Cardano – Understanding why ADA’s whales aren’t ‘buying the dip’

- ADA dropped nearly 21% on a monthly timeframe.

- Whale cohort holding more than 1,000 ADA coins shrank significantly.

Cardano’s [ADA] price action has been underwhelming in recent weeks, fuelling serious concerns among holders of the coin. In fact, the ninth-largest cryptocurrency slipped by 11% over the week, and by nearly 21% over the month, as per CoinMarketCap. By doing so, ADA has emerged as one of the market’s biggest under-performers.

Generally, periods of such correction are utilized by a seasoned cohort of users to accumulate at low prices. However, this was not the case with ADA.

Whales are not interested in ADA

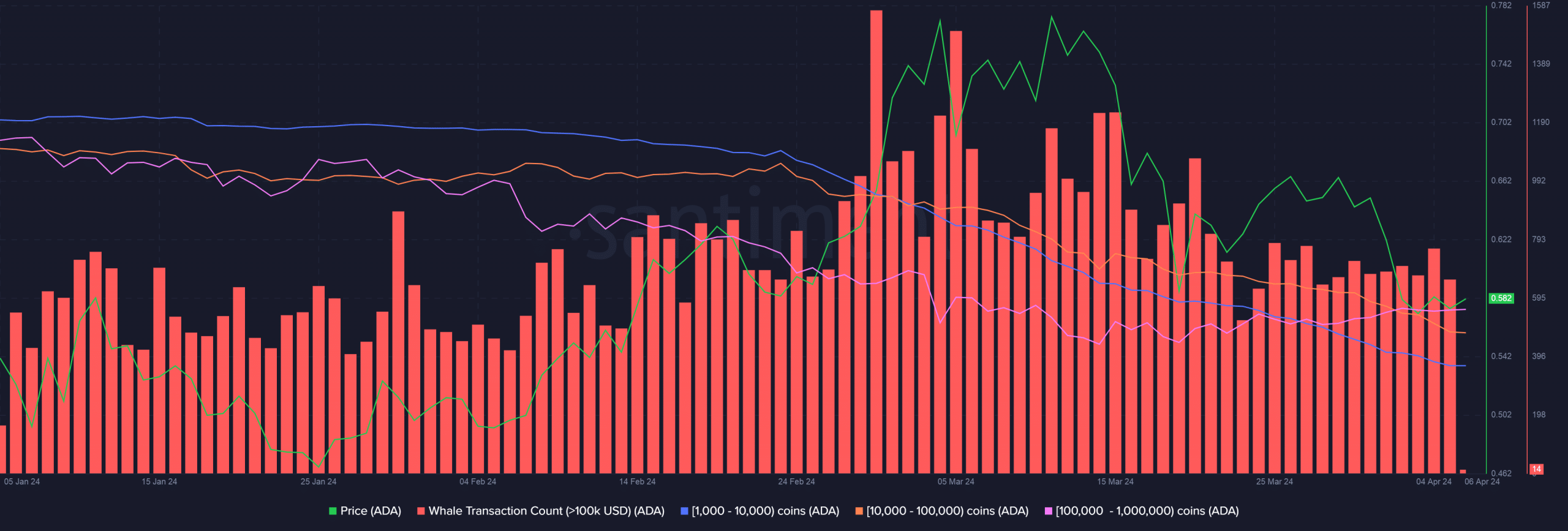

The last 2-3 weeks have seen a considerable drop in whale interest in the coin. This was evidenced by a slump in transactions worth more than $1k, as observed by AMBCrypto using Santiment’s data. Furthermore, the cohort holding between 1,000 to 1 million coins shrank significantly over the aforementioned period – A sign that whales were offloading.

Popular technical analyst Ali Martinez interpreted these observations as bearish signals. He predicted that they could either lead to price stagnation, or worse, further declines.

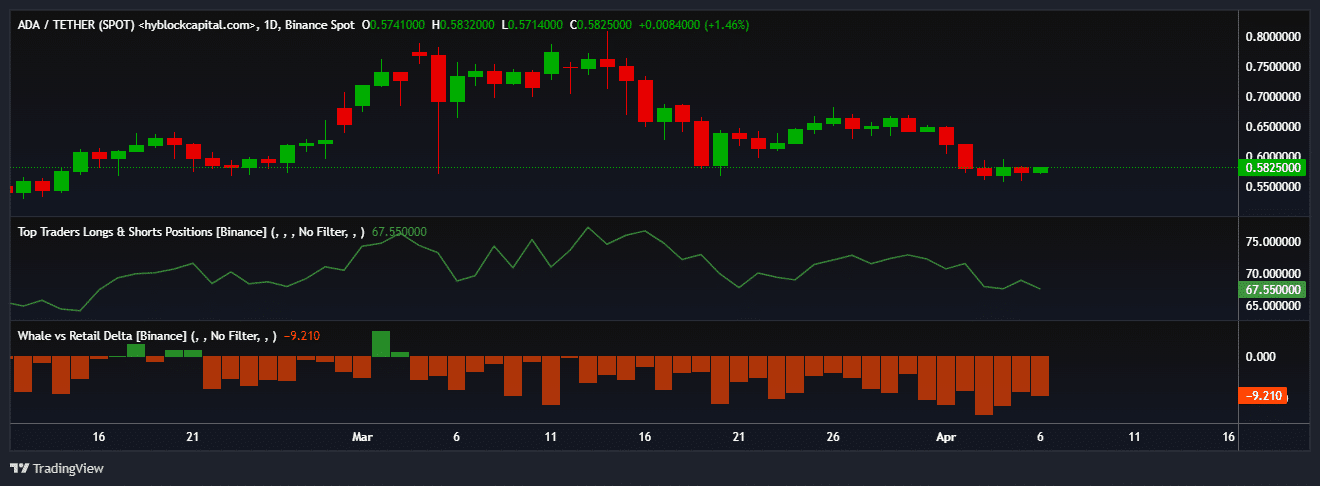

The bearish sentiment among whales was also seen in ADA’s derivatives market. According to AMBCrypto’s analysis of Hyblock Capital data, total number of whale positions on Binance that were long on ADA dropped from 76% in mid-March to 67%, at the time of writing.

In fact, retail investors had a higher long exposure than whales, as per the Whale v. Retail Delta indicator.

Whales’ unwillingness to engage with ADA highlighted the low confidence they had in its potential to bounce back – A sentiment which could rub off on the broader market.

Read ADA’s Price Prediction 2024-25

ADA suffers another jolt

The latest blow to the struggling altcoin came when Grayscale, the world’s largest digital asset manager, dropped it from the flagship Grayscale Digital Large Cap Fund (GDLC).

The removal from a fund, whose shares reflect the value of a basket of large-cap digital cryptocurrencies, may point to ADA’s waning prominence in the market.

ADA was trading at $0.58 at press time, remaining flat over the last 24 hours.