Cardano vs Solana: Which network has long-term potential? These metrics suggest…

- Solana secures a bigger piece of the TVL pie but on a technicality.

- Can Cardano close the gap thanks to its market cap lead?

A Cardano vs Solana battle has been brewing despite the fact that the two networks initially wanted to wanted to be Ethereum [ETH] killers. The competition has intensified because these are among the top 10 smart contracts. So, which of the two has more growth potential?

Before we get into the Cardano vs Solana competition, let’s look at the numerous ways in which the two are similar. They are both Proof-of-Stake (POS) networks that have smart contract capabilities, just like Ethereum. Both Solana [SOL] and Ethereum are also in the early stages of adoption.

The other side of the coin highlights some key differences that may offer insights into which one is currently winning the Cardano vs Solana battle. One of the best ways is to explore key metrics, such as TVL and market cap.

Cardano vs Solana: Win some, lose some

SOL secures lead on TVL front

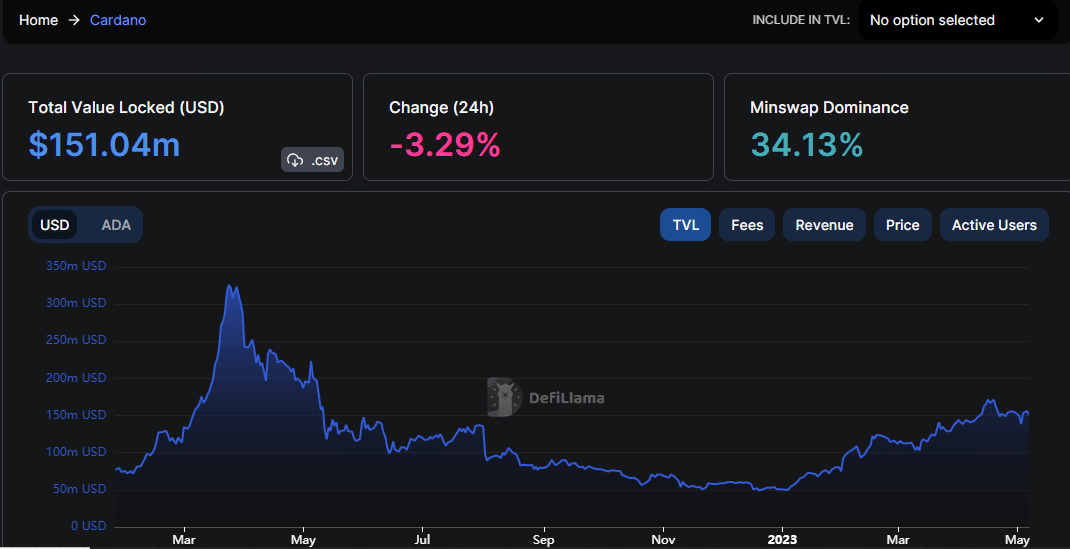

Cardano’s [ADA] total value locked (TVL) at press time stood at $151.04 million. A noteworthy surge, considering that its TVL fell slightly below $50 million at its most recent bottom in December last year.

While it has achieved a significant TVL recovery so far, it still has a lot of ground to cover before pushing back to its previous ATH. The latter was slightly above the $235 million mark.

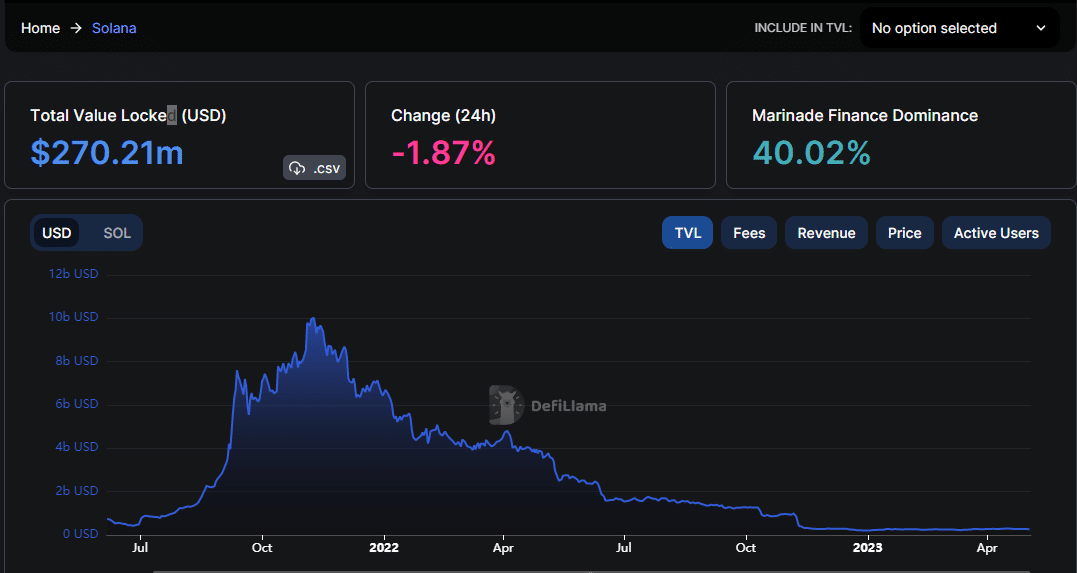

Although Cardano has achieved a fairly significant TVL recovery, it lags behind Solana, which had a $270.21 million TVL at press time. However, this lead may be undermined by one key observation. Solana’s TVL has not achieved much of a bounce back since the start of the year compared to Cardano.

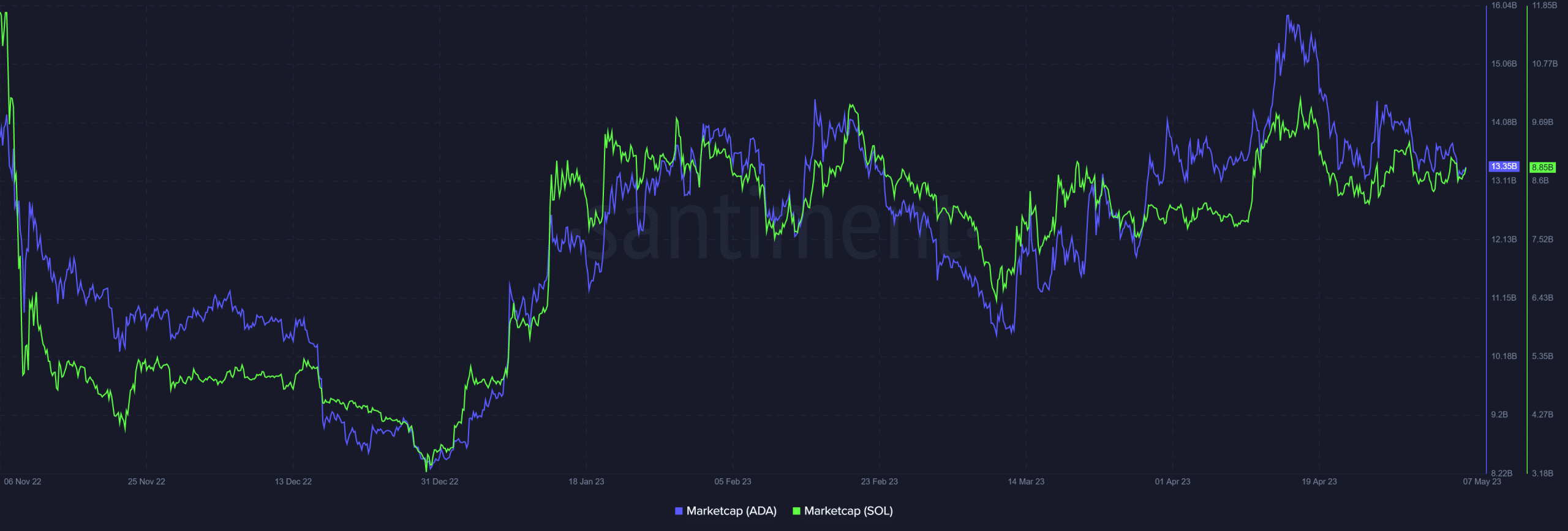

While Solana won in TVL, albeit on a technicality, it is clear that Cardano’s TVL is growing at a faster pace. The same growth is also evident in the market caps of the two projects. Cardano maintained a higher market cap than Solana since the start of 2023.

Solana’s current TVL underscores a more severe loss from its historic ATH, slightly above the $10 billion. This was at the height of the November 2021 bull market.

Cardano takes poll position on market cap

One could look at Solana’s bigger TVL loss from the perspective that Cardano might currently be the better option. However, that would be a bit of a biased decision. This is because Cardano launched smart contract capabilities in September 2021. In other words, Cardano did not have enough time to capitalize on organic growth compared to Solana, which had a solid head start.

Cardano’s market cap hovered in the $8.3 billion at its lowest point in the last six months and almost at $16 billion at its highest point. Its press time market cap hovered at $13.3 billion. However, Solana’s market cap hovered slightly above $3.3 billion at its lowest 6-month level and $9.9 billion at its highest level within the same duration. It hovered at $8.8 billion at press time.

Cardano vs Solana active addresses are closely matched. Both had daily active addresses hovering between 43000 and 68000 addresses within the last 24 hours. But how well matched are they as far as volumes are concerned?

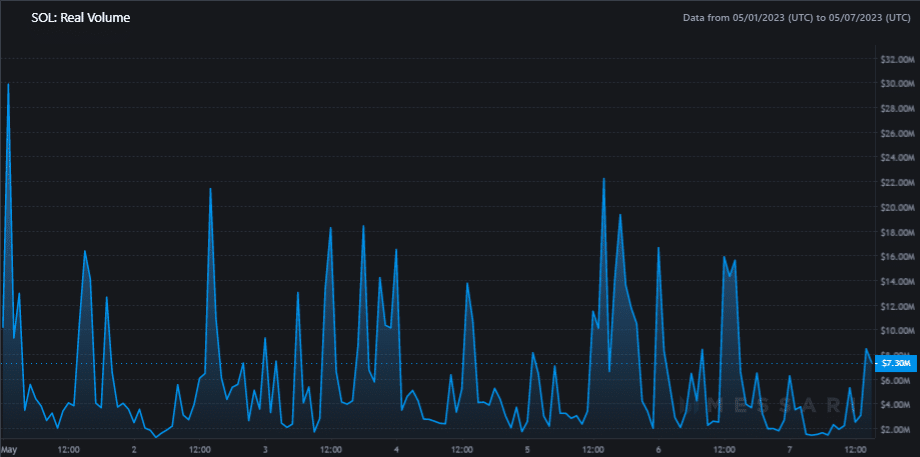

Solana’s weekly volume peaked at $29.84 million at the start of May. It fell as low as $1.25 million during the week.

Meanwhile, Cardano’s weekly volume peaked at $11.56 million at the start of the month and $0.63 million at its lowest point. This means Solana has been averaging higher volumes compared to Cardano.

Too close to call?

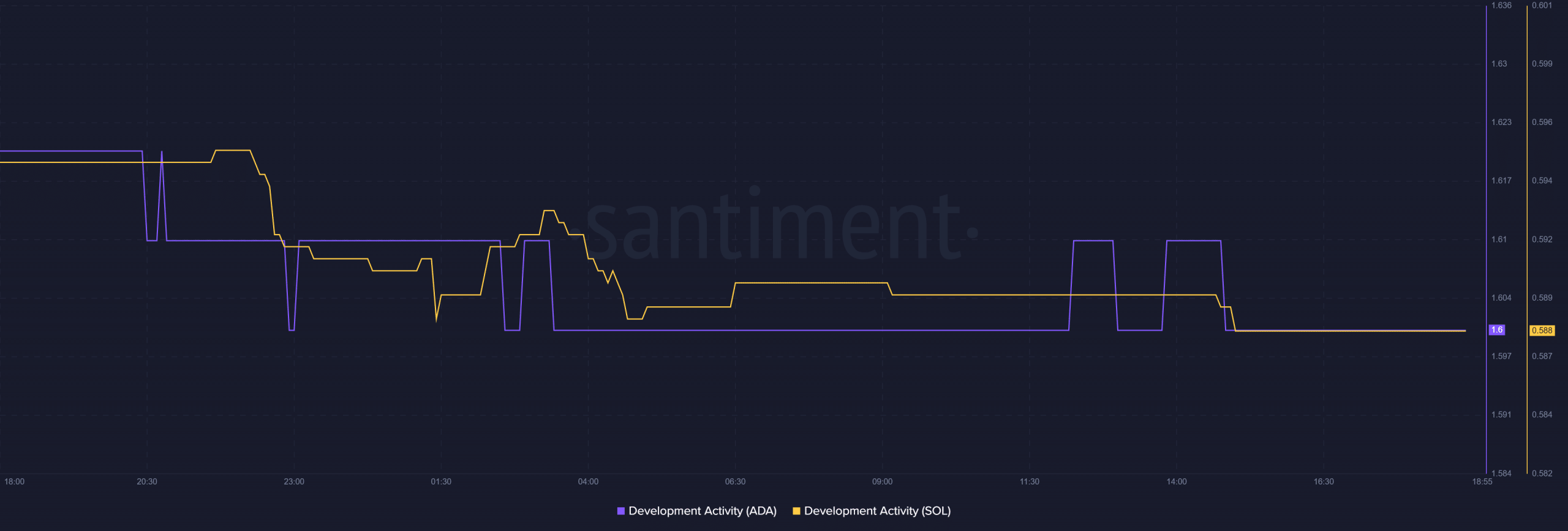

Based on the above analysis, the Cardano vs Solana battle appears to be quite evenly matched. However, the higher Cardano TVL suggests that there is more confidence in its ecosystem compared to Solana. Meanwhile, volume data favors more trading activity in the Solana ecosystem. Development activity has also been quite evenly matched.

Summary

Both networks have been pushing for more organic growth, but the current state of the market has been slowing them down. Cardano is catching up despite its late start. On the other hand, Solana has demonstrated resilience despite stumbling multiple times along the way due to instances of network downtime.

Nevertheless, investors looking for a clear winner may have a hard time picking a clear winner in the Cardano vs Solana battle. Perhaps investors choosing the diversification route will have the advantage.