Cardano’s TVL surge is pushing ADA this way

- Cardano’s TVL surged by 4.53% in the last 24 hours

- However, ADA’s RSI didna seem to second the TVL update and stood in the neutral zone at press time

Cardano’s [ADA] performance over the last 30 days has been equal parts of up and equal parts of down. The network and the altcoin saw healthy growth lately courtesy of Cardano’s high transaction count.

However, the Cardano ecosystem had a lot more going on in the background. As of 23 May, Cardano’s Total Value Locked (TVL) seemed to be going parabolic as per Cardano Feed’s latest tweet. This meant that a significant number of investors were staking their ADA.

? BREAKING: $ADA #Cardano Total Value Locked going parabolic! pic.twitter.com/5aA1U4jtKT

— Cardano Feed ($ADA) (@CardanoFeed) May 23, 2023

Read Cardano’s [ADA] Price Prediction 2023-24

A moment of celebration

Data from the intelligence platform DeFiLlama stated that as of 23 May, ADA’s TVL stood at $158.16 million. The TVL saw a 4.53% raise in the last 24 hours. Furthermore, the number of active users on the network stood at 63.31k at the time of writing.

Although the number of active users stood lower than 21 May, it still hovered around the same number for the last two days. This could be deemed as a bullish narrative for the altcoin since more and more users were willing to stake their ADA.

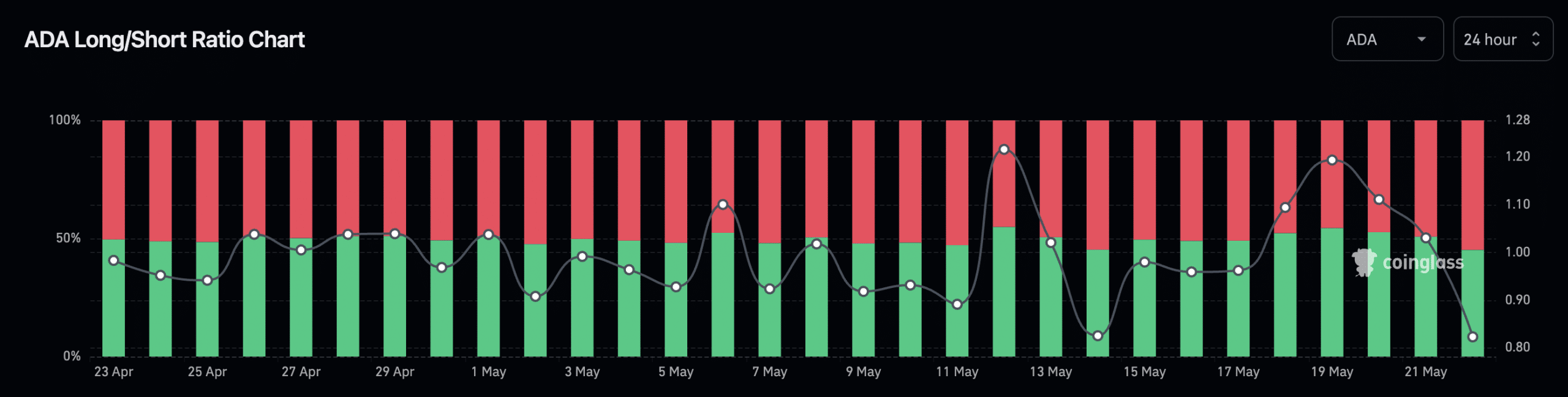

Despite the rise in TVL, what looked concerning for ADA was the long/short ratio. At the time of writing, ADA’s long/short ratio favored short-term traders over long-term traders. At press time, short-term traders held 54.85% of the positions as compared to 45.15% of long-term traders.

At the time of writing, the long/short ratio stood at 0.8232.

Reversal on the charts?

As per data from the intelligence platform Santiment, ADA’s metrics didn’t exactly seem in a bullish mood. The amount of ADA holders did witness a steady rise as of 23 May but rose only after witnessing a drop around mid-April. However, the weighted sentiment witnessed a significant rise which was a good sign for the network.

On the contrary, ADA’s development activity took a hit and dropped down to 79.02 from the high of 94.39. This indicated that developers weren’t contributing enough toward making developments on the network.

At the time of writing, ADA was exchanging hands at $0.371 and the bullish narrative seemed to getting onto ADA since it was moving in the green. Additionally, ADA was trading 0.68% higher in the last 24 hours and 1.28% higher over the last seven days as per data from CoinMarketCap.

How much are 1,10,100 ADAs worth today?

Furthermore, as per additional data from CryptoQuant, ADA’s Relative Strength Index (RSI) stood in a neutral zone at 55. This indicated that ADA’s price could move toward the overbought zone in light of higher buying pressure.

Thus, traders could keep a further watch on ADA’s TVL to assess a further upswing in the bullish momentum over the next few days.