Altcoin

Cardano was a whale favorite in October – Will it continue in November?

Large holders grabbed nearly 1.89 billion ADA coins in the month of October, amounting to roughly $670 million at press time market price.

- The behavior of the user cohort reflected bullish momentum for ADA.

- The OI in ADA futures rose to the highest level in nearly five months.

Recently Cardano [ADA] again came on the radar of investors who held a substantial chunk of the coin’s circulating supply.

Large holders on accumulation spree

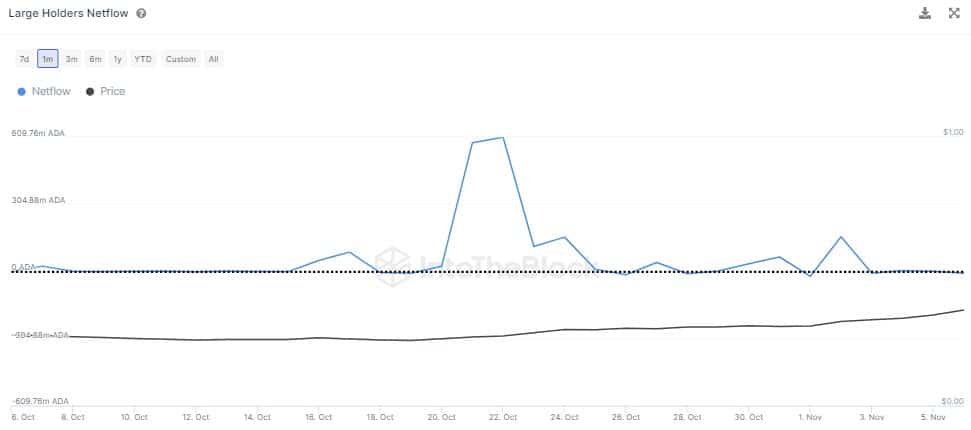

According to a recent X post by on-chain research firm IntoTheBlock, large holders grabbed nearly 1.89 billion ADA coins in the month of October. In terms of market price at press time, the purchased supply amounted to roughly $670 million.

As per IntoTheBlock, large holders are addresses holding over 0.1% of a crypto’s circulating supply. Large Holders Netflow measures the number of inflows minus outflows pertaining to these addresses.

Spikes in this indicator are interpreted as aggressive accumulation by large players. Typically, when this cohort exhibits strong preference for a coin, it reflects bullish momentum.

IntoTheBlock mentioned that bulk of the buying happened in the range between $0.249 and $0.271. Interestingly, while ADA has risen almost 29% since then until press time price of $0.35, a similar enthusiasm in purchasing was not seen.

Big whales go into overdrive

AMBCrypto dug deeper and came up with new findings after analyzing Santiment’s whale transaction data.

While transactions worth more than $100,000 in ADA indeed plateaued after a spike, big whale transfers worth more than $1 million lifted during the period between 1st November-3rd November.

This was the time when ADA covered the distance between $0.28-$0.32.

The dramatic spikes in accumulation by different user cohorts at different points of time started reflecting on their overall holdings. Addresses holding a minimum of 100 ADA coins steadily increased since late October.

A glance at ADA’s derivatives market

ADA’s price has jumped by nearly 24% over the past week. Such sharp rips in value generally increase speculative interest for a crypto asset.

The Open Interest (OI) in ADA futures contracts rose to $164.88 million at press time, a gain of 30% over the past week, and the highest in nearly five months.

An uptick in OI coming on the heels of the price rally implied new positions being opened for ADA.

How much are 1,10,100 ADAs worth today?

For a greater part since late October, the Longs/Shorts Ratio has been greater than 1, indicating dominance of traders gunning for price increases.

As more traders looked to profit from an ADA rally, there were reasons to believe that demand for the crypto would increase in the short-term.