Cardano shows bearishness in short-term, but reversal was possible at…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

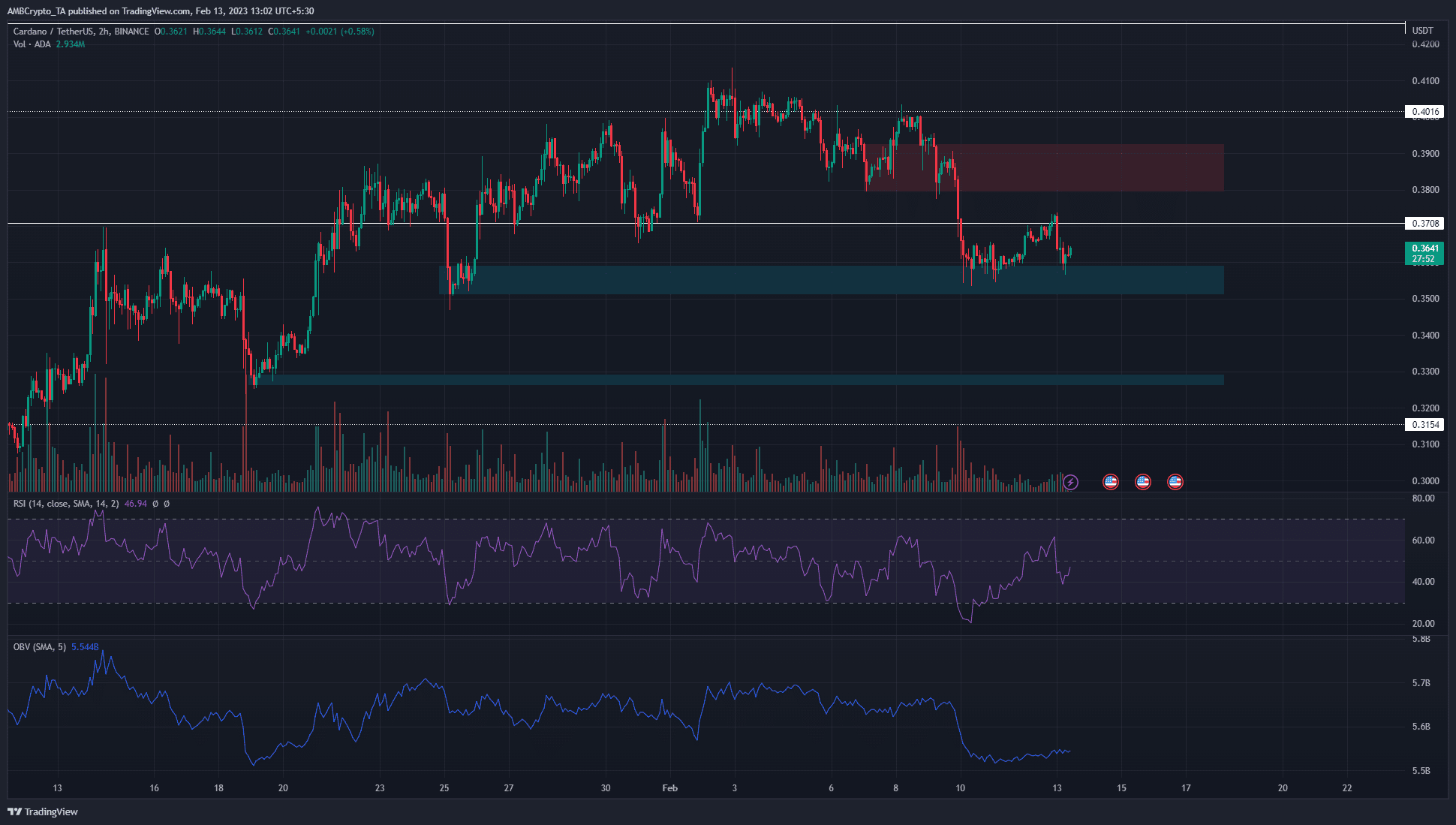

Cardano released the weekly development update on 10 February. It highlighted some notable statistics but did not shore up buyer confidence in the short term. Instead, the price retested $0.37 as resistance before another move downward.

Read Cardano’s Price Prediction 2023-24

Over the weekend, Bitcoin showed little impetus on the price chart. It oscillated from $21.6k to $22k, a fluctuation of close to 2%. Monday’s high and low could establish a range for the week. A move below $21.6k could herald further losses across the altcoin market, including ADA.

Former support levels flipped to resistance as more downside beckons

The 1-hour bullish order block at $0.38 was broken convincingly on 9 February. The two days of trading prior to that move downward saw weak bounces from this area. A move upward to $0.4 turned out to be a bearish retest before the slump that followed.

In a similar fashion, the $0.37 level of former support was also retested as resistance. This came after ADA tested a zone of support at $0.35 and bounced. The two bullish order blocks (H2) at $0.357 and $0.327 can see some positive reactions from the price in the coming days.

Realistic or not, here’s ADA’s market cap in BTC’s terms

Traders can wait for a move beneath $0.35 and a subsequent retest to short the asset, targeting $0.33. A move back above $0.37 won’t necessarily show bullish promise- a move up to $0.4 can also offer a shorting opportunity.

Both bulls and bears must recognize that the daily timeframe structure was bullish, but the weak push above $0.4 last week signaled exhaustion from buyers.

The RSI on the 2-hour chart showed neutral momentum, while the OBV saw a freefall for a couple of days together. Taken together, they showed some bearish dominance in the near term.

Source: Coinalyze

The Open Interest climbed slightly on 10 and 11 February as ADA bounced from $0.356 to reach $0.37. This attempt to break past resistance was quickly snuffed and the bearish sentiment was reinforced.

This was reflected in the dip that the OI saw recently. Falling prices and OI pointed toward bears being in the driving seat.

The predicted funding rate also saw multiple dips into negative territory over the past few days. The bearish retest of $0.37 was one such event, and highlighted the conviction of short sellers in the past few days.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)