Altcoin

Celsius Network: Here’s why CEL skates on thin ice

With a persistent fall in CEL’s price, the commencement of the sale and conversion of altcoins held by Celsius puts its holders at risk of a further decline if sentiment fails to improve.

- CEL’s value continued to drop following Celsius’ bankruptcy proceedings.

- CEL’s price took an unimpressive turn after the 29 June short squeeze put short sellers at a loss.

Despite the recent approval from the judge overseeing Celsius’ bankruptcy proceedings, its native token, CEL, experienced a continued decline in trading value.

Read Celsius’ [CEL] Price Prediction 2023-2024

The approval allowed the troubled crypto lender to initiate the sale and conversion of its altcoins into popular cryptocurrencies, Bitcoin [BTC] and Ethereum [ETH], starting from 1 July.

At press time, CEL exchanged hands at $0.1543, logging a 4% price decline in the past 24 hours, per data from

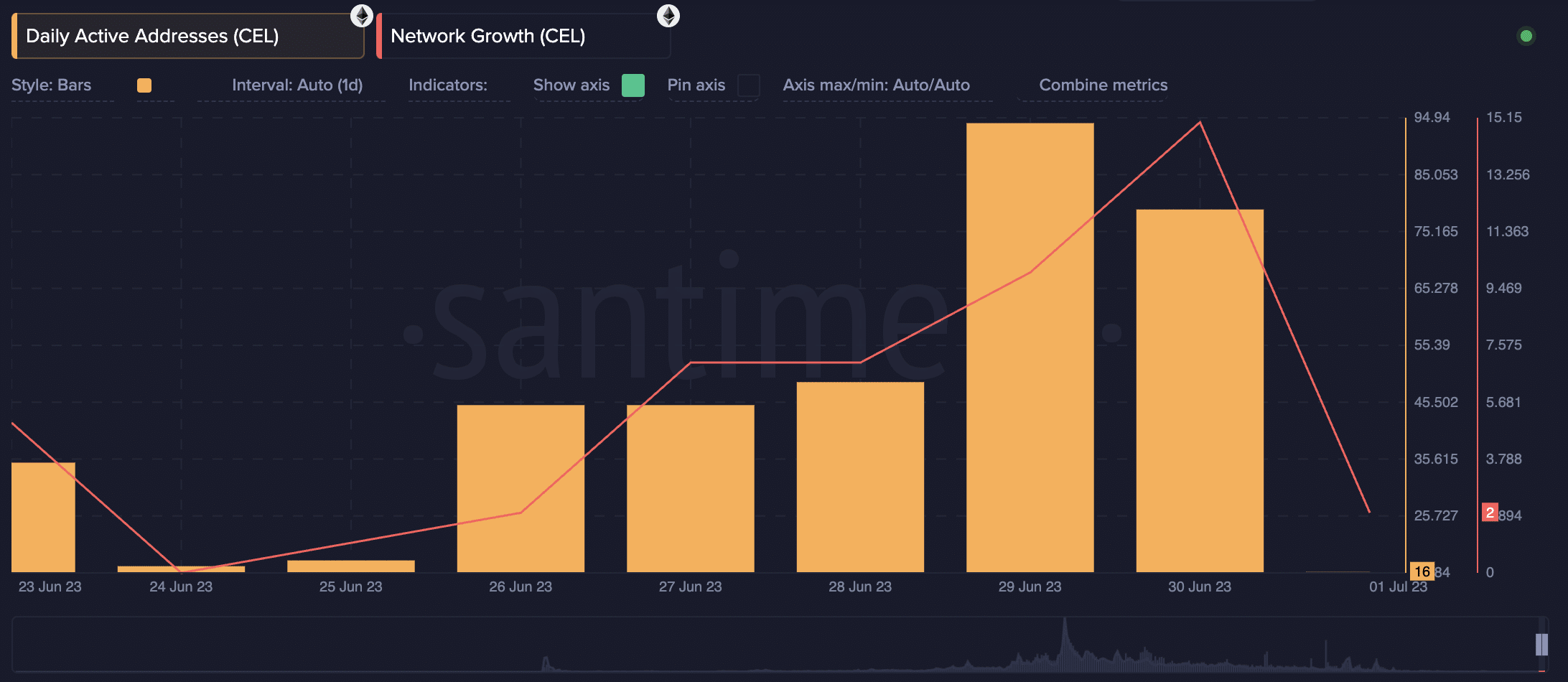

CoinMarketCap. The decrease in CEL’s value came after it experienced a momentary hike in value on 29 June.The rally was due to a high volume of bets against CEL, following a 45% drop in value in the preceding month. On-chain data from Santiment confirmed increased network activity for the alt on 29 June, as its active addresses and new addresses count jumped by 92% and 42%, respectively, on that day.

However, contrary to what short sellers expected, a short squeeze was initiated as CEL’s price recorded an intraday high of 45%. According to CoinMarketCap, the alt traded for as high as $0.20. At its press time value, the alt’s price has since dropped by 25%.

CEL’s fate as tokens sell-off commences

An assessment of CEL’s performance on a daily chart revealed a bearish divergence between the alt’s price and its Moving Average Convergence Divergence (MACD) indicator.

The last week had been marked by a persistent fall in CEL’s value. However, its MACD line rested above the trend line. This suggested that the crypto’s short-term moving average remained higher than its long-term moving average.

This kind of movement generally indicates that the asset in question is in a bullish trend or about to commence one.

With CEL’s price moving in the opposite direction, a bearish divergence was foisted upon the market. Thus, there was a loss of any upward momentum.

Further, CEL’s Chaikin Money Flow (CMF) rested beneath the center line at press time, returning a negative value of -0.24. A negative CMF value is typically taken as an indication of dominant selling pressure in the market.

Is your portfolio green? Check the CEL Profit Calculator

CEL’s price traded close to the lower band of its Bollinger Bands indicator at the time of writing. This typically highlights increased selling pressure, which may result in a further decline in asset price. However, it also suggested that CEL’s sellers might inch closer to exhaustion, and a potential price reversal was imminent.

However, for this to happen, weighted sentiment amongst investors has to improve and flip to positive.