Chainalysis to offer compliance solution for Lightning Network transactions

Adoption of the Lightning Network, which launched in 2018, has risen at a comparatively faster pace in 2021. Lightning Network introduces greater scalability to the Bitcoin ecosystem, ergo, enabling more commerce-based use cases. Not so surprisingly, the number of nodes on the network grew by 68% last year, according to data by Bitcoin Visuals.

Rising thunderstorms

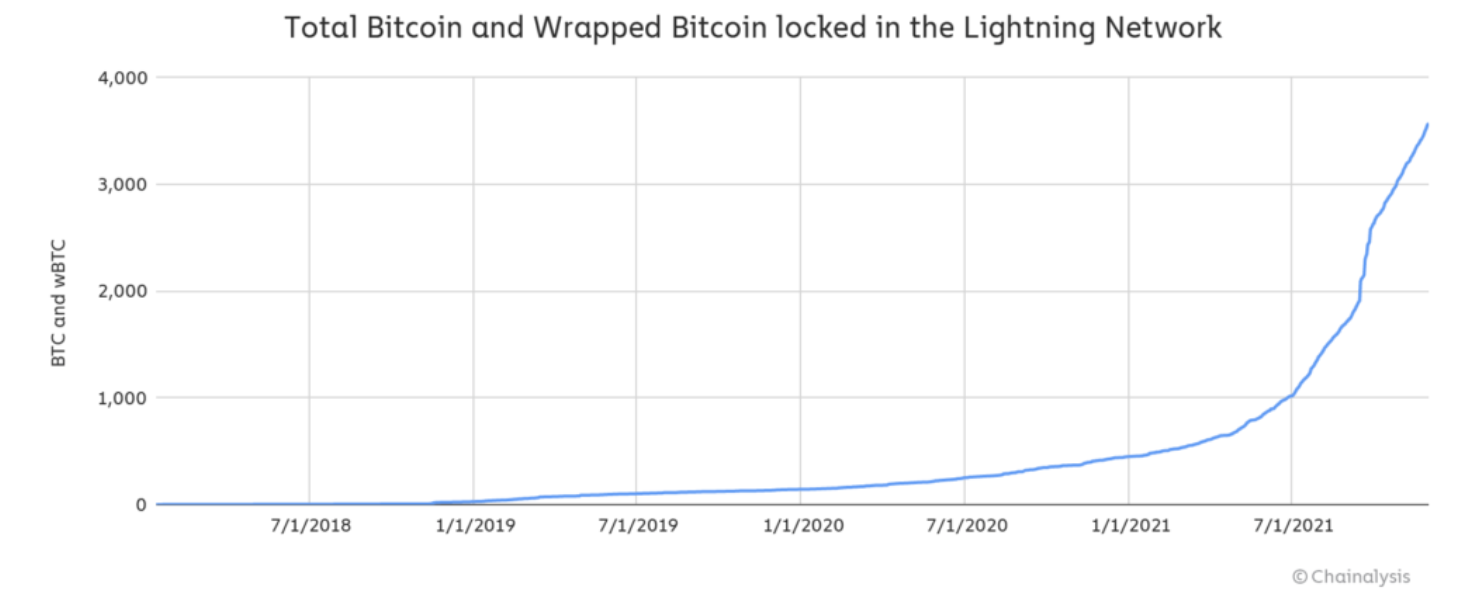

The amount of Bitcoin locked in the Lightning Network has grown significantly throughout 2021. As of 1 December 2021, around 3,600 BTC worth over $205 million is locked in public Lightning Network channels. Up from 468 BTC worth roughly $4.8 million on 1 January 2021.

The number of open lightning channels has also increased substantially over time. The graph below highlights the sheer popularity of the said network.

Source: Chainalysis

Needless to say, several cryptocurrency businesses are looking to utilize the Lightning Network to enable fast, low-cost transactions.

Joining the queue

According to the official Chainalysis blog,

“As blockchain technology evolves, we evolve with it.”

It further mentioned that the Blockchain data platform, is “dedicated to providing our customers with products and guidance that help them interact with emerging cryptocurrency technology while abiding by global regulatory best practices.”

In accordance with the same, earlier today, Chainalysis announced product support for the Lightning Network adding, “At the beginning of next year we will be introducing Lightning Network transaction monitoring to Chainalysis KYT, the world’s leading cryptocurrency transaction monitoring software.”

The said feature will allow users “to use KYT to monitor their Lighting Network transactions, screen for risky activity, and gain valuable insights.” Moreover, virtual asset service providers (VASPs), like exchanges, will handle Bitcoin transactions in a way that’s compliant with global standards.

It is noteworthy, that the VASP terminology, which Chainalysis used in its press release, comes directly from Financial Action Task Force (FATF) guidance that was updated at the end of October.

Pratima Arora Chief Product Officer of Chainalysis noted:

“Chainalysis exists to build trust in cryptocurrency in order to promote more financial freedom with less risk.

The Lightning Network solves many of the challenges that prevent the Bitcoin protocol…by enabling our customers to compliantly support Lightning transactions, we hope to grow the network’s popularity and help it scale.”

Well, Chainalysis will be the first blockchain analysis company to offer customers a transaction monitoring solution for the Lightning Network.

Other users reiterated a similar optimism following the said collaboration. For instance, Reio Piller, Co-founder, and CTO of Yolo Group opined,

“Chainalysis support of the Lightning Network gives us the compliance tools we need to safely leverage Lightning to grow our business and provide a better payments user experience for our customers.”

Overall, different businesses have already commenced their operation utilizing the feature. In fact, governments and corporations – including Twitter – have adopted Lightning solutions for payments, driving adoption to record highs.