Cardano struggles with low demand, but recovery is possible – Here’s how!

- Cardano is trading within a descending triangle pattern but some bullish signs suggest an upward breakout.

- However, retail and whale interest is needed for ADA to flip resistance and rally past $0.40.

Cardano [ADA] traded at $0.367 at press time. In the last 24 hours, ADA price oscillated between $0.35 and $0.36 showing a lack of volatility. During this time, there were no significant changes in trading volumes, as seen on CoinMarketCap.

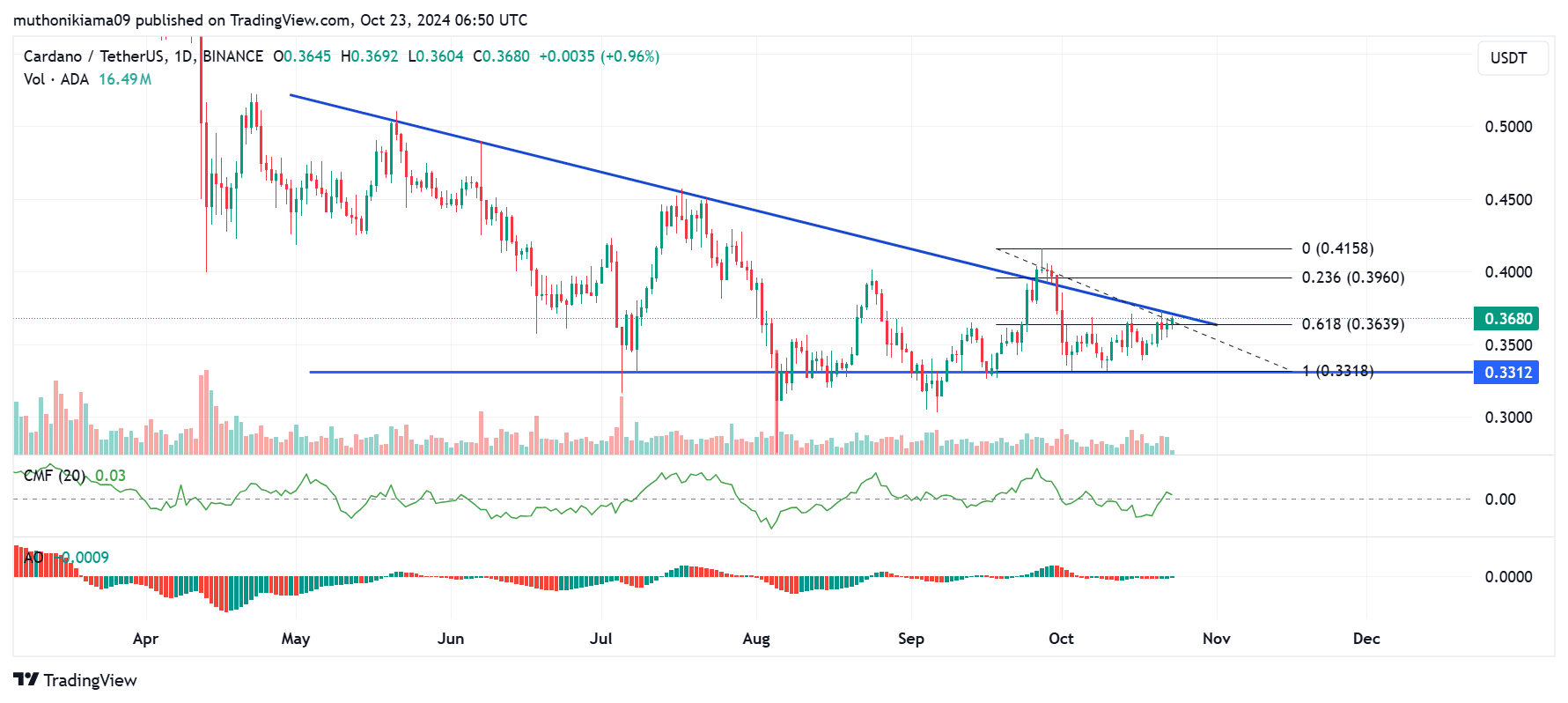

ADA has been trading within a descending triangle pattern on the one-day chart. This shows that sellers have pushed the price down each time ADA attempted to rally.

The descending triangle is now narrowing suggesting that ADA is entering consolidation before breaking out from this channel, either to the upside or the downside.

The uptrend faces strong resistance at the 0.618 Fibonacci level ($0.36). Each time ADA has tested this resistance, the price has either stagnated or dropped. This shows fewer buyers are willing to interact with ADA at this price.

If ADA flips the $0.36 resistance and overcomes the hurdle at the upper boundary of the descending triangle pattern, bulls could take over and support a rally toward $0.40.

Conversely, if Cardano fails to hold support at $0.33, it will confirm the continuation of a downtrend.

A look at technical indicators shows that an upward breakout is more likely. The Chaikin Money Flow (CMF) has entered positive territory for the first time in two weeks, which underscores the rising buying pressure.

The Awesome Oscillator (AO) bars are green but negative. This shows that while the overall trend remains bearish, a bullish reversal could be underway.

Spot netflows show sellers are active

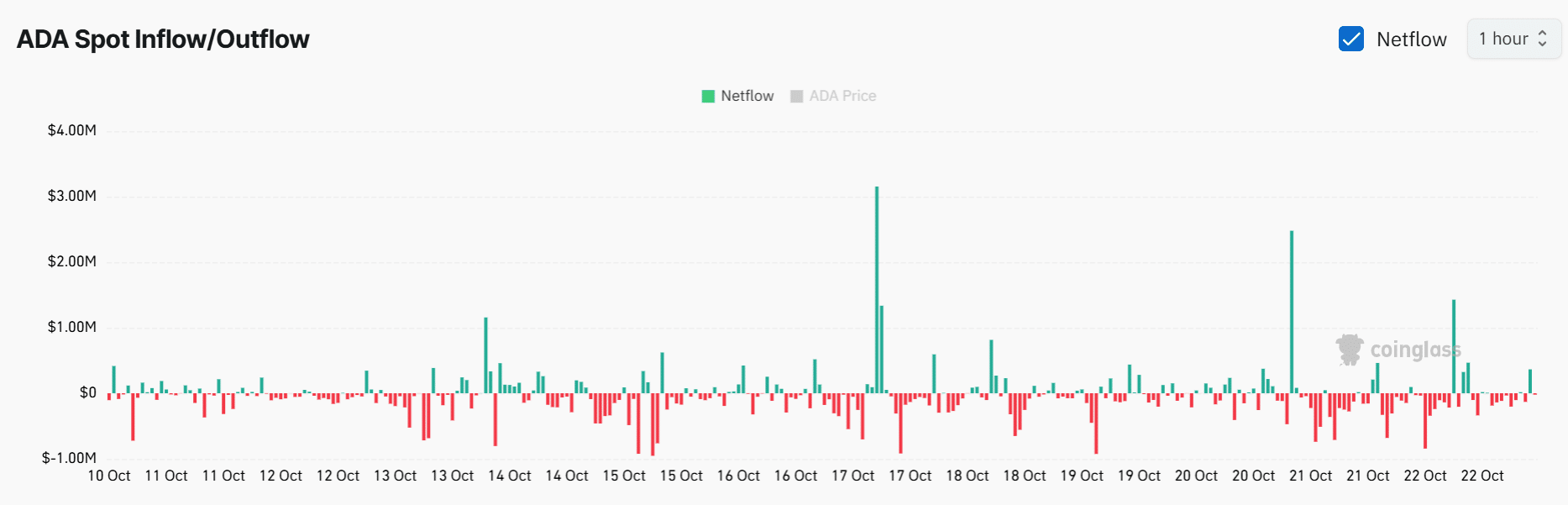

The spot exchange netflow data shows that Cardano sellers have been active amid significant spikes in inflows to exchanges.

However, during the same time, Cardano has recorded consistent outflows, which shows a clear tussle between sellers and buyers.

For buyers to take control, there needs to be interest from both retail and whale traders. While whales control only 8% of ADA’s supply, a spike in large transactions could spur volatility and renew positive sentiment.

Read Cardano’s [ADA] Price Prediction 2024–2025

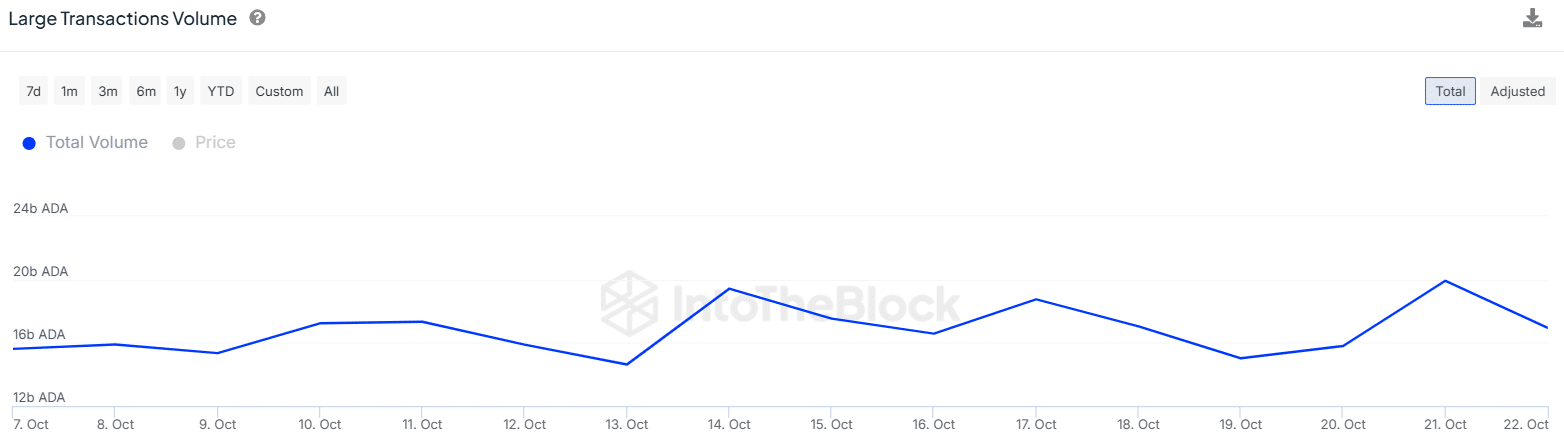

However, whales appear to be hesitant. At press time, large volumes for ADA transactions exceeding $100,000 had dropped by 15% from 19.92 billion to 16.94 billion.

The decline in whale activity coincided with bearish sentiment by smart money around Cardano per Market Prophit. However, retail interest remains high as the crowd sentiment is positive.