Cardano’s [ADA] key metrics are going up, is trend reversal on the cards

![Cardano's [ADA] key metrics are going up, is a trend reversal on the cards](https://ambcrypto.com/wp-content/uploads/2023/04/ADA-3.png.webp)

- Cardano’s number of stakers and 24-hour active addresses increased last week.

- Development activity was up, but a few market indicators remained bearish.

Cardano [ADA] has been witnessing a decline in interest from stakers as the percentage of ADA staked went down substantially over the last few weeks.

Total staked $ADA dropped some more to 65%-ish.

Flip side is rewards will go up for remaining stakers.

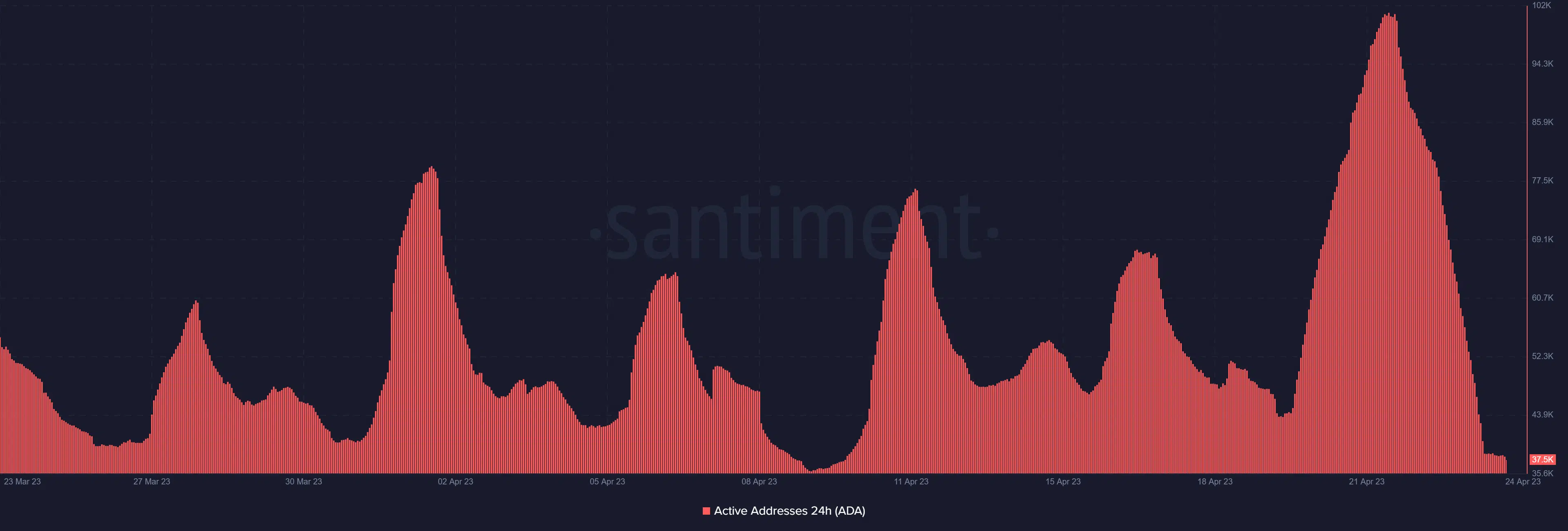

Active #Cardano addresses are up a bunch.

Is this the DEAN effect? pic.twitter.com/57NWzd5NYs

— St₳kΣ with Pride ? (@StakeWithPride) April 23, 2023

A possible reason for this decline could be the drop in ADA’s price, which was caused by the dominant bearish sentiment in the crypto market.

Read Cardano’s [ADA] Price Prediction 2023-24

Wait! Here is good news

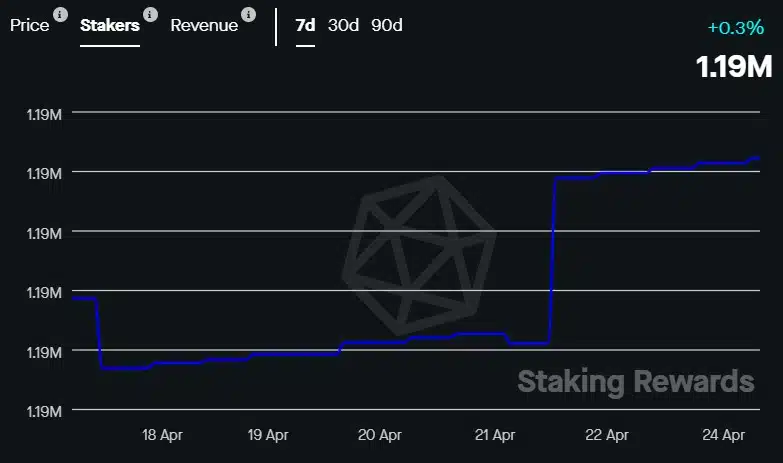

However, the declining trend in the staking space seemed to have come to an end. As per Staking Reward’s chart, the number of ADA stakers increased over the last seven days, which is an encouraging signal for the long-term holders of ADA.

At the time of writing, the ADA staking ratio stood at nearly 65% and had a market capitalization of more than $9.1 billion. Not only that, but ADA’s 24 active addresses have also soared lately, suggesting a higher number of users on the network.

TVL growth halted

Another area that was affected by ADA’s price plummet was its network value. DeFiLlama’s data revealed that Cardano’s TVL-gaining streak had come to an end.

The network’s TVL, which had been on an increasing trend since the beginning of this year, registered declines after 19 April 2023.

The decline of TVL meant that investors were slowing the rate of smart contract deposits which were getting diverted into several other chains.

A quick health checkup

On the other hand, Cardano’s development activity remained high throughout the week, which corresponds to its weekly development report. The report highlights the work done by Cardano’s various teams throughout the previous week.

ICYMI: all the updates on core tech, wallets and services, smart contracts, and scaling and governance are in this week’s development update. Live on #EssentialCardano. https://t.co/RCWzve291m

— Input Output (@InputOutputHK) April 23, 2023

However, ADA’s weighted sentiment metric drifted downwards over the last few days, which can also be attributed to the token’s negative price action.

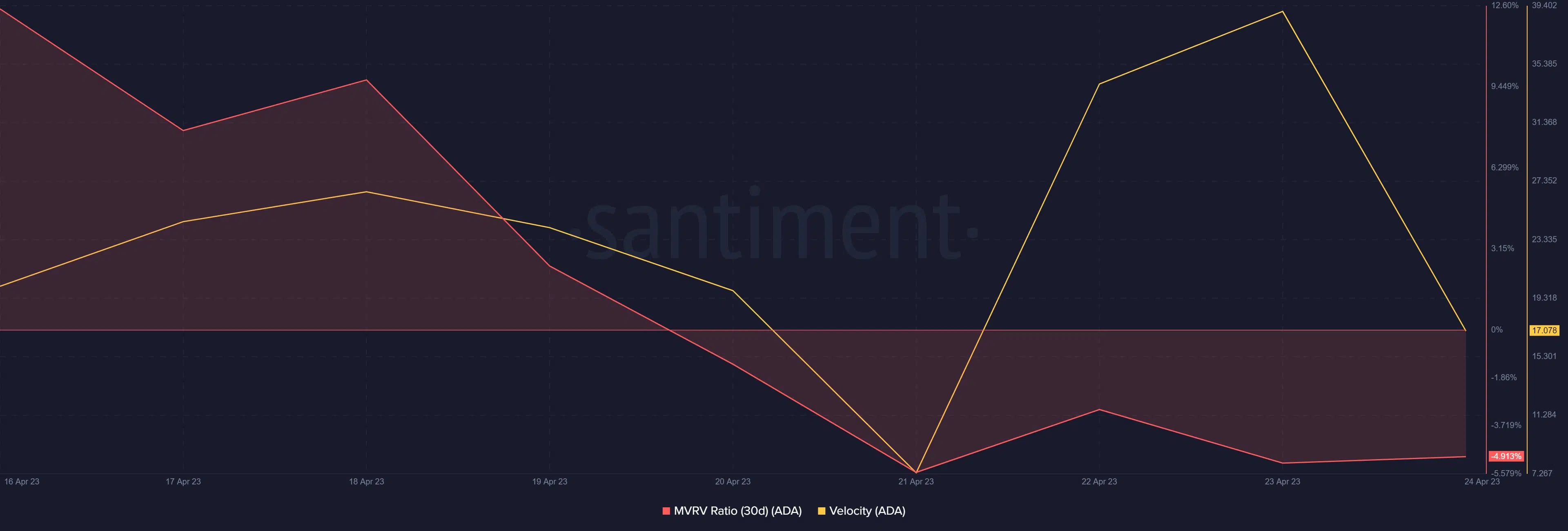

The coin’s MVRV Ratio also declined sharply last week, which was negative. ADA’s velocity was, however, relatively high, suggesting more token transfers were made across wallets.

Should investors expect a trend reversal?

ADA’s price plummeted by more than 11% in the last week. At press time, it was trading at $0.3911 with a market capitalization of over $13 billion.

Though the previous week was hard on investors, the future can be better. CryptoQuant’s data revealed that, while writing, ADA’s stochastic was in an oversold zone. This is a typical bullish signal, as it can potentially increase buying pressure in the near future.

Realistic or not, here’s ADA market cap in BTC’s terms

This possibility of a trend reversal was supported by ADA’s Chaikin Money Flow (CMF), which registered an uptick and was set to cross the neutral mark.

Nonetheless, nothing can be said with certainty as ADA’s MACD displayed a bearish crossover. In fact, the coin’s Relative Strength Index (RSI) was also below the neutral mark of 50.