Cardano sees major sell-off: Is a price drop imminent for ADA?

- With decreasing volatility, and large sell-offs, ADA’s price could decrease to $0.42.

- Long liquidations exceeded shorts, and this could fuel a bearish bias for the token.

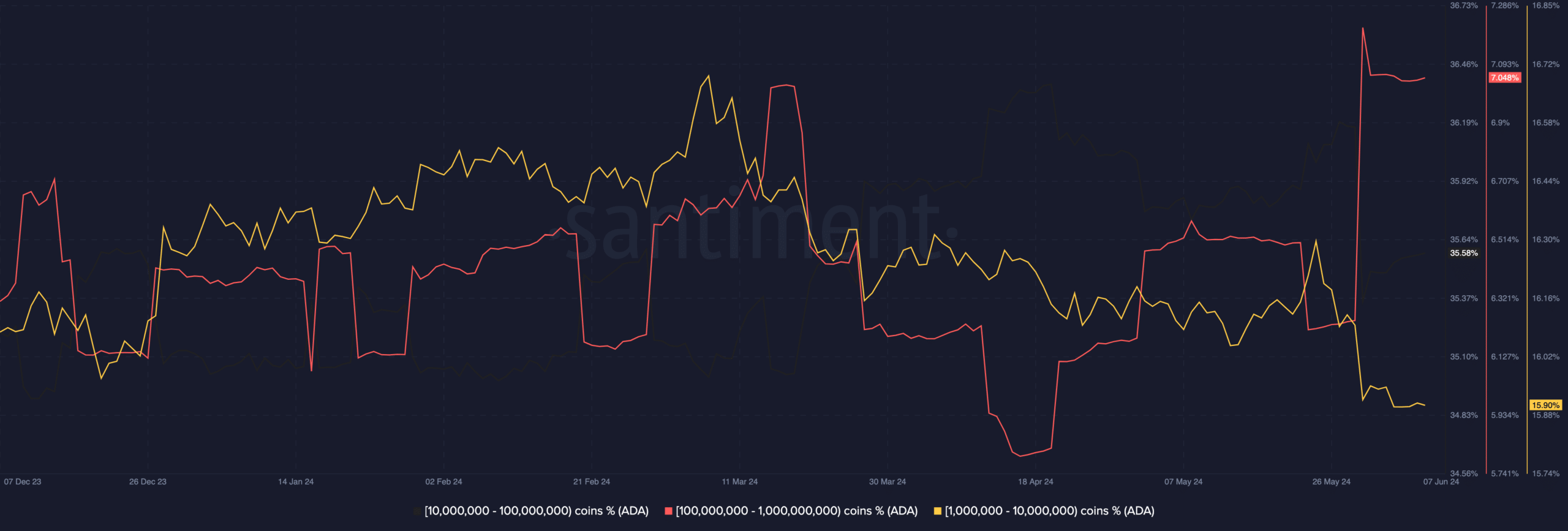

AMBCrypto’s analysis revealed that addresses holding a ton of Cardano [ADA] have been selling some of their tokens. At press time, we observed that the balance of addresses holding 1 million to 10 million ADA has decreased.

Furthermore, Santiment data showed that the 100 million to 1 billion tokens group has been doing the same since the 1st of June. When large addresses sell, it means that holders are losing confidence in a token.

It’s a tight season for ADA

In most cases, this leads to a price decrease. Hence, Cardano’s native token could be on the brink of a decline. As of this writing, ADA’s price was $0.46. This was a 4.65% increase in the last seven days.

However, if these big players continue to let go of another round of token, the increase could be halted. Apart from this, AMBCrypto examined the volatility around ADA.

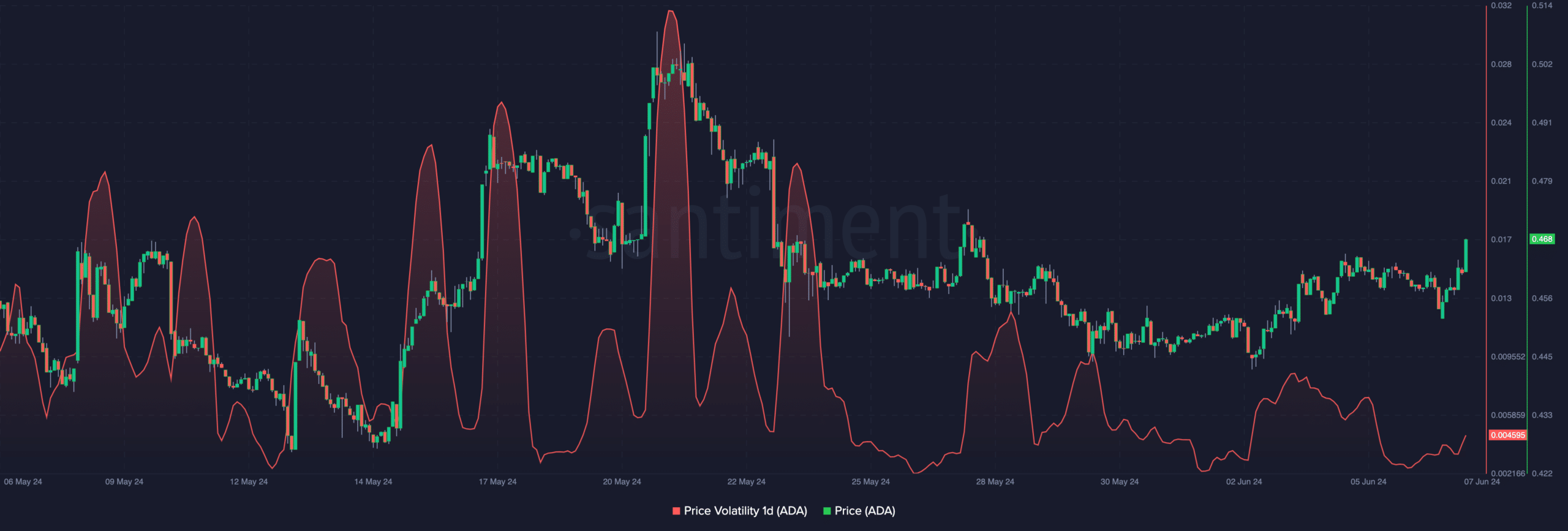

At press time, on-chain data showed that the one-day volatility was down when compared to what it was on the 5th of June. Volatility tracks how quick price can fluctuate in the market.

If the volatility is high, Cardano might experience wild price swings. However, since ADA’s volatility was low, the price could be suppressed. Should buying pressure decrease, ADA could consolidate between $0.44 and $0.46.

But a rise in sell-offs could lead the token lower. If this happen, ADA could slide to $0.42— a price it last hit on the 14th of May.

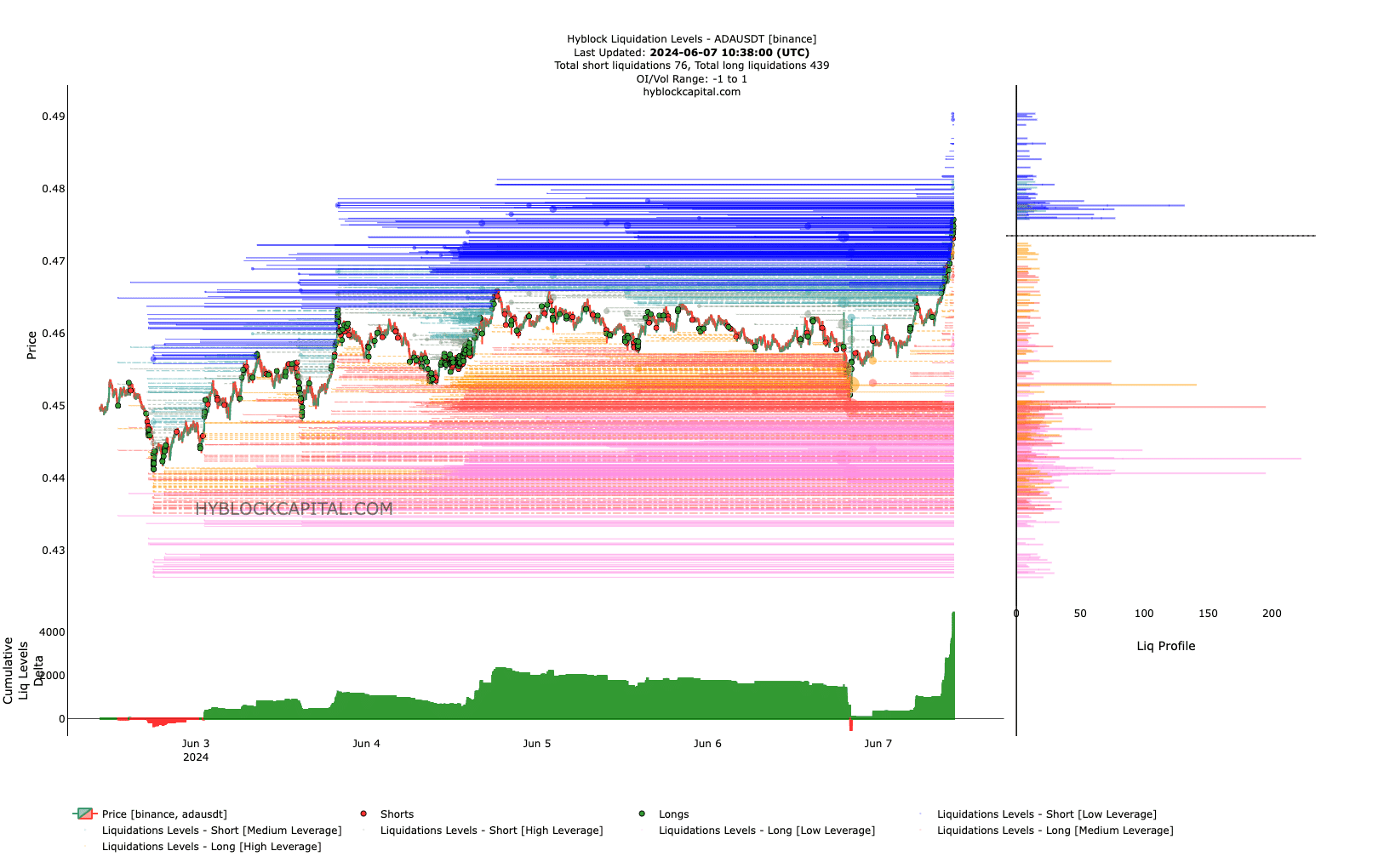

To check the Cardano’s price movement further, AMBCrypto looked at the liquidations levels. For context, liquidation levels are price points that large liquidations might occur.

Can bulls sustain the hike?

Liquidation occurs when an exchange closes a trader’s position due to insufficient margin balance to keep it open.

At press time, there was high liquidity for ADA between $0.46 and $0.47, indicating that ADA’s price could move within that region in the short term.

However, the Cumulative Liquidation Levels Delta (CLLD) indicated that the token could be at risk of another fall. The CLLD is the sum of the difference between long liquidations and short liquidations.

If the difference is positive, then it means that there are more long liquidations. On the other hand, a negative reading of the indicator suggests that there are more long liquidations.

But beyond the sum and difference, the CLLD also affects the price. If the reading is negative, it serves as a bullish bias as price might quickly recover upon full retrace.

Read Cardano’s [ADA] Price Prediction 2024-2025

At press time, ADA’s CLLD was positive because majority of the dip has been reversed, and the token might have hit a local top.

As such, the price might slip below $0.45.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)