Cardano turns bullish on-chain – Buy signal for ADA?

- On the 17th of September, ADA whales moved a significant 19.5 billion ADA tokens.

- ADA could rise by 20% to the $0.42 level if it closes a weekly candle above the $0.35 level.

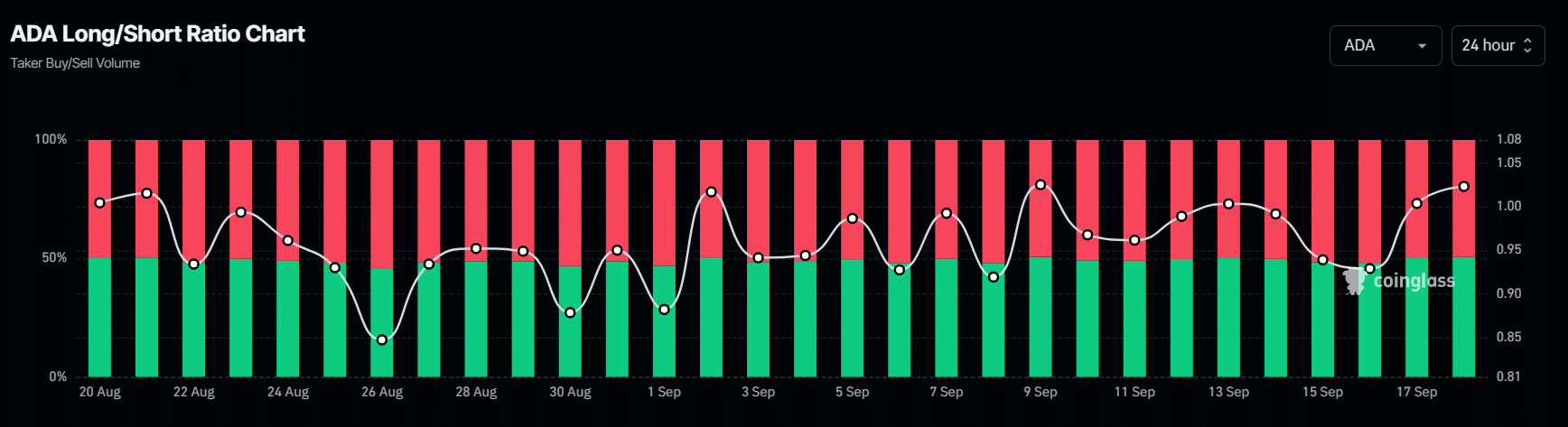

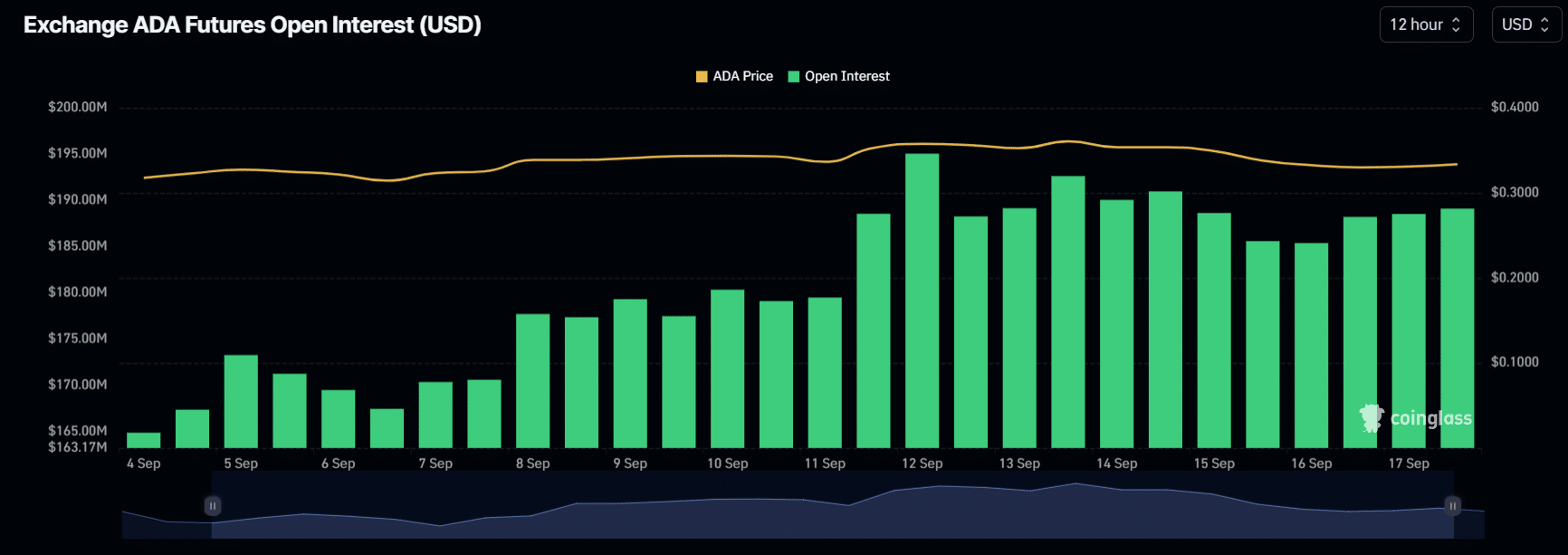

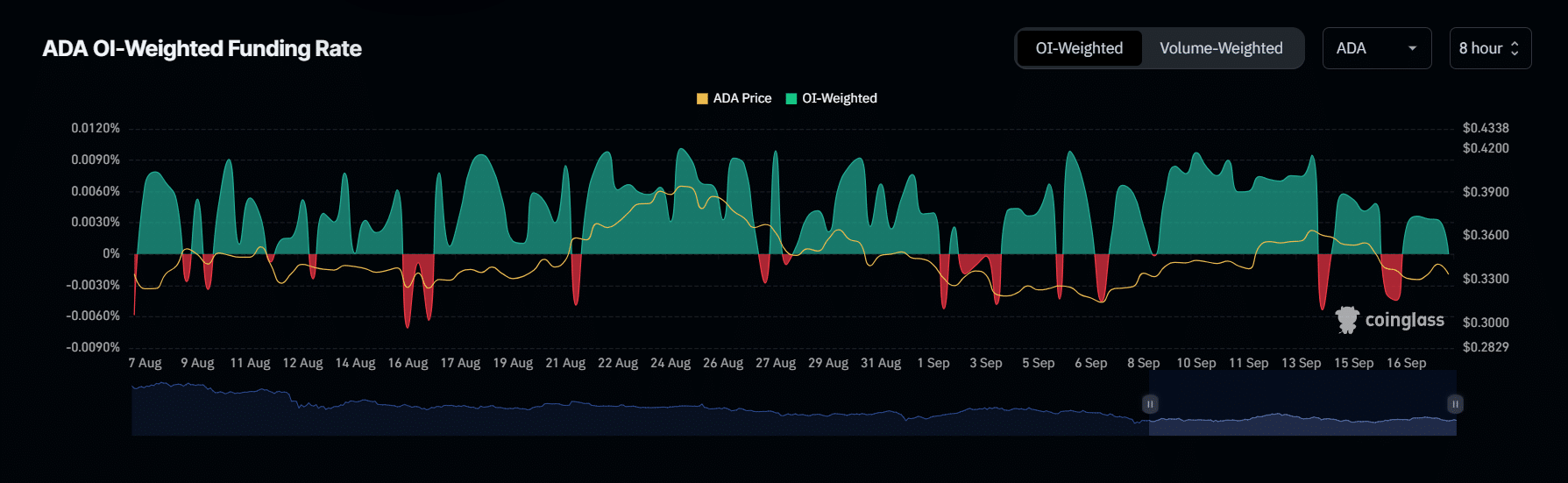

The overall market sentiment is currently bearish, while Cardano [ADA] on-chain data, such as the Long/Short ratio, Futures Open Interest, and OI-Weighted Funding Rate are flashing bullish signals.

Despite these bullish on-chain metrics, ADA struggled to gain momentum, having experienced a price decline of 1% over the past 24 hours.

ADA looks bullish, on-chain

According to the on-chain analytics firm Coinglass, ADA’s Long/Short Ratio was $1.0167 at press time, indicating bullish market sentiment among traders.

Its Futures Open Interest increased by 3% in the last 24 hours and has been steadily rising since the beginning of September 2024.

Traders and investors often used the combination of rising Open Interest and a Long/Short Ratio value above 1 to build their position.

Based on the data, if the Long/Short Ratio is above 1 and Open Interest is increasing, it suggested that traders were potentially building long positions.

Conversely, if Open Interest is rising and the Long/Short Ratio was below 1, indicated that short sellers were betting more on short positions.

At press time, 51.2% of top traders held long positions, while 48.8% hold short positions, indicating a bullish outlook for ADA.

Additionally, ADA’s OI-Weighted Funding Rate was positive, which further suggested a bullish sentiment for the asset.

Whales recent activity

This bullish outlook is potentially due to recent whale activity. On the 17th of September, ADA whales moved a significant 19.5 billion ADA tokens, worth $6.48 billion, according to the on-chain analytic firm IntoTheBlock.

Additionally, the large transactions (value above $100,000) increased by 10% on the same day. This uptick in the whale activity indicated a potential upside rally in the coming days.

Cardano technical analysis and key levels

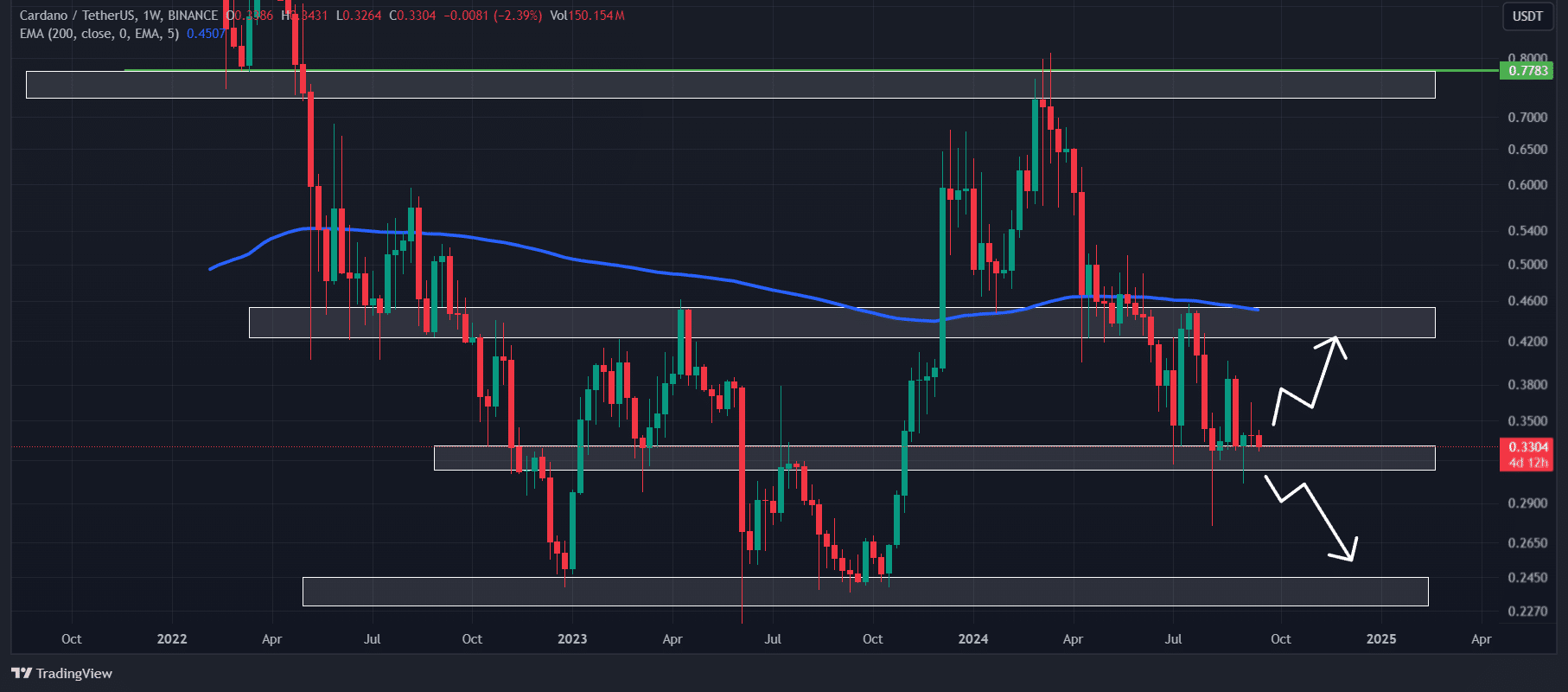

According to the expert technical analysis, ADA appeared bearish and was trading near a crucial support level of $0.315.

On ADA’s daily chart, there were no bullish price action patterns, suggesting a potential rise in the coming days.

However, based on the historical price momentum, if ADA closes its weekly candle above the $0.35 level, there is a strong possibility it could rise by 20% to the $0.42 level in the coming days.

Meanwhile, the 200 Exponential Moving Average (EMA) indicates it is in a downtrend, as ADA has been trading below this indicator since April 2024.

Read Cardano’s [ADA] Price Prediction 2024–2025

ADA price momentum

At press time, ADA was trading near the $0.33 level and has experienced a modest price decline of 0.15% in the last 24 hours.

During the same period, its trading volume increased by 20%, indicating higher participation from traders amid the market downturn.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)