Chainlink: A renewed interest from these holders could drive LINK towards…

- Whales and sharks showed massive interest in Chainlink in the last few days

- Chainlink made numerous integrations across networks, but interest in some services declined

Santiment, in a tweet on 4 December, observed that whales had accumulated large amounts of the LINK token. An increased interest from large investors could induce a surge in LINK’s prices.

?? #Chainlink's shark and whale address, holding between 1K to 1M $LINK, have gone on an unprecedented surge of accumulation. These wallets have added a collective 26.8M $LINK ($194.3M) in just 2 months, a 12.8% increase of coins to their bags. ? https://t.co/5GSPIVts6q pic.twitter.com/Mc9fUTQ0vz

— Santiment (@santimentfeed) December 4, 2022

Read Chainlink’s [LINK] Price Prediction 2023-2024

Big-time accumulation

The tweet further stated that whales and shark addresses holding 1,000 to one million LINK increased significantly. At press time, the holdings of these addresses stood at 26.8 million LINK. Furthermore, these large addresses accounted for nearly a quarter of Chainlink’s overall supply.

One reason for the whales’ increasing interest could be Chainlink’s growing number of collaborations. On 3 December, Chainlink stated that it had integrated with Ethereum and the BNB Chain. The integrations ranged from Chainlink helping protocols with sourcing various types of data to randomizing mint rewards.

⬡ DAILY WRAP-UP ⬡

⛓️ Integrations on #BNBChain and #Ethereum ⛓️

• @AtamoAscension | VRF | Randomizing mint rewards

• @DerifyProtocol | CPF | Supplying data to perpetual contractsMore integrations? pic.twitter.com/0eq2pyWZDe

— Chainlink (@chainlink) December 2, 2022

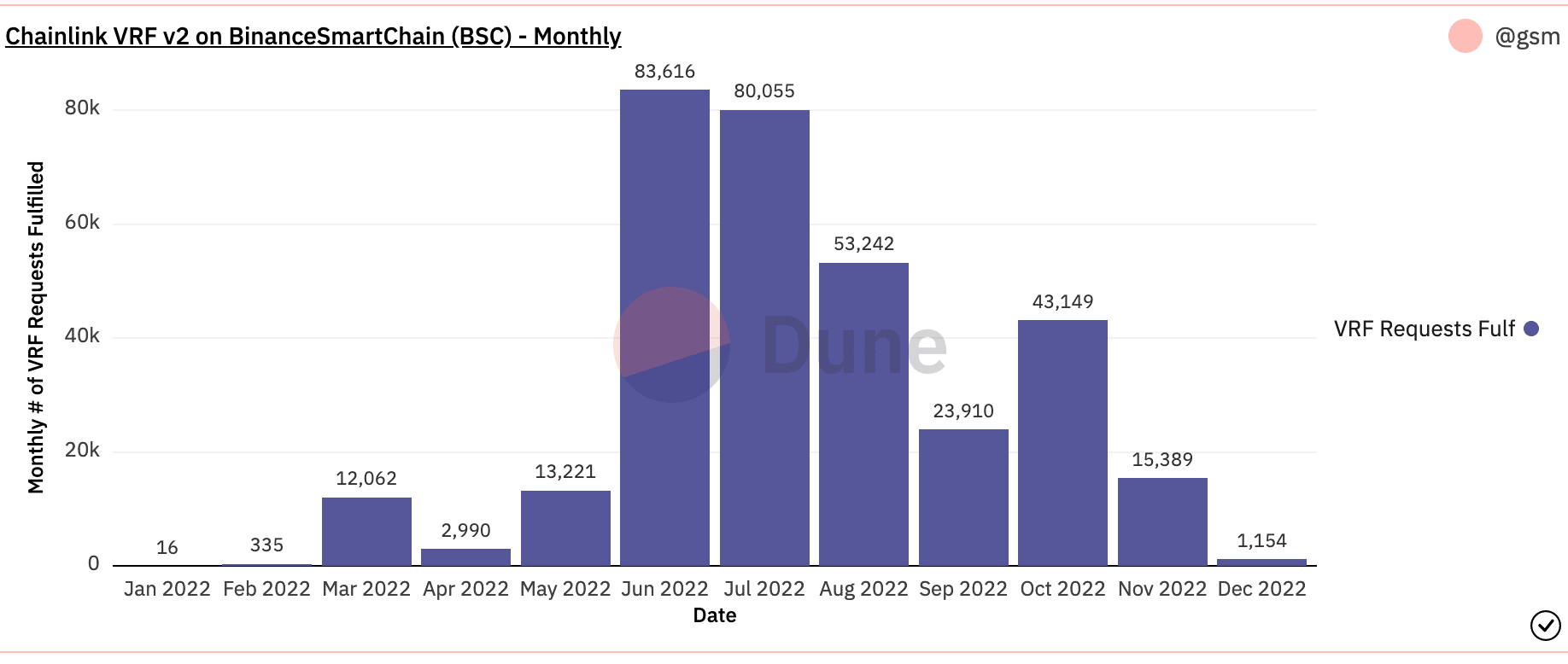

However, despite providing its technologies to various protocols in Web3, there was a decline in demand observed for some of its technologies. According to data from Dune, the demand for Chainlink’s VRF technology dropped. Additionally, the number of VRF requests on the BinanceSmartChain reduced over the past few months.

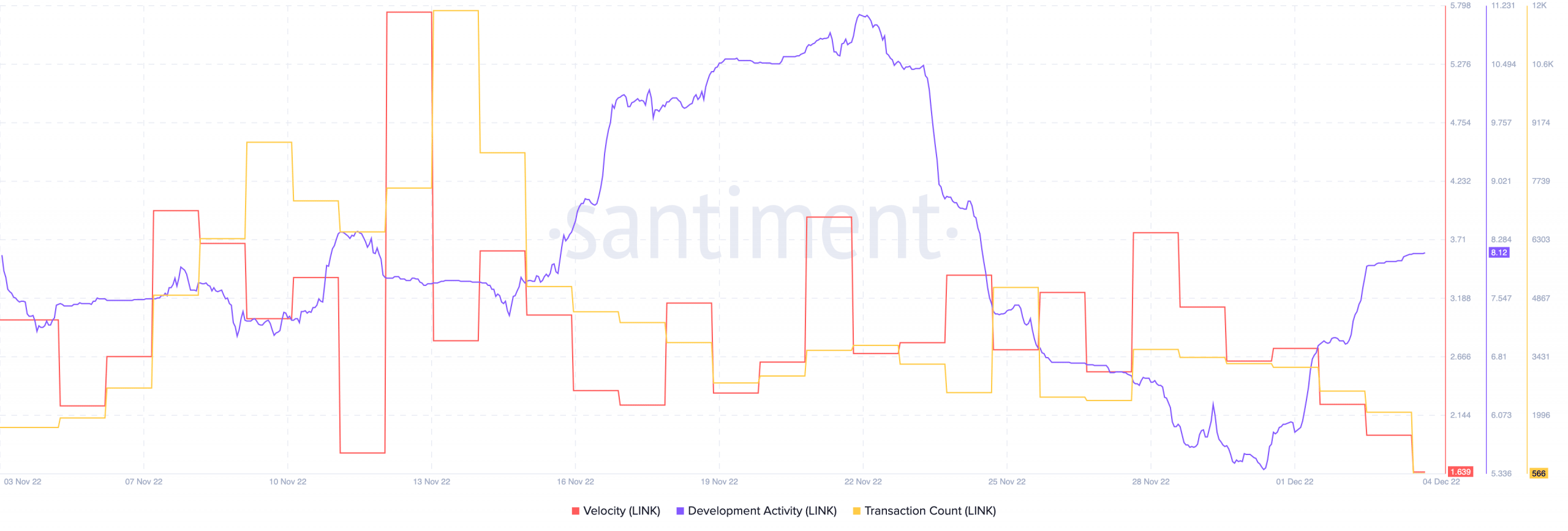

Along with the declining demand for its VRF technology, LINK’s activity dwindled on-chain as well.

LINK activity declines

LINK’s velocity fell over the past month, as the number of times LINK was being exchanged amongst addresses had diminished. Coupled with this, Chainlink’s transaction count declined as well.

However, in terms of development activity, Chainlink witnessed a spike over the last few days. This implied that the developers at Chainlink were making more contributions to the network’s GitHub. This could be attributed to the upcoming launch of staking on Chainlink.

It remains to be seen what impact whale interest will have on Chainlink and whether the launch of staking will prove beneficial for LINK holders. At the time of writing, LINK was trading at $7.35. Its price had gone down by 1.31%, according to CoinMarketCap.