Cardano whale activity surges 1218% in 7 days – What about ADA?

- ADA surged by 21.35% in the last seven days and 2.5% in the last 24 hours.

- Whale activities and new developments like Chang Hard Fork has shifted market sentiment.

After a sustained decline, Cardano [ADA] has been soaring once again. As of this writing, ADA has recorded a 21.35% surge in the last seven days, while trading volume increased by 26.85% to $324M in the last 24 hours.

According to CoinMarketCap, Cardano’s market cap has risen 2.36% to $14.3B in 24 hours. The question in every trader’s mind is — why is there a sudden reversal?

What’s driving the surge

The surge has left traders and market analysts speculating on the cause. For starters, ADA has been experiencing an exponential surge in whale activity for the last seven days.

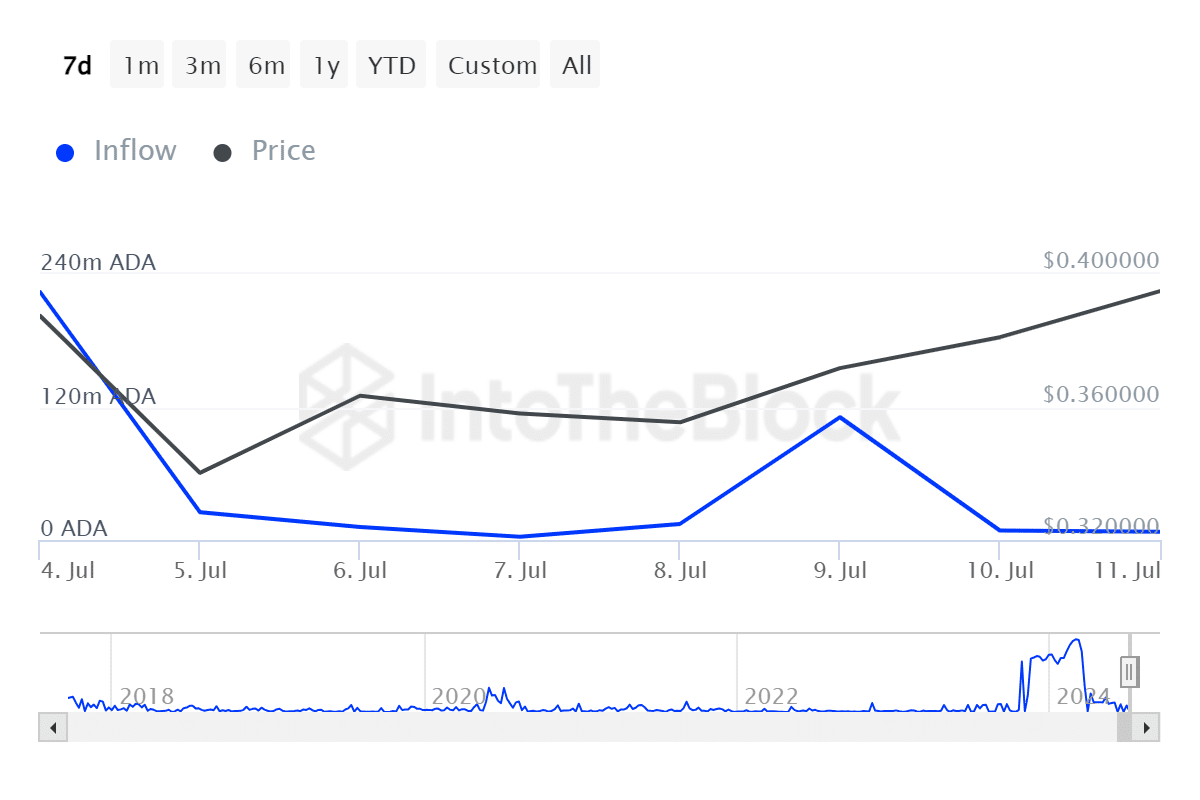

AMBCrypto’s analysis of IntoTheBlock indicated that large holders’ inflow has increased from 14.51M to 110.8M between the 8th and the 9th of July.

This was after a 1218% rise after a fall from 223.8M on the 4th of July to 25M on the 5th.

The rise in large purchases showed that investors were buying at lower prices, anticipating future price increases. The surge in whale activity has increased the demand for altcoins, further driving prices up.

Also, on the 9th of July, Charles Hoskinson announced the completion of Chang Hard Fork. Thus, the increased development activities promises investors a better future for Cardano, increasing their confidence.

ADA: What price charts indicate

AMBCrypto’s analysis showed that ADA was experiencing upward momentum at press time. The altcoin’s Chaikin Money Flow (CMF) was above zero at 0.07 at press time.

A positive CMF suggested that buyers dominated the market due to sustained buying pressure. Thus, a positive CMF is a bullish signal, implying a potential continued price rise.

Equally, the Money Flow Index (MFI), at 51, showed increasing buying pressure and a change in market sentiment towards bullish.

With a higher volume of money flowing into the altcoin than outflow, the market was experiencing heightened buying interest.

Cardano’s Relative Strength Index (RSI) at 52 and RSI-based MA at 44 showed a bullish bias at press time. Thus, the RSI above the moving average indicated that the bullish momentum is strengthening.

Therefore, the RSI above the recent average showed strong upward pressure.

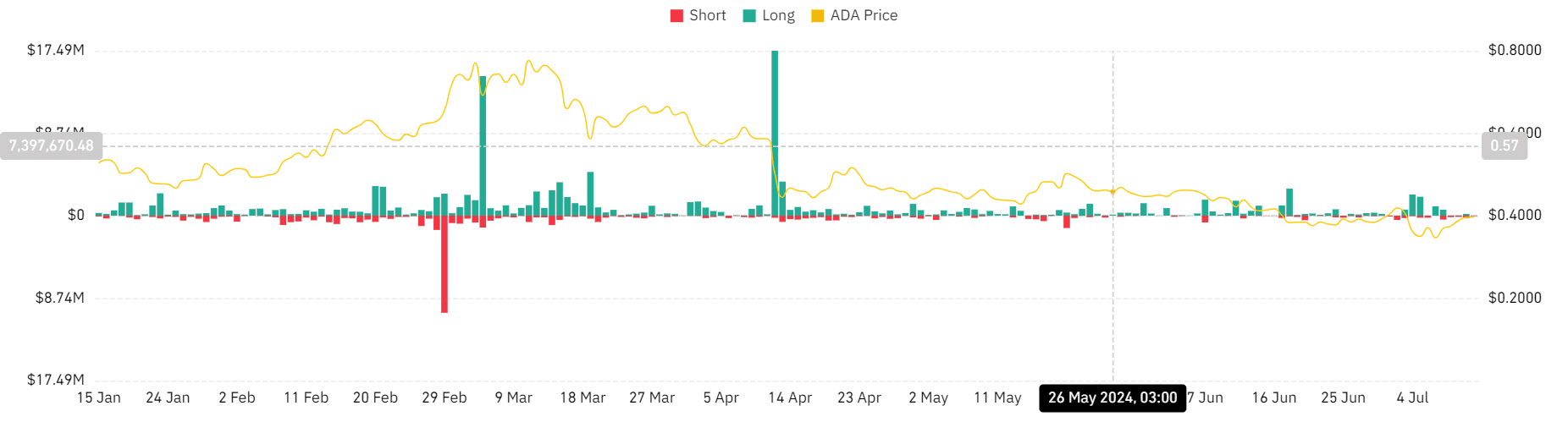

Looking further, AMBCrypto’s Coinglass analysis showed ADA liquidation for short and long positions has been declining for the last seven days. Long positions liquidation has declined from $2M to $0 at press time.

The decline suggested a positive market sentiment with investor’s confidence in the future potential of the altcoins.

How far will ADA surge?

ADA was trading at $0.4 at press time after a 2.5% increase in 24 hours. If the market sentiment with increased buying pressure resulted in upward momentum, the ADA could experience a short-term rally.

Is your portfolio green? Check out the ADA Profit Calculator

Thus, a sustained upward momentum will extend prices to the next resistance level at $0.457. If it breaks out of the above resistance level, it could further push prices to $0.521.

Consequently, if the daily charts close below $0.385, the bullish outlook will reverse towards $0.362.