Cardano: Why increase in whale transactions should be a cause of concern

- ADA has seen a rally in large whale transactions in the past few days.

- Price assessment, however, revealed that a price reversal might be imminent.

Layer 1 coin Cardano [ADA] has seen a spike in large whale transactions in the past few days, data from Santiment revealed.

Realistic or not, here’s ADA market cap in BTC’s terms

According to the on-chain data provider, the daily count of ADA transactions over $100,000 has significantly increased since 3 February.

As of 5 February 1526 ADA transactions worth over $100,000 were completed, marking the highest daily count since 11 May 2022.

All ADA has in store in a price drop

An analysis of historical trends in network transactions has indicated that a substantial increase in the number of transactions valued at over $100,000 can foreshadow a subsequent shift in the asset price, either upwards or downwards.

Based on the recent activity and the current state of ADA, there may be a negative price change in the coming days.

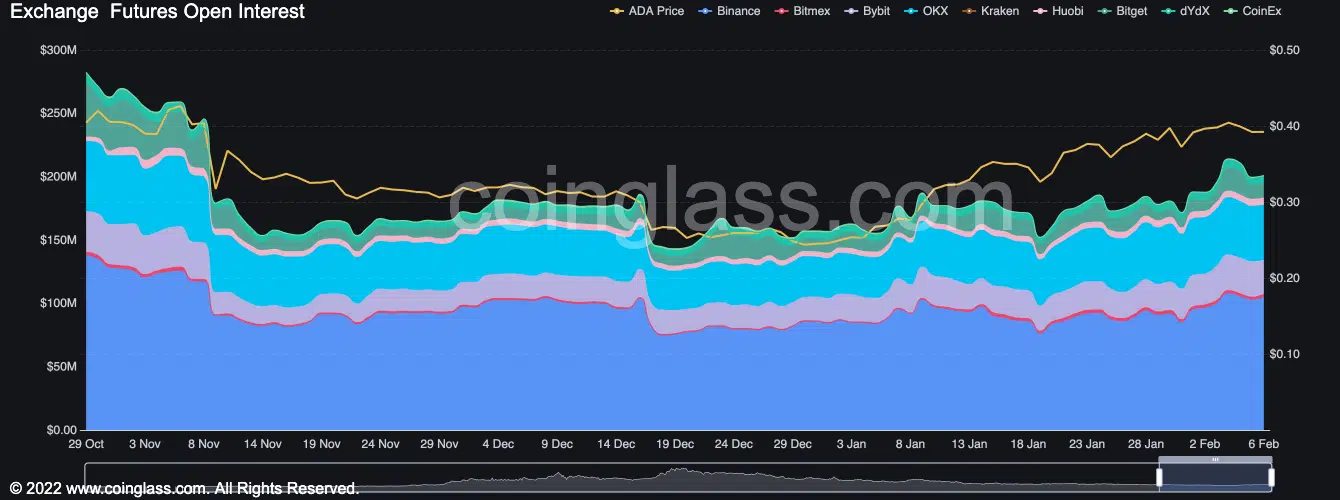

First, the altcoin’s Open Interest declined in the past two days, data from Coinglass revealed. At $200 million at press time, ADA’s Open Interest fell by 7% in the past two days.

The decrease in Open Interest in the last two days revealed that ADA traders believe that long positions were no longer favorable, indicating a potential bearish trend in the coming days.

Further, an assessment of ADA’s price performance revealed that the coin has traded in the tight range since the end of January. Since 27 January, ADA’s price has oscillated between $0.38 and $0.40. According to CoinMarketCap, the coin traded at $0.39 at press time.

When a crypto asset’s price trades in a narrow range, it usually indicates a period of consolidation before a potential price breakout or reversal.

This could mean that the market participants are unsure of the direction of the price and are waiting for more clarity or a catalyst to drive the price in a particular direction.

During these periods of consolidation, the volatility in the market may decrease, and the trading volume may also decrease as traders are less active.

Read Cardano’s [ADA] Price Prediction 2023-24

With the buyers losing their hold on the market, the likelihood of a price reversal was higher than that of a rally in the current ADA market.

At press time, the positive directional indicator (yellow) of the alt’s Directional Movement Index (DMI) was in a downtrend at 18.96, ready to intersect with the negative directional index (red).

When this intersection takes place, ADA sellers would regain full control of the market and initiate a price decline.

Lastly, the Chaikin Money Flow (CMF) was in a downtrend at 0.05 at the time of writing. This indicator has been so positioned since mid-January. While the alt’s price rose, its CMF fell, creating a bearish divergence.

This showed that although ADA’s price rose in the last month, mirroring the general trend in the market, the demand for it declined as buying pressure dropped severely.

If the CMF falls into negative territory below the center line, it would suggest increased selling pressure, which would likely result in a further decline in the price of ADA.