Centralized Exchanges’ volumes decline- Did Uniswap and SushiSwap benefit

- The volumes on Centralized Exchanges (CEX) took a hit after Binance and OKX got affected.

- On the contrary, activity on Decentralized Exchanges (DEX) increased.

Centralized Exchanges have been the first preference of many traders in the crypto space. However, of late, it appears that many users have lost faith in CEXes.

Read BNB’s Price Prediction 2023-2024

On the SPOT

According to recent data, spot trading on popular exchanges such as Binance and OKX has fallen by 46.9% and 36% over the last month.

For context, spot trading refers to the buying and selling of cryptocurrencies for immediate delivery, where settlement typically occurs within a short timeframe and at the current market price.

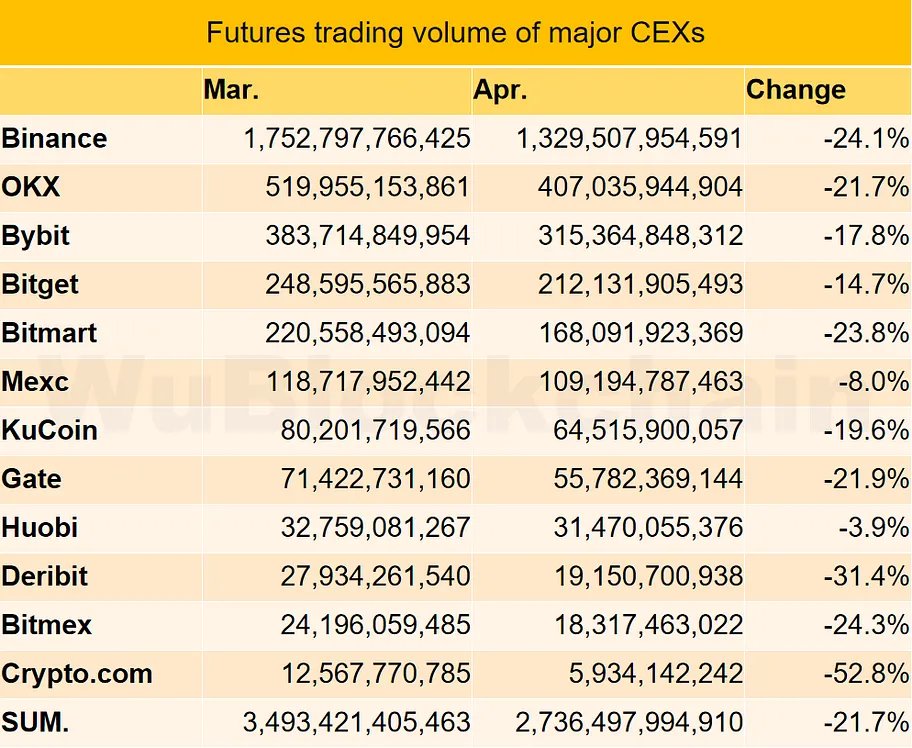

These exchanges were also impacted in the futures sector. According to the data, the volume of futures trades on both exchanges decreased by 24.1% and 21.7% respectively.

Due to the declining volume of trades occurring on these platforms, the overall traffic change observed on these exchanges turned negative.

This decline in volume impacted the market cap of the CEX tokes. According to Santiment’s data, the market cap of BNB and OKB fell significantly over the last week. Additionally, the number of active addresses transferring these tokens also declined.

After the activity on CEXes got impacted, Decentralized Exchanges(DEX) saw growth.

DEXs take the lead

Prominent players in the market such as Uniswap and SushiSwap, managed to observe a massive spike in activity over the last few months.

In Uniswap’s case, the overall number of active addresses on the network surged by 86.5% in the last few months. Due to the high spike in activity, the fees generated by the protocol increased by 86.5% according to data provided by the token terminal.

Realistic or not, here’s UNI’s market cap in BTC terms

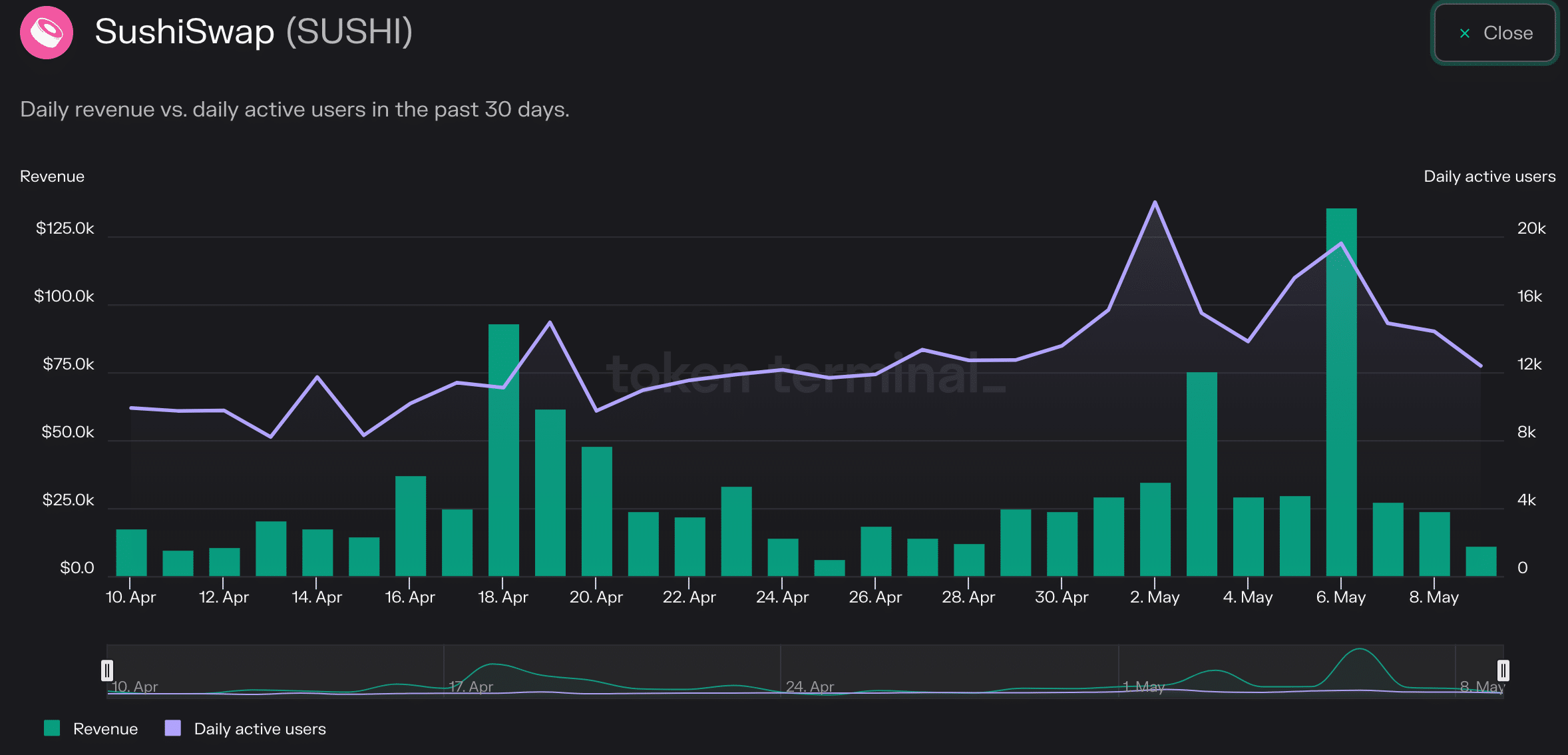

SushiSwap also observed growth over the last month. In terms of daily activity, overall usage of the DEX surged by 25%. This impacted the revenue generated by the protocol, which increased by 10.1%.

However, these positive developments failed to have an impact on the DEX tokens. Over the last week, the market cap of these tokens has declined significantly. Coupled with the declining market cap, the velocity of these tokens has also fallen.

A decreasing velocity indicated that the frequency with which these tokens were being traded amongst addresses had started to fall.