Cardano update: ADA aims for $3 as on-chain metrics show…

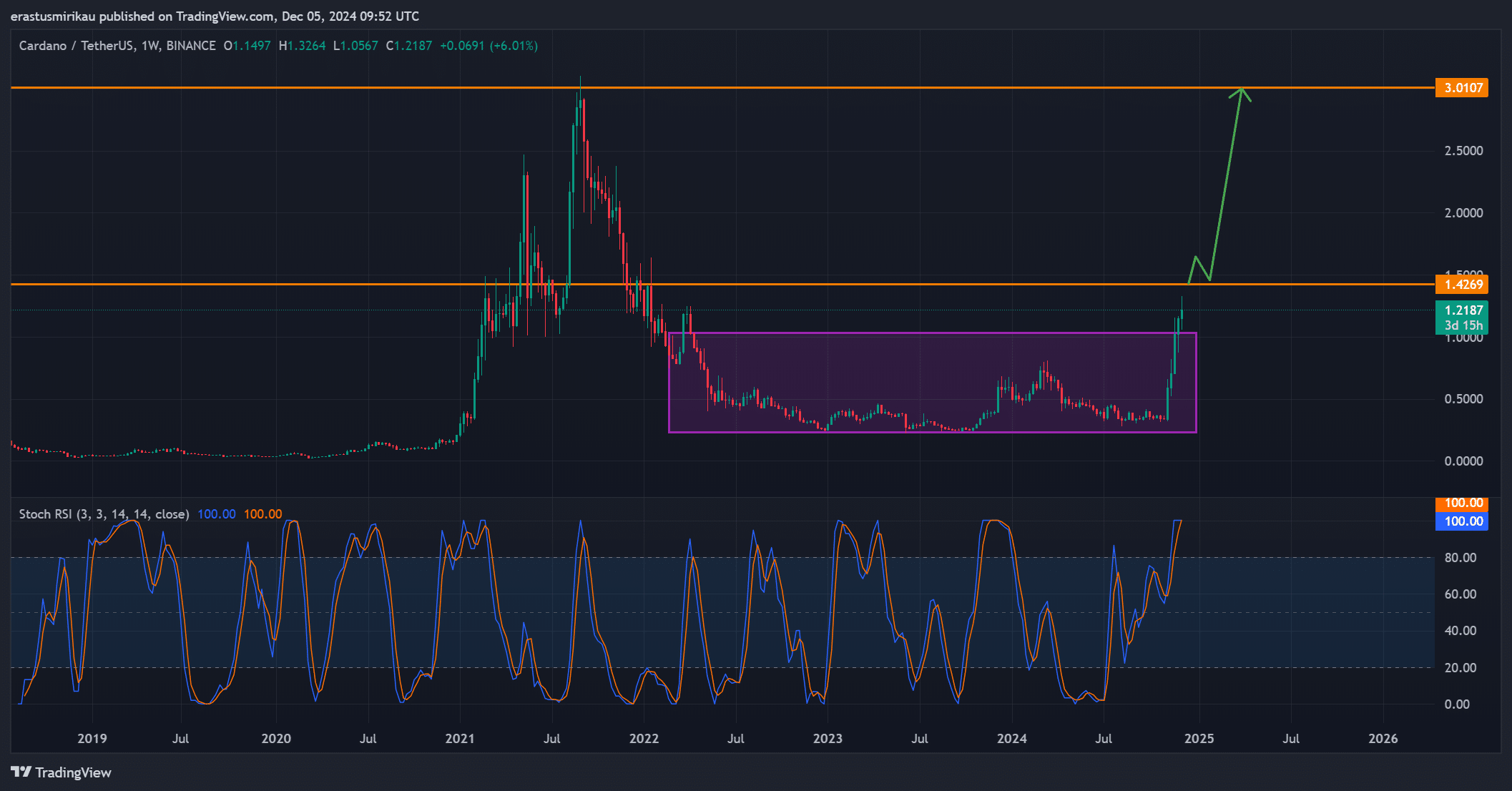

- ADA has broken out of consolidation, approaching key resistance at $1.40, targeting $3.00.

- Positive on-chain metrics and development activity hint at sustained momentum, despite some bearish sentiment.

Cardano [ADA] is making waves in the crypto space, surpassing a major milestone by reaching 130,000 transactions per second on its network. At press time, ADA was trading at $1.22, down 0.28% over the last 24 hours.

Despite this minor dip, the cryptocurrency has broken out of a prolonged consolidation phase and is now approaching crucial resistance at $1.40.

With such a move, Cardano could trigger a potential rally, sending ADA to new highs. However, can it maintain this momentum, or will resistance hold it back?

ADA’s chart analysis: A breakout to new heights?

ADA’s recent breakout from its consolidation phase has caught the attention of traders. The price is approaching the $1.40 resistance level, which will be crucial for the next phase of growth.

If ADA can surpass this level, the next target may be as high as $3.00. The Stochastic RSI, which stands at 100, signals strong bullish momentum, confirming that ADA is in an overbought condition.

However, this may indicate that a correction is near unless the breakout is sustained.

Are ADA’s on-chain metrics supporting the rally?

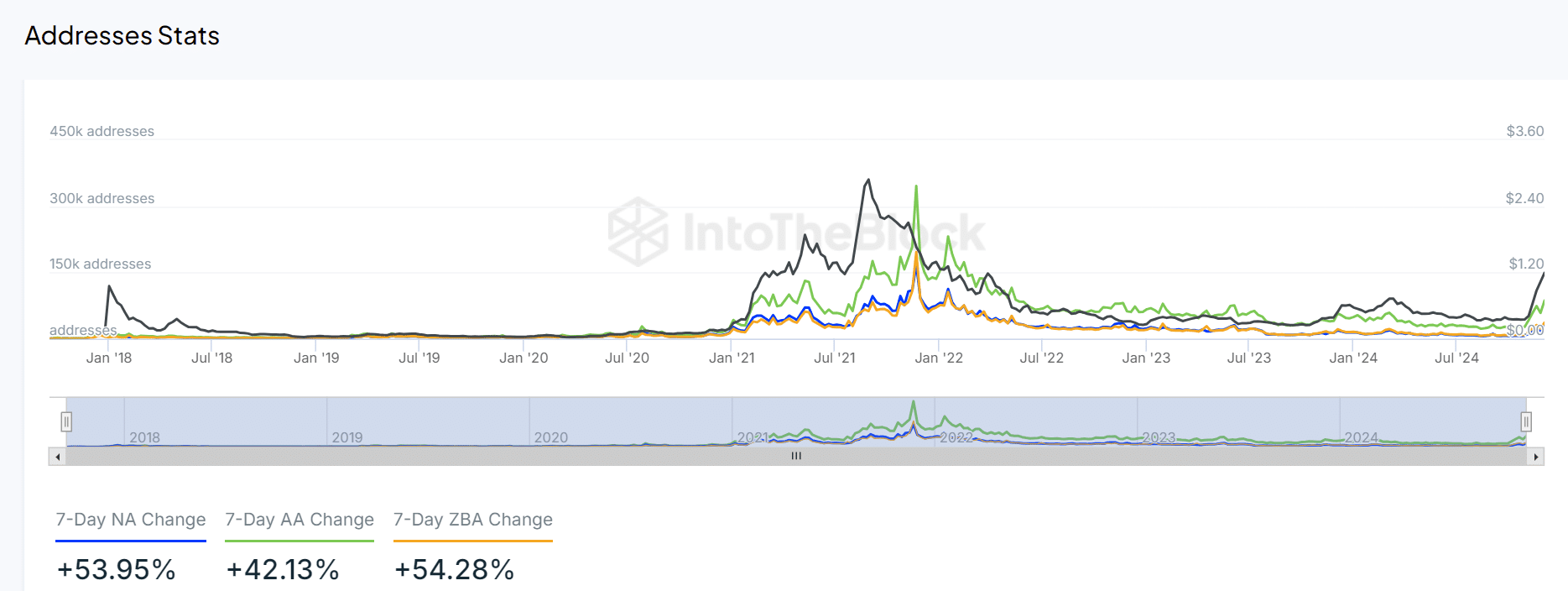

Cardano’s on-chain metrics reveal a positive trend, further supporting the bullish case. Over the past seven days, Cardano has seen a +53.95% increase in new addresses, signaling that more users are joining the network.

Active addresses have also surged by +42.13%, indicating that existing users are becoming more engaged.

Additionally, zero-balance addresses have increased by +54.28%, reflecting an influx of new participants into the ecosystem. These numbers show that Cardano’s ecosystem is growing, which may help support the price action.

What do ADA’s trading sentiment and long/short ratios suggest?

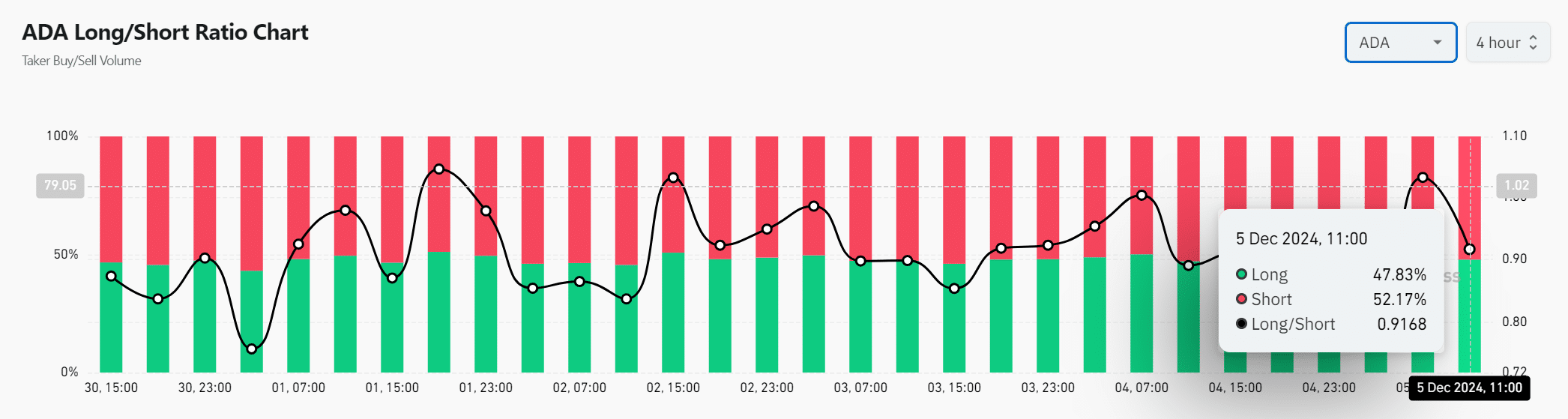

The current long/short ratio for ADA is slightly tilted towards short positions, with 52.17% of traders holding short positions, compared to 47.83% holding long positions.

This gives a long/short ratio of 0.92, suggesting that there may be a bearish sentiment in the market. However, this could also point to the possibility of a short squeeze, especially if Cardano continues to rally past its resistance levels.

Is Cardano’s development activity paving the way for growth?

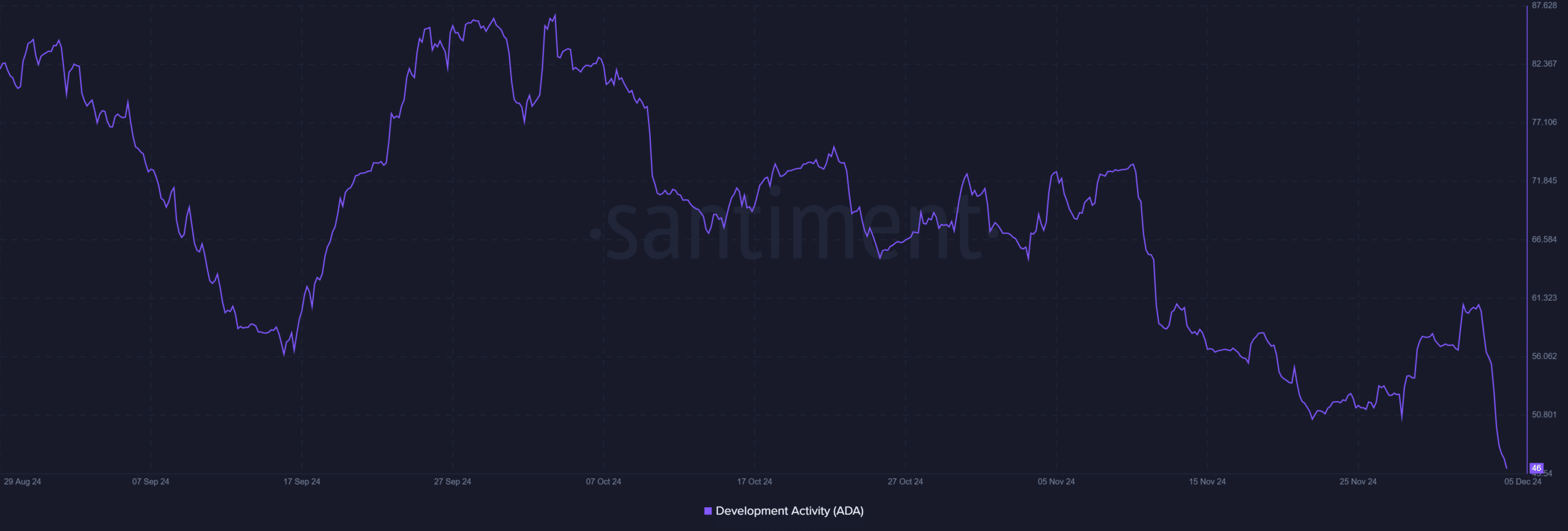

Despite the positive on-chain activity, Cardano’s development activity remains relatively low, with a score of 46. This could indicate that while the network is experiencing growth, the development side is not progressing as rapidly.

Therefore, the current price action may be driven more by speculation and market sentiment than by fundamental upgrades.

Read Cardano’s [ADA] Price Prediction 2023-24

Will ADA break through or face resistance?

ADA’s recent breakout and the positive on-chain metrics show promising signs of continued growth. However, the $1.40 resistance level is critical.

If ADA can break through this, it could lead to a rally that propels the price towards $3.00. On the other hand, if resistance holds, ADA may face a retracement. Investors will be closely watching the price action as Cardano continues to develop and build its ecosystem.