Cardano’s [ADA] Stablecoin Djed took advantage of the gap left by…

![Cardano’s [ADA] Stablecoin Djed took advantage of the gap left by…](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-03T140949.237.png.webp)

- Djed became Cardano’s fourth-biggest project.

- The development team was working towards an increase in adoption with the option to borrow and use the stablecoin as collateral.

Cardano’s [ADA] stablecoin Djed which launched on 31 January, has surpassed many projects in the ecosystem to become the fourth largest.

Created by the blockchain’s development group Input Output in collaboration with the COTI network, Djed serves as the algorithmic stablecoin for Decentralized Applications (dApps) in the Cardano ecosystem.

How much are 1,10,100 ADAs worth today?

Djed: The young kid on the block

COTI, the blockchain enterprise provider revealed details of the development via a 2 March Medium post. It is significant to acknowledge that the Layer one (L1)- focused firm accrues fees into its treasury through the usage of the stablecoin.

According to the blog post, COTI admitted that it was glad about the milestone. And its next focus was to expand Djed’s adoption and establish more use cases for it and Shen, Djed’s reserve coin. The publication read,

“Now, our main focus is to establish DJED’s adoption and create more utility for it. In the coming weeks, we will present to you various use cases for DJED and SHEN”

In February, Djed boasted of a 600% reserves ratio with 27 million ADA backing the stablecoin. With the over-collateralization mechanism, Djed would be able to remain stable irrespective of the market condition.

However, the stablecoin’s journey to the top would have been impossible if not for its input into the Cardano Total Value Locked (TVL). The TVL tells the number of unique deposits by protocols into an ecosystem.

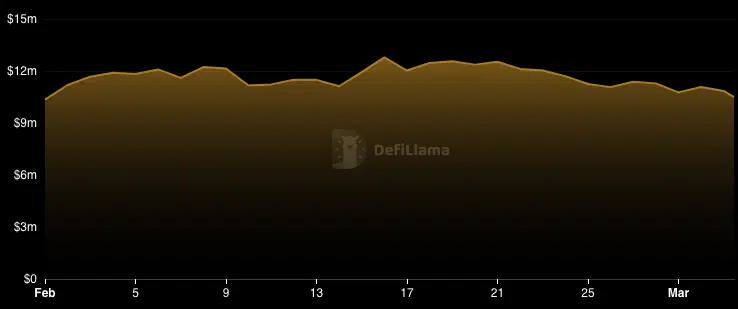

As of this writing, DeFiLlam showed that Djed’s addition to the TVL was around $10.49 million despite its decline in the last 30 days. Adverse, the Cardano and Ergo ecosystems tracker confirmed that the rise helped Djed gain 9% of the total Cardano TVL.

JUST IN: Cardano $ADA stablecoin $DJED has 9% of the ecosystem's total value locked.

— Adaverse News | Cardano and Ergo News (@AdaverseNews) March 2, 2023

Lending season, bubbling activities on the chain

Further details from the COTI release disclosed that the firm was preparing a Djed integration on Aada Finance.

Aada Finance is a lending protocol under the Cardano. The full implementation would also allow DJED and SHEN to become borrowable assets on Aada, as confirmed on 16 February.

? Governance voting No. 4 has passed – new assets for borrowing and new collateral assets has been added to the Aada Finance

Happy trading at https://t.co/pVjs8q6WuN@DjedStablecoin @COTInetwork @Indigo_protocol @claymates @SingularityNET pic.twitter.com/po33aQfRSn

— Aada (@AadaFinance) February 16, 2023

Realistic or not, here’s ADA’s market cap in ETH’s terms

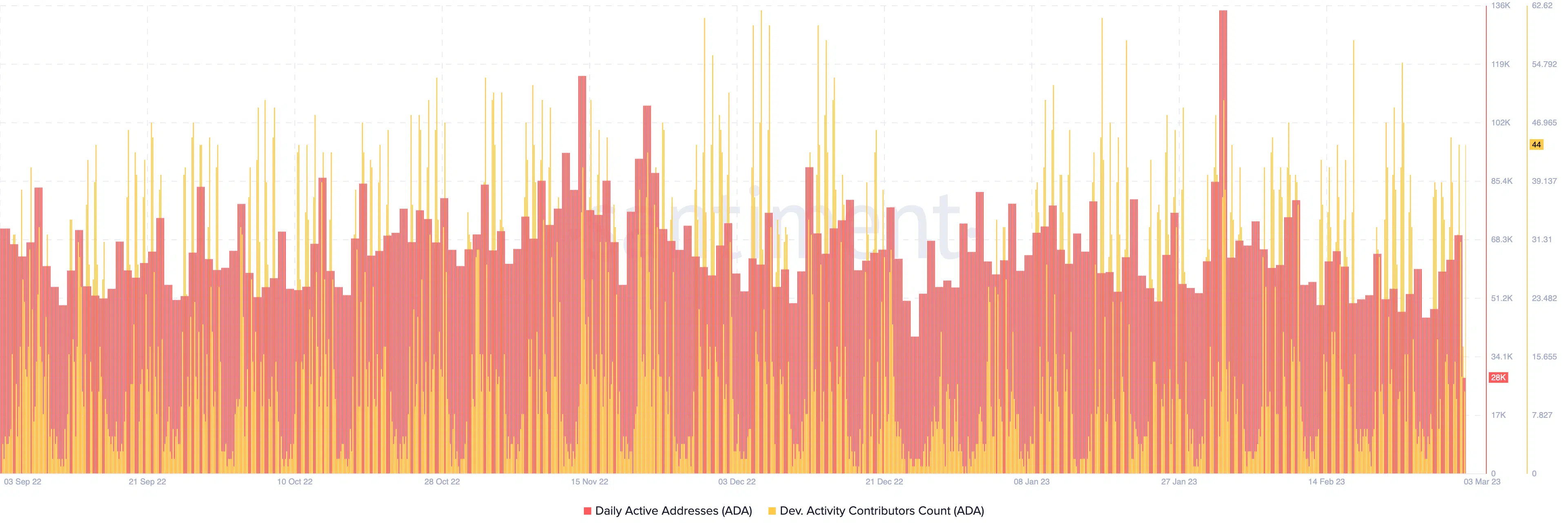

Though the ADA value slid just like other cryptocurrencies, there were major improvements per on-chain activity. According to Santiment, daily active addresses hit the highest on 3 March since the 135,000 year-to-date record on 10 February.

The metric describes the number of distinct wallets that participated in ADA transfers on a daily basis. Therefore, the hike supported an increase in transactions.

Also performing at an excellent level was the development activity contributor count which peaked at 44.