Cardano: What whale holding patterns reveal about ADA’s future

- ADA whales were committed to holding rather than selling, which has positively impacted recent price action.

- At the same time, both large transaction volumes and overall selling activity had decreased, further supporting a potential recovery.

Cardano [ADA] seems positioned to recoup losses from recent weeks, where it previously declined by 3.87% and 4.87% on weekly and monthly time frames, respectively.

With the whales stepping back from selling and opting to hold, the asset has posted a 0.50% gain over the past 24 hours.

This reinforced the coin’s gradual upward trend.

Whales show long-term commitment to ADA

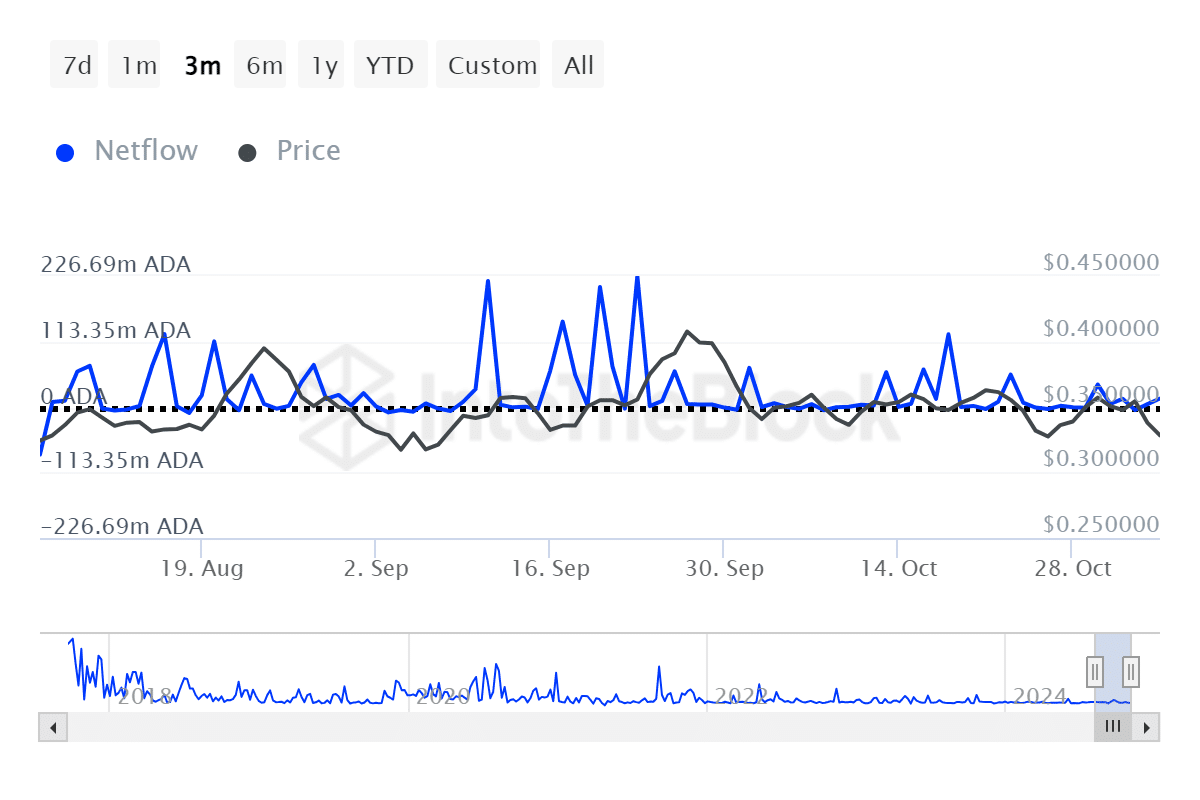

According to data from IntoTheBlock, the number of large holders who control at least one percent of the ADA’s supply has seen a substantial drop in the Large Holder Netflow.

Large Holder Netflow is a metric that tracks the net inflow or outflow of assets.

Currently, this metric is negative for the altcoin, having dropped by 1181.52% over the past week.

A decline of this magnitude suggested that large holders are moving their ADA from exchanges to private wallets, signaling a shift toward long-term holding.

This activity can lead to a supply squeeze, which may drive up ADA’s price as it continues its recent upward momentum, gaining over the last 24 hours.

Bullish activity may signal a potential rally

Further analysis by AMBCrypto revealed signs that the altcoin was gradually positioning for a potential price rally.

One key metric to be noted is the large volume of transactions, which tracks the amount of ADA traded by large holders with significant holdings.

Over the last 24 hours, ADA transactions totaling 18.39 billion have taken place.

This metric can signal either bullish or bearish sentiment, depending on whether volume trends upward or downward.

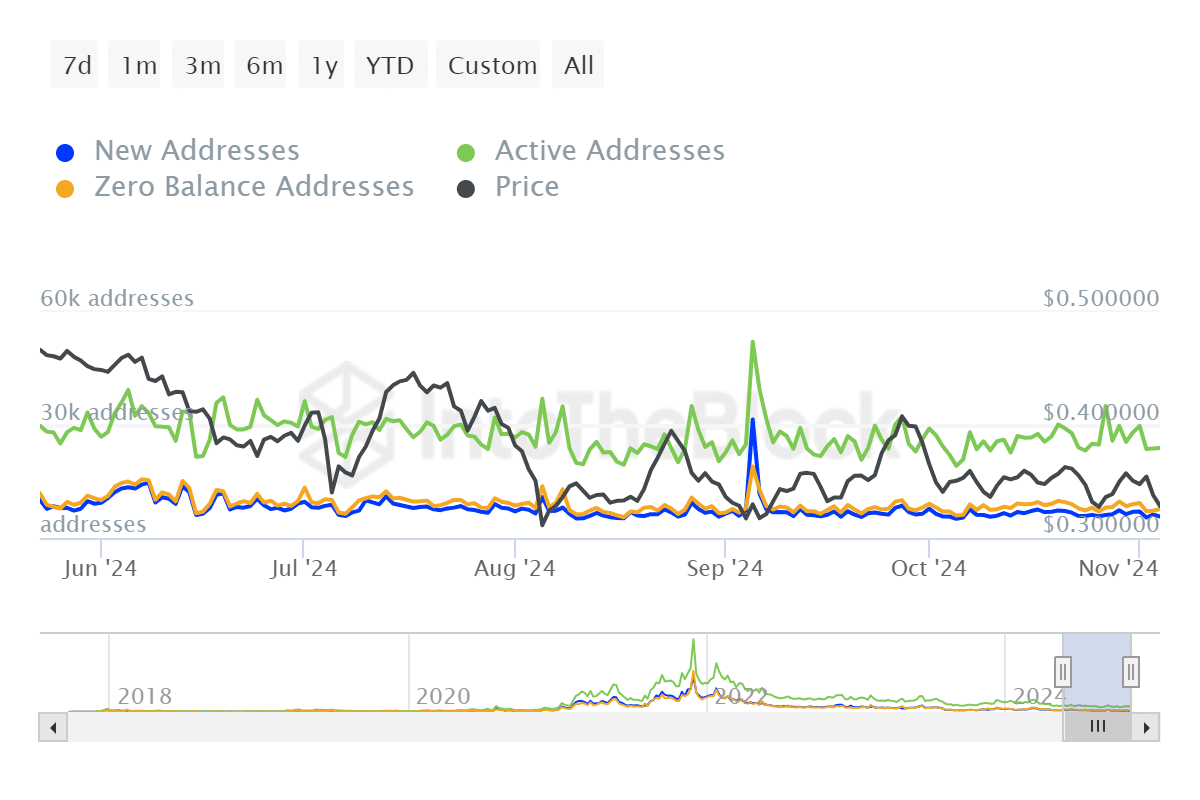

AMBCrypto also highlighted a slight decline in the number of Daily Active Addresses (DAA) while ADA’s price saw a minor increase.

This, coupled with a drop in Large Holder Netflow, suggested that market participants are shifting away from selling and increasingly holding their assets.

This accumulation trend could support ADA’s price growth, potentially driving higher trading levels in the upcoming sessions.

Gradual uptick in buying activity

Open Interest (OI) in ADA has shown a modest uptick over the past 24 hours, rising by 0.28%, at press time, according to Coinglass.

This increase pointed out that more long contracts are being opened and actively funded, potentially supporting a positive price movement for ADA.

Realistic or not, here’s ADA’s market cap in BTC terms

Despite this bullish signal, the Total Value Locked (TVL) within ADA’s ecosystem has remained flat according to Defillama, indicating neutral sentiment in the broader market.

TVL represents the total capital held within a DeFi platform, reflecting the amount users have staked, deposited, or invested.

A rise in TVL would likely confirm the bullish trend and reinforce ADA’s upward momentum.