Cardano

Cardano whales re-enter at $0.91 – Can ADA target $1.30 next?

Whale activity plays a crucial role in Cardano’s market dynamics, signaling confidence amid volatility.

- ADA bounced back above key $1 support, signaling the potential for a bullish breakout

- Whale accumulation at lower levels sparked optimism for ADA’s future price recovery

Cardano [ADA] has been at the center of attention in recent weeks, showcasing wild price swings that have left investors both anxious and intrigued.

After dropping from a peak of $1.32 to a low of $0.91, ADA has clawed back to a critical price level.

This volatility has sparked debates about whether the cryptocurrency is poised for recovery or facing more turbulence. Amid this uncertainty, one factor stands out: whale activity.

Cardano whales signal confidence amid volatility

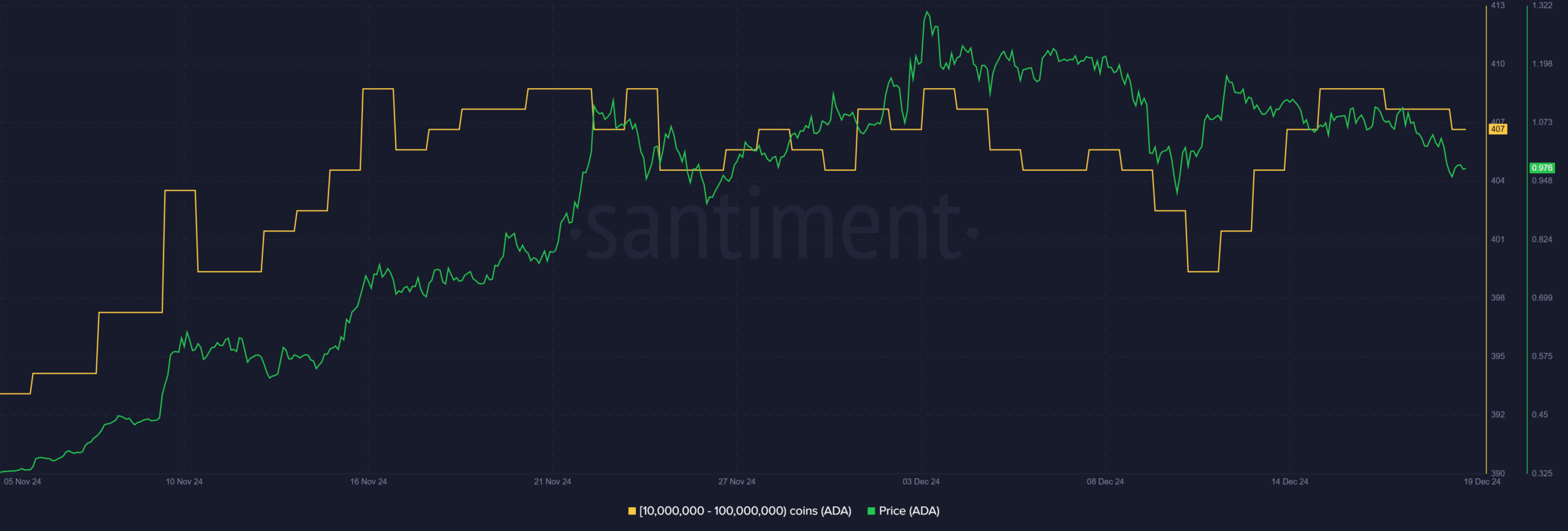

The recent price movements have been significantly shaped by the strategic actions of Cardano whales. Data reveals that these entities quickly offloaded their holdings as ADA surged from $1.15 to $1.33, capitalizing on the bullish momentum to lock in profits.

However, as the price retraced sharply to $0.91, these same whales re-entered the market, accumulating an estimated 160 million ADA tokens during the dip.

This calculated accumulation has sparked optimism among market participants, suggesting that whales see the current price levels as undervalued. Historically, such buying behavior by smart money has preceded significant price recoveries.

Whether this marks the beginning of a sustained rally or serves as a temporary liquidity play, it underscores the critical role of whale activity in driving ADA’s market dynamics.

Key price levels

Cardano recently demonstrated resilience by bouncing back above the critical $1 level, which has historically acted as both psychological and technical support.

This swift recovery suggests strong buying interest at this threshold, making it a pivotal area for bulls to defend. Currently, ADA is trading slightly above $1, consolidating near the $1.04 mark.

A decisive close above this level could serve as a springboard for further upward momentum, with traders eyeing $1.20 as the next key resistance zone. In the past, this level triggered selling pressure, making it crucial for confirming a bullish breakout.

The RSI at around 46 indicates a neutral market, with enough room for a price surge if bullish momentum builds.

Meanwhile, trading volumes have stabilized after a sharp increase during the recent sell-off and rebound phases. If ADA breaks and holds above $1.20, it could pave the way for a rally toward $1.30–$1.35, while failure to do so might result in a pullback to $1.

Read Cardano’s [ADA] Price Prediction 2024–2025

What’s Cardano’s next move?

Cardano’s next move hinges on its ability to maintain momentum above $1. A break past the $1.20 resistance could spark a rally toward $1.30–$1.35, driven by whale accumulation and bullish sentiment.

Consolidation between $1 and $1.20 is another plausible outcome, reflecting indecision and offering an opportunity for further accumulation.

If ADA fails to hold $1, bearish pressure could push the price back to $0.90 or lower, especially if broader market sentiment weakens.

Recent whale activity and strong support at $1 suggest that a bullish breakout or consolidation is more likely in the short term. Traders will closely monitor key levels and market dynamics for confirmation of ADA’s trajectory.