Cardano’s wild 4 days: From $0.48 peak to 10% fall, what’s next?

- ADA’s price has fallen almost 10% in the past three days.

- This has occurred despite the surge in its daily active addresses.

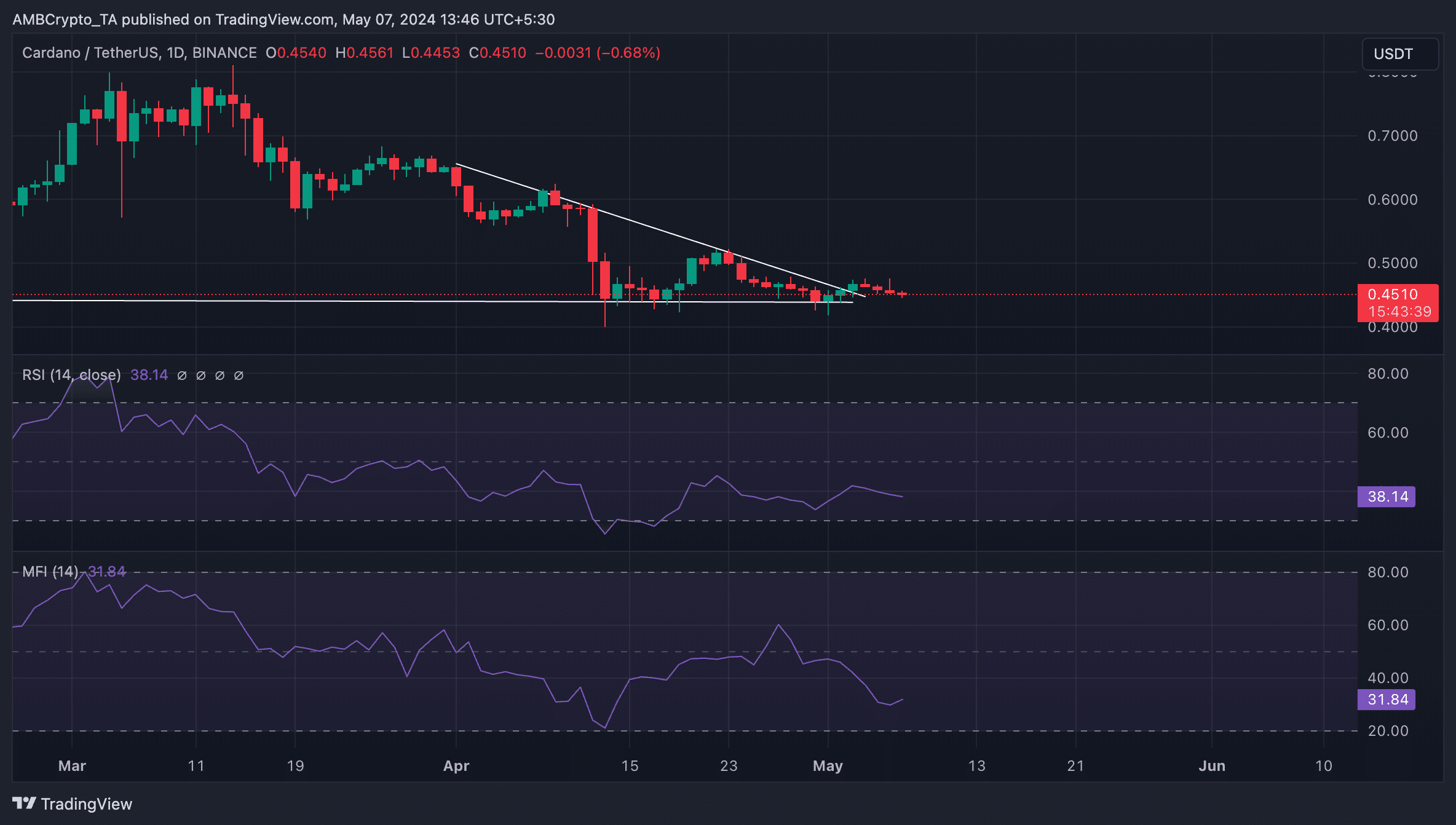

Cardano [ADA] is back trading at the $0.44 support price level after a brief rally when it broke out of a descending triangle on the 2nd of May.

AMBCrypto assessed ADA’s price performance on a one-day chart and found that the altcoin broke out of the descending triangle in an uptrend after it touched the support level on that day.

By the 4th of May, the coin’s price peaked at $0.48, after which it initiated a decline. At press time, ADA exchanged hands at $0.44, dropping 8% of its value in the past three days.

The current demand for ADA is not enough

An on-chain assessment of ADA’s demand showed that the price decline has occurred despite the uptick in the number of addresses that traded the altcoin in the past few days.

According to Santiment’s data, since the 3rd of May, the number of daily addresses that have completed at least one transaction involving ADA has risen by 15%.

Confirming the decline in demand for ADA, its key momentum indicators rested below their respective neutral lines at the time of writing.

For example, ADA’s Relative Strength Index (RSI) was 38.14, while its Money Flow Index (MFI) was 31.84.

At these values, these indicators showed that market participants significantly favored selling their coins over accumulating more ADA.

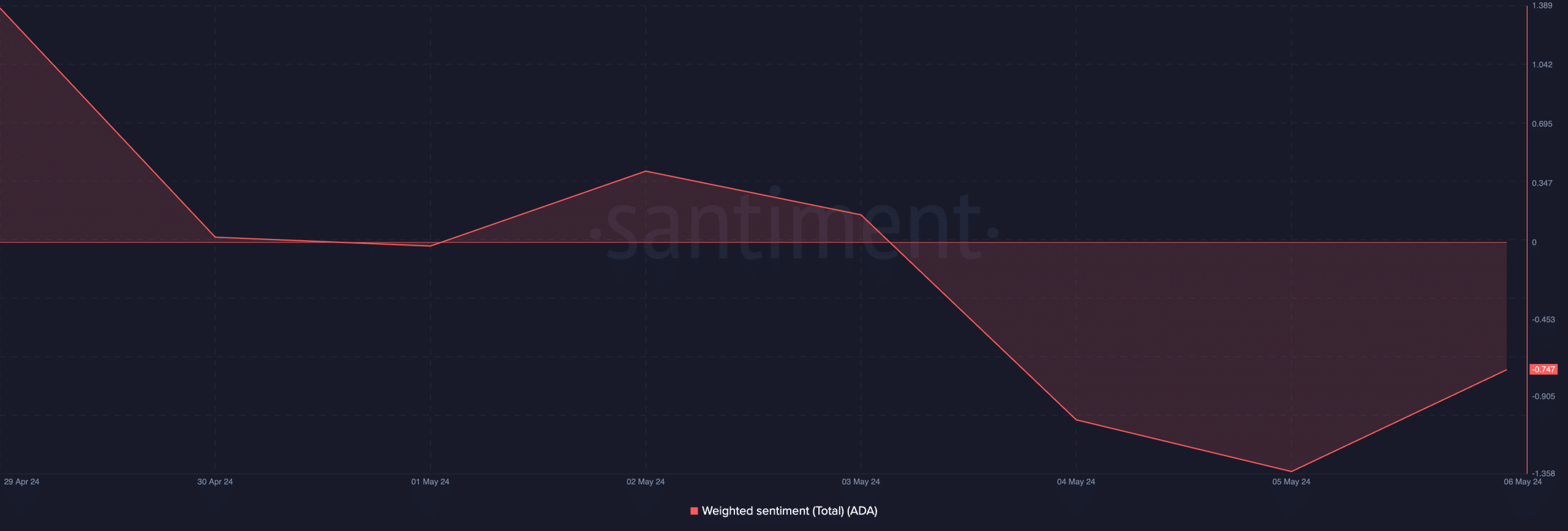

The divergence in ADA’s price movements and network activity might be due to the negative sentiment that has continued to trail the altcoin. As of this writing, ADA’s Weighted Sentiment was -0.74.

The reason for the poor sentiments is not far-fetched. According to CoinMarketCap’s data, ADA has shed almost 30% of its value in the last month, making it hard for its daily traders to turn a profit.

An assessment of ADA’s daily transaction volume ratio in profit to loss (using a 30-day moving average) revealed that traders had incurred more losses than profits in the last month.

Read Cardano’s [ADA] Price Prediction 2023-24

As of this writing, the metric’s value was 0.9.

This showed that for every transaction that returned a loss in the last month, only 0.9 transactions ended in profit.