Chainlink: Assessing the way ahead

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LINK extended a recovery above the multi-month supply area of $8.5.

- The long-term uptrend strengthened amidst improved sentiment.

The crypto market sentiment improved in the past few days as the deadline for US Bitcoin [BTC] ETF approval and April 2024 halving draws closer. In particular, Chainlink [LINK] cleared a key long-term hurdle and supply area of $8.5 as BTC made new highs.

Read Chainlink’s [LINK] Price Prediction 2023-24

A previous LINK price analysis established conflicting on-chain metric readings with recent bullish action. However, the bullish momentum saw LINK crack a multi-month resistance at $8. Will the bulls defend recovery gains?

LINK flips the previous supply zone to support

On the 4-hour chart, liquidity and price imbalance existed at $8.98 – $9.24 (orange), just below the immediate overhead hurdle at $9.5. Already, near-term bulls had defended the previous supply zone of $8.0 – $8.8 (cyan) as of press time.

So, the previous supply area and the liquidity on charts could be key interest levels for late bulls if BTC maintained its bullish momentum in the next few hours/days.

However, late buyers should be aware of the hurdles at $9.5 and the daily bearish order block (OB) of $11.0 – $12.0 (red).

Conversely, a retracement below the previous supply area will confirm an increasingly negative sentiment and could tip the scale in favor of sellers.

Nevertheless, as indicated by an upswing in OBV, the massive Spot market demand could delay a sharp retracement. However, the overbought condition of the RSI was something to worry about if BTC posted more short-term losses.

The Futures market was bullish on Chainlink

Is your portfolio green? Check out the LINK Profit Calculator

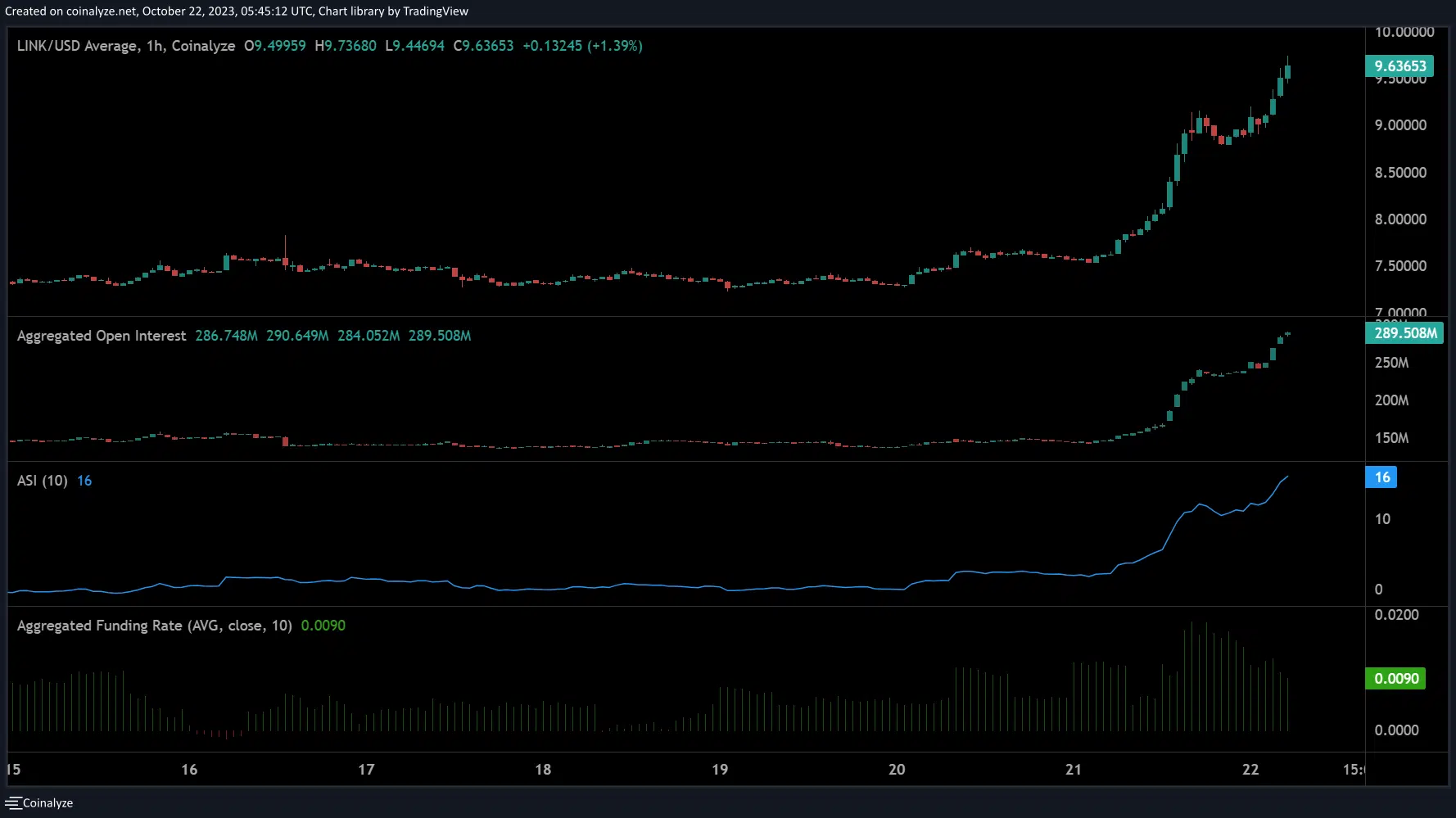

According to Coinalyze, Futures market sentiment was bullish, as per the positive funding rates. Also, the derivative segment’s demand improved tremendously, as shown by the uptick in Open Interest (OI) rates.

The bullish action also strengthened the long-term uptrend, as the increasing and positive Accumulative Swing Index (ASI) demonstrated. The ASI tracks the strength of price swings, and the improvement indicated buyers had the upper hand.