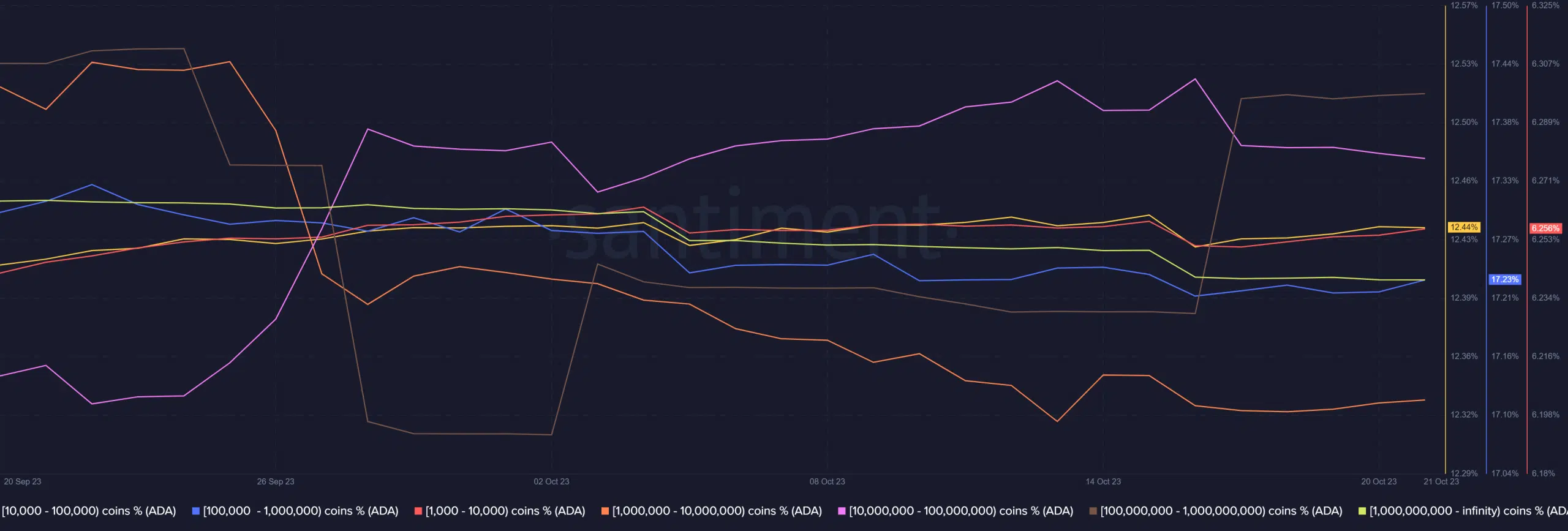

Addresses holding between 10 million and 1 billion coins have been accumulating over the last four weeks. The same addresses hold most of ADA’s circulating supply and have thus been contributing to bullish momentum.

Addresses in the 100 million to 1 billion bracket have been the most noteworthy bullish proponents recently. The same addresses registered a large spike in number of coins held, hence confirming strong accumulation in the last few days.

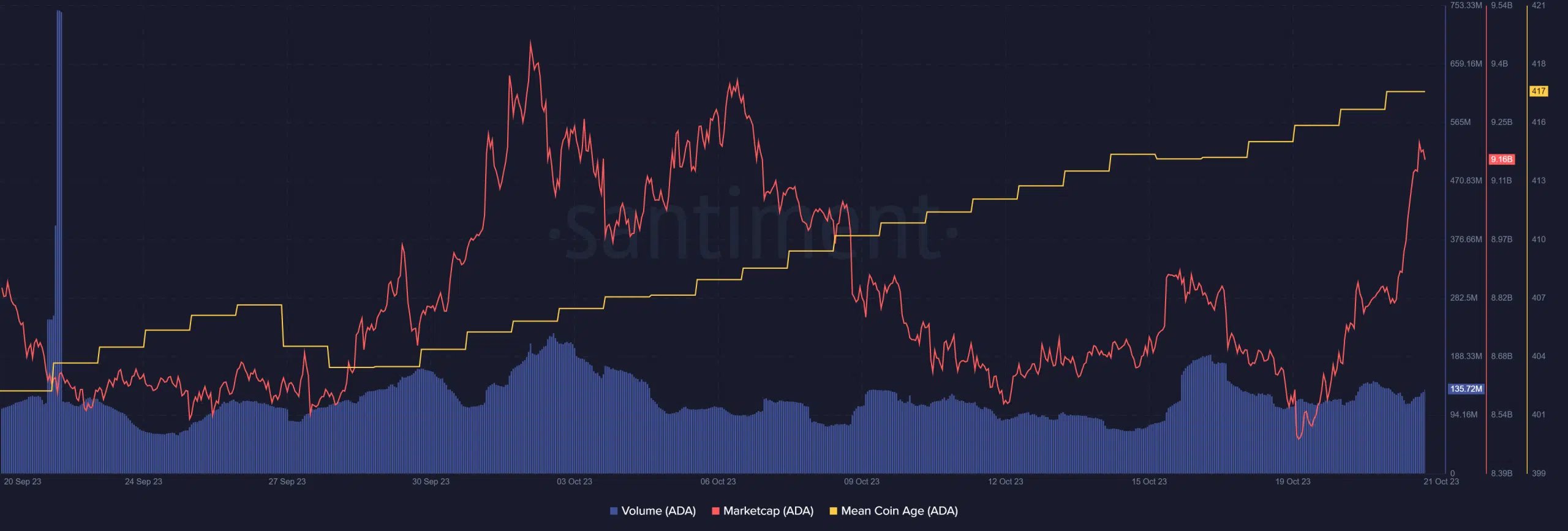

ADA’s mean coin age showed steady upside in the last four weeks, confirming the same whale activity. Its market cap also bounced by almost $800 million in the last few days, which confirmed a strong influx of liquidity.

Is your portfolio green? Check out the ADA Profit Calculator

Despite these findings, ADA’s on-chain volume remained within the normal range. Perhaps this is an indicator that retail buyers have yet to exercise their full buying potential.

If that is the case, then we will likely witness more bullish momentum in the coming days if the retail participants jump on board.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)