Cardano’s monthly report reveals intriguing activity: What was its effect on ADA

- Cardano pushed positive network growth in April.

- ADA gave up its April gains after struggling to shake off the bear.

Every other top blockchain has been working towards building and attracting organic growth. Similarly, Cardano [ADA] just dropped its monthly report for April and it reveals some interesting insights as far as network activity is concerned.

Is your portfolio green? Check out the Cardano Profit Calculator

April may not have been the most optimal month for growth due to market and regulatory headwinds. Nevertheless, Cardano still achieved some growth.

According to the update, the network maintained positive growth in its network transactions, which grew by 2.49% to 65.6 million transactions. This growth was backed by a 1.19% increase in the number of wallets.

#Cardano On-chain Stats ?

Let's keep growing #CardanoCommunity! ? pic.twitter.com/6Ct5iGW67k

— Cardano Foundation (@Cardano_CF) May 1, 2023

Simple type of transactions accounted for the majority of the transactions at 49%. Smart contracts transactions were up 30% during the month while metadata accounted for the remaining percentage. The key takeaway from the monthly report was that Cardano’s utility was seeing significant growth.

Cardano’s TVL also gained by a substantial margin. It grew from as low as $138.61 million at the start of the month to a high of $171.3 million. A weak second half of the month saw a sizable TVL drawdown before closing at $152.90 million. However, this was still a premium compared to its lowest TVL in April.

ADA gives up its April gains

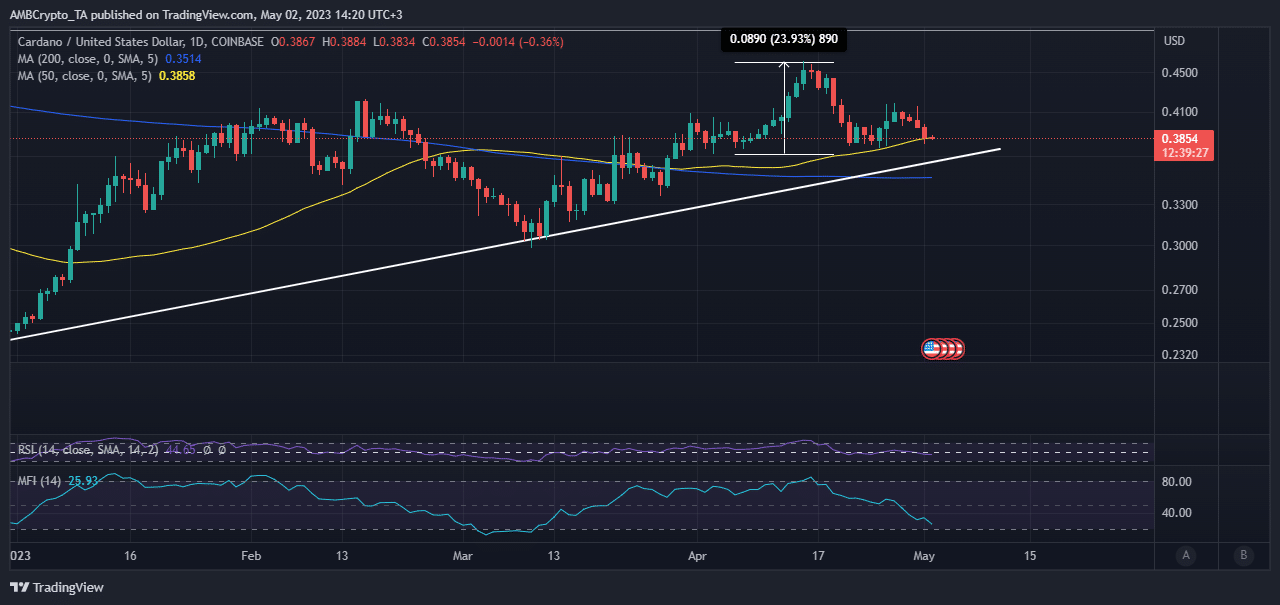

In the subject of Cardano’s monthly recap, its native cryptocurrency ADA also had a positive performance in the first half of April. It delivered a 23% price gain in the first two weeks of the month, but then gave up almost all of those gains.

A crypto’s performance at the end of every month may set precedence for how it will perform in the new month. ADA’s performance in the last 48 hours built on the bearish performance that the cryptocurrency delivered in the last week of April. It exchanged hands at $0.38 and was rapidly approaching short-term support near $0.37 at press time.

ADA investors should note that an extended downside may occur if the support level turns out to be weak. Such an outcome may cause a retest of its mid-term support level near the $0.35-$0.36 range. ADA’s RSI was already slipping below the RSI’s mid-level at the time of writing, while the MFI still indicated signs of outflows.

How many are 1,10,100 ADAs worth today?

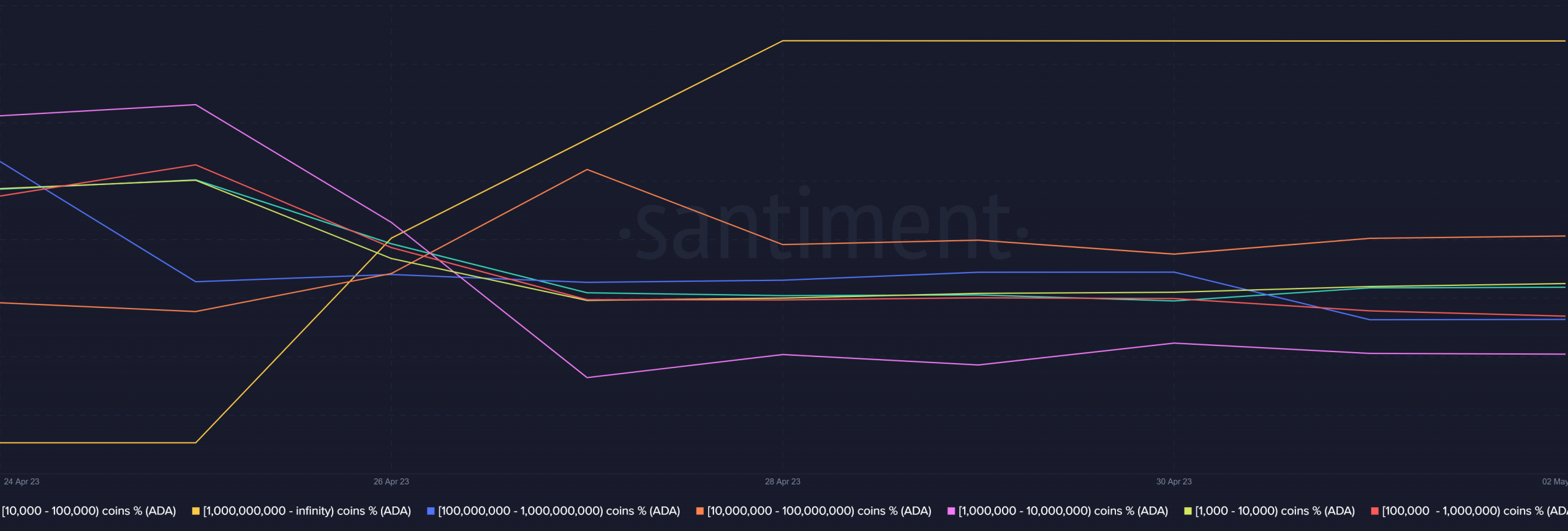

As far as ADA whales were concerned, its supply distribution revealed low activity. However, there was some slight activity by both bullish and bearish whales in the last two days. This was reflected in the lack of confidence in the market at press time.

ADA traders should keep an eye out for mid-week directional stimulation. It may offer some insights into the cryptocurrency’s next move in the upcoming two weeks.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)