Altcoin

Cardano: Why ADA seems to be ‘overlooked’ by traders

While the general altcoin market has witnessed a rally following the recent ETF approval, ADA continues to be trailed by poor sentiment.

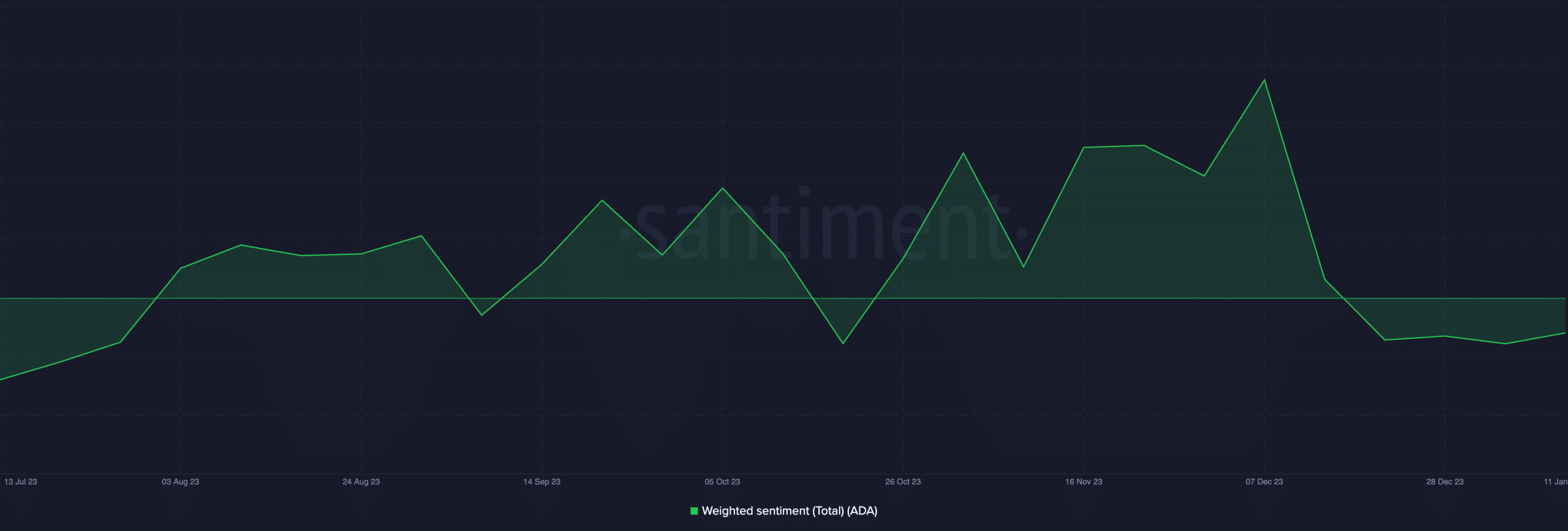

- ADA’s weighted sentiment has remained negative despite the growth in the altcoin market.

- Demand for the coin has fallen since the year began.

Cardano’s [ADA] weighted sentiment has remained negative despite the rally in the general altcoin market following the Securities and Exchange Commission’s (SEC) recent approval of a Bitcoin ETF.

In a recent post on X (formerly Twitter), on-chain data provider Santiment noted that while ADA “is overlooked,” the “sentiment toward top cap assets remain at extremely optimistic levels with spotlights on them following the ETF approvals.”

ADA’s weighted sentiment at press time was -0.29, pegged below the center line since 21st December.

Demand for ADA is low

Despite the poor sentiment, ADA has benefited from the altcoin market rally to log a 7% uptick in the past week, according to data from CoinMarketCap.

However, an assessment of the coin’s price movements on a daily chart showed that the rally had not been backed by any significant demand for ADA.

Suggesting a decline in ADA accumulation, the coin’s key momentum indicators have trended downward since the year began. This has shown that ADA traders have increasingly sold off their holdings rather than accumulate new coins.

At press time, ADA’s Relative Strength Index (RSI) was 51.52, while its Money Flow Index (MFI) was 48.93.

ADA’s price has witnessed a decline since the bears pushed out the bulls on 3rd January, as observed from readings on its Directional Movement Index (DMI).

On that day, the coin’s negative directional index (red) crossed above the positive directional index (green) and has since remained in that position.

This kind of crossover occurs when selling pressure exceeds buying momentum. It is seen as a significant marker of a change in sentiment from bullish to bearish.

Confirming the bearish trend, ADA’s Aroon Down Line (blue) has since risen to return a value of 64.29% at press time.

Is your portfolio green? Check the ADA Profit Calculator

When an asset’s Aroon Down line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

Also, the coin’s MACD line below the zero level remained positioned below its trend line. A MACD value below zero indicates that the shorter-term moving average is below the longer-term moving average, suggesting a downward trend.