Cardano’s short positions increase: What should you do with your ADA?

- Short positions taken against ADA grew significantly.

- Activity on the Cardano network fell materially as well.

Cardano [ADA] has been one of the many coins that has not been performing as well in the last few weeks, compared to other tokens.

Due to this, the short positions taken against ADA soared. Over the last 12 hours, ADA was the third most-shorted token out of all cryptocurrencies.

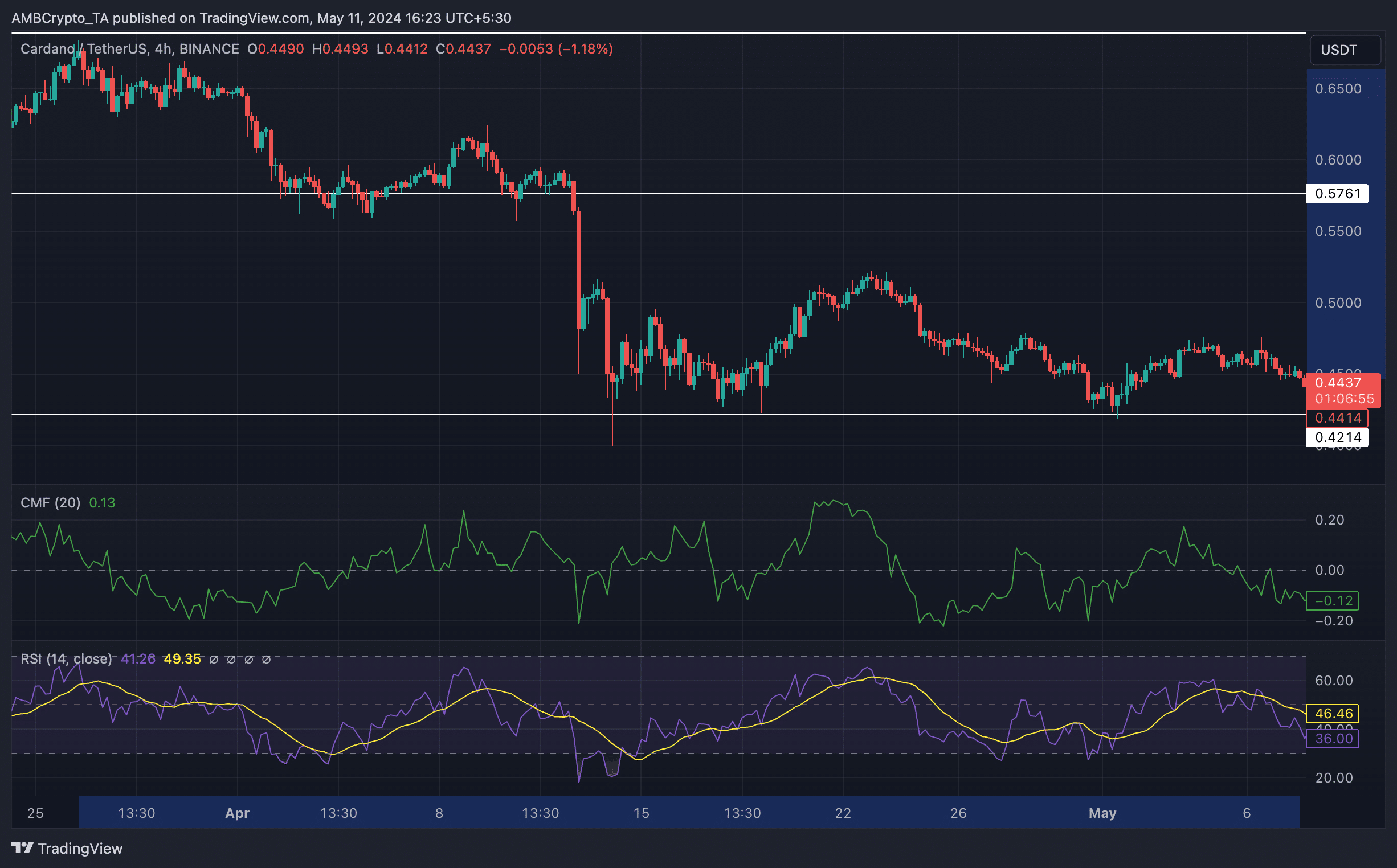

ADA’s fall began after the 27th of March after it tested the $0.6700 level. The price fell by 35% during this period, while exhibiting multiple lower lows and lower highs, which were signs of a bearish trend.

Over the past few weeks, there has been no sign of a reversal for ADA. The CMF (Chaikin Money Flow) indicator declined significantly as well. A falling CMF indicated that the money flowing into ADA had fallen.

Additionally, the RSI (Relative Strength Index) for ADA had also fallen below to 36, implying that bullish momentum around ADA had weakened materially.

Social activity on the rise

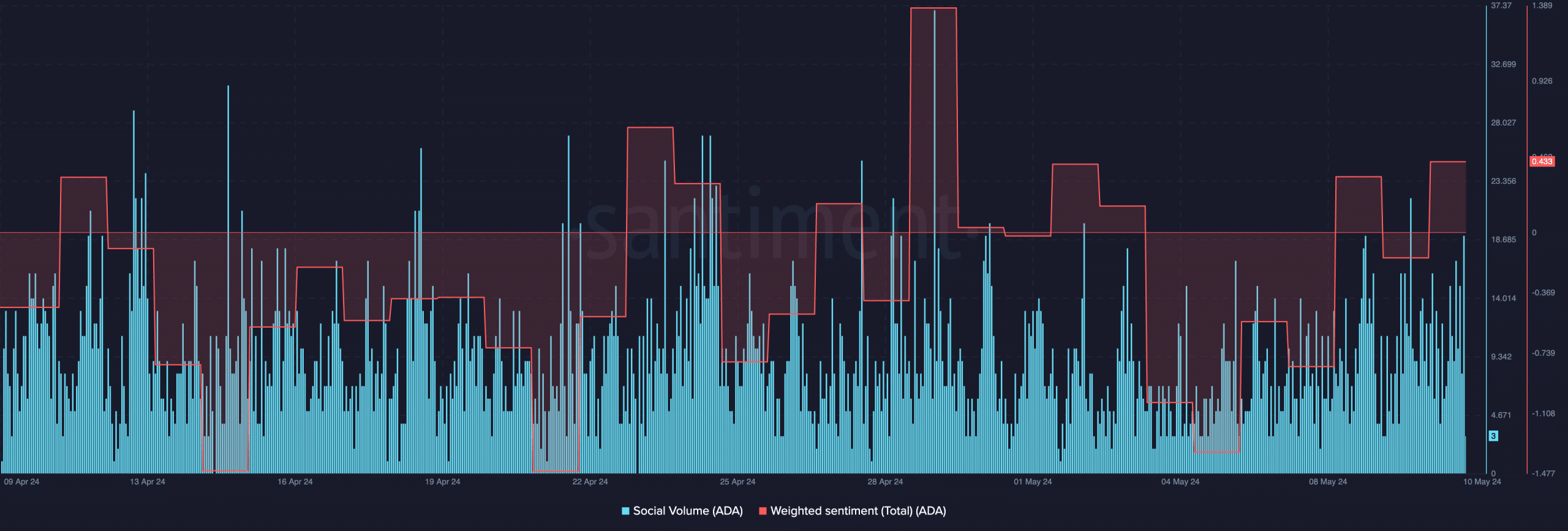

On the social front, things were looking positive for ADA. The Social Volume for ADA had remained consistent over the past month, indicating that the token was getting traction on social media platforms.

The Weighted Sentiment around ADA had also grown at press time, implying that the number of positive comments around ADA had outnumbered the negative ones.

ADA’s popularity on social media may play a key role in a possible reversal for its price in the future.

How is ADA doing?

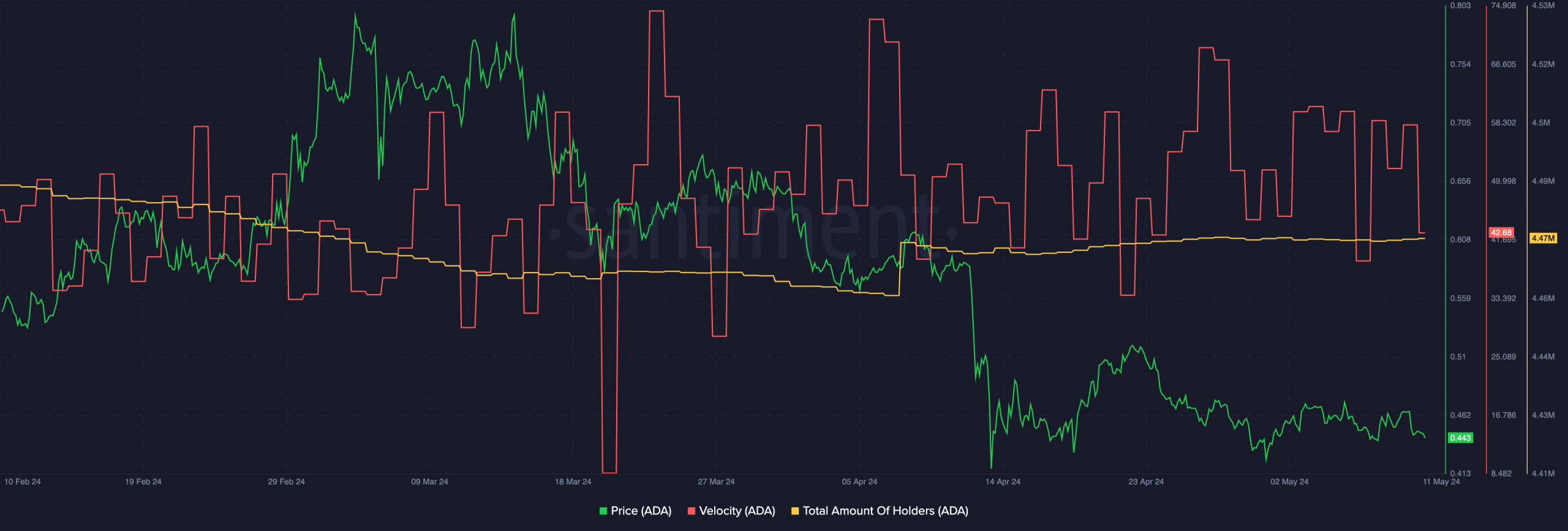

Coming to the state of the token, it was seen that the velocity of ADA had fallen materially.

Surprisingly, despite the decline in price, the number of ADA token holders continued to grow.

The rising number of ADA holders suggested that there may be some retail interest in the ADA token, however, it hasn’t been significant enough to push the price of ADA upwards.

Read Cardano’s [ADA] Price Prediction 2023-24

The Cardano protocol was also performing poorly. Over the past month, the number of daily transactions on the network fell from 90,000 to 45,000.

Coupled with that, the number of daily active addresses on the network also significantly fell from 70,000 to 29,000 during the same period.