Chainlink breaks through key level- Opportunities ahead for short sellers?

- LINK bulls dominate, pushing the price beyond a short-term resistance level.

- Signs of a potential retracement emerge potentially pointing to an upcoming opportunity for short-sellers.

Another week of 2023 is in the rearview mirror and the bulls have emerged victorious once again. LINK holders are ecstatic after the rally that the coin has delivered since mid-February. Here’s a look at how LINK has kicked off the second half of February.

Read about Chainlink [LINK] price prediction for 2023-2024

The first half of February looked like the start of a bearish retracement after the bullish performance that LINK delivered in January.

It did, in fact, pulled back below the 200-day moving average and briefly below the 50-day MA. The bulls just made a strong mid-month comeback that culminated in a 27.86% rally from its 4-week lows to its press time high of $8.25.

LINK’s rally in the last two days was so strong that it managed to break through the $7.79 resistance level.

Also, the rally kicked off from the RSI mid-range, confirming that the relative strength was still in favor of the bulls. In other words, LINK, at press time, was still carrying on with the bullish momentum previously witnessed in January.

LINK may be subject to another selloff

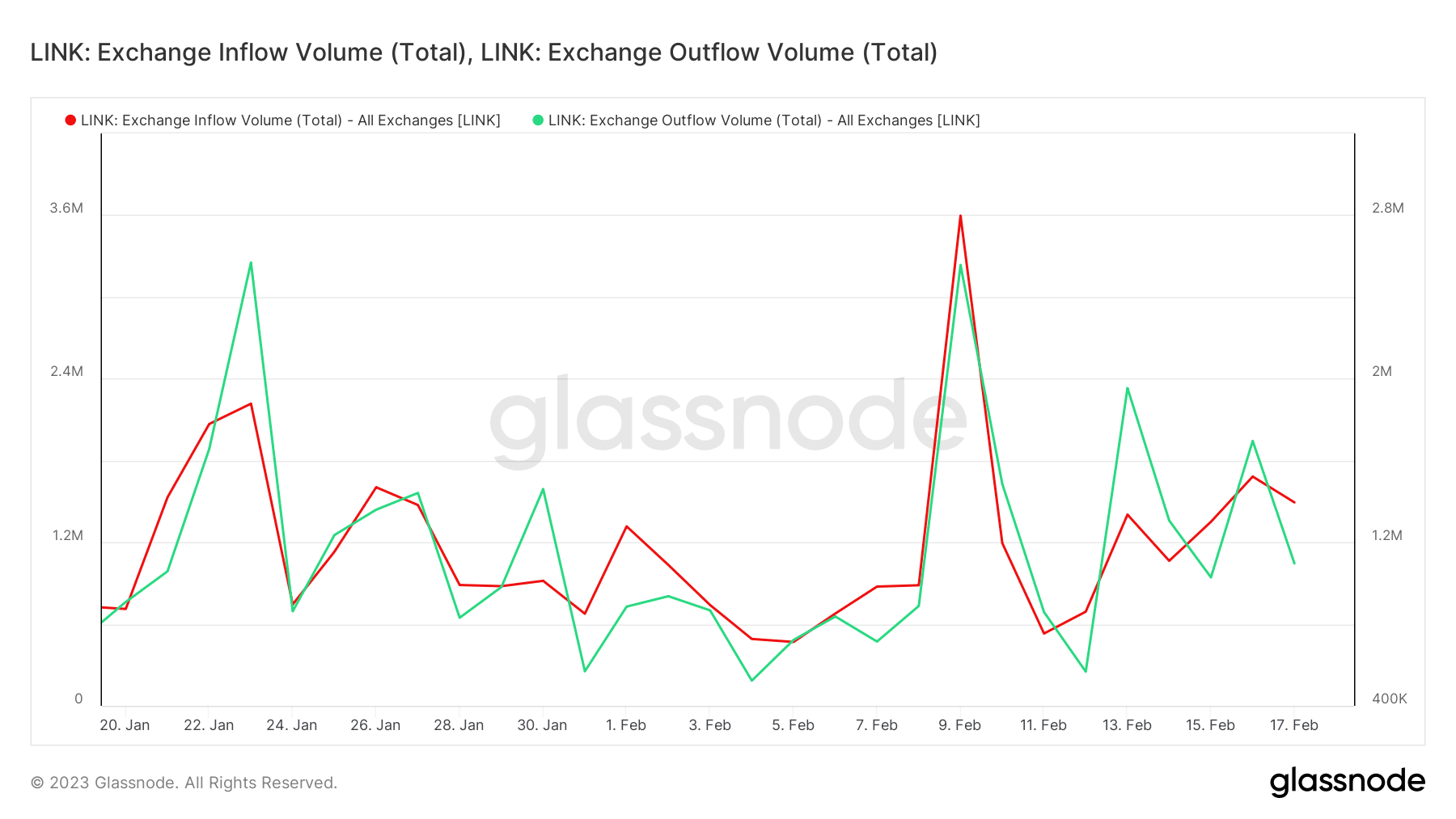

The bears might just be around the corner despite this impressive performance. The latest Glassnode data reveals that exchange outflows are slowing down. The last 24 hours demonstrated a return of higher exchange inflows, suggesting that sell pressure was building up.

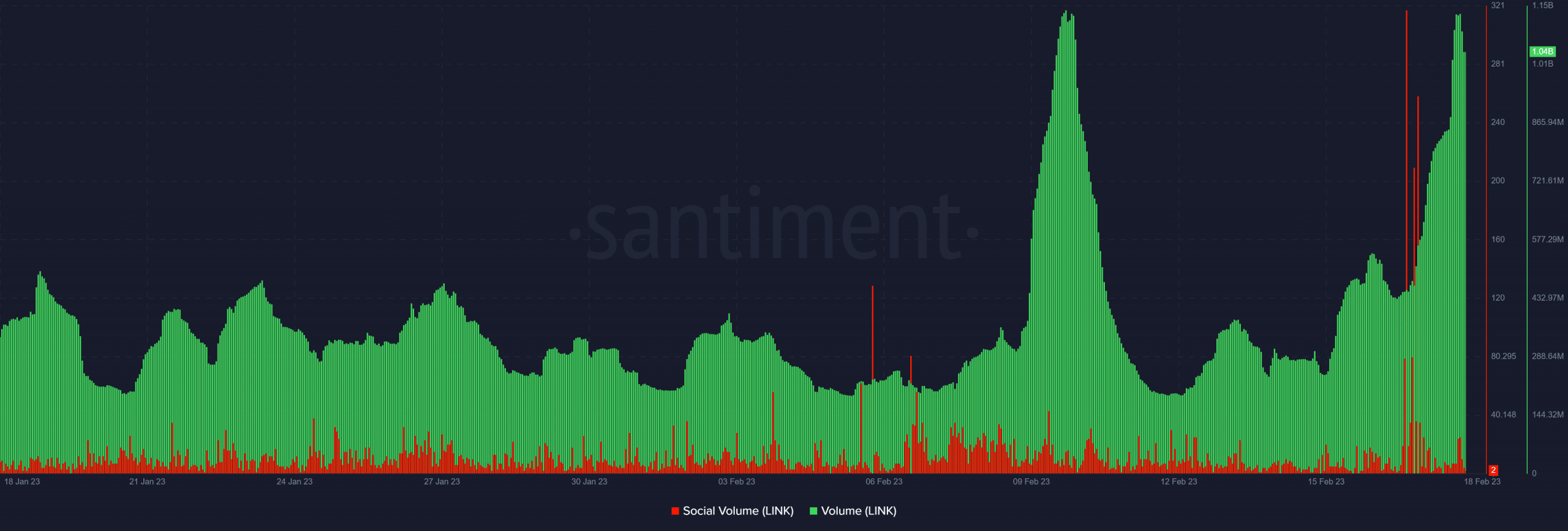

The slowdown in exchange volumes was preceded by a large spike in social volume to the highest monthly levels on 17 February.

This was followed by a surge in on-chain volume back to the previous monthly high.

A bearish retracement ensued the last time that the volume peaked at the same level. A retest of this same level carries a higher probability of yielding similar results.

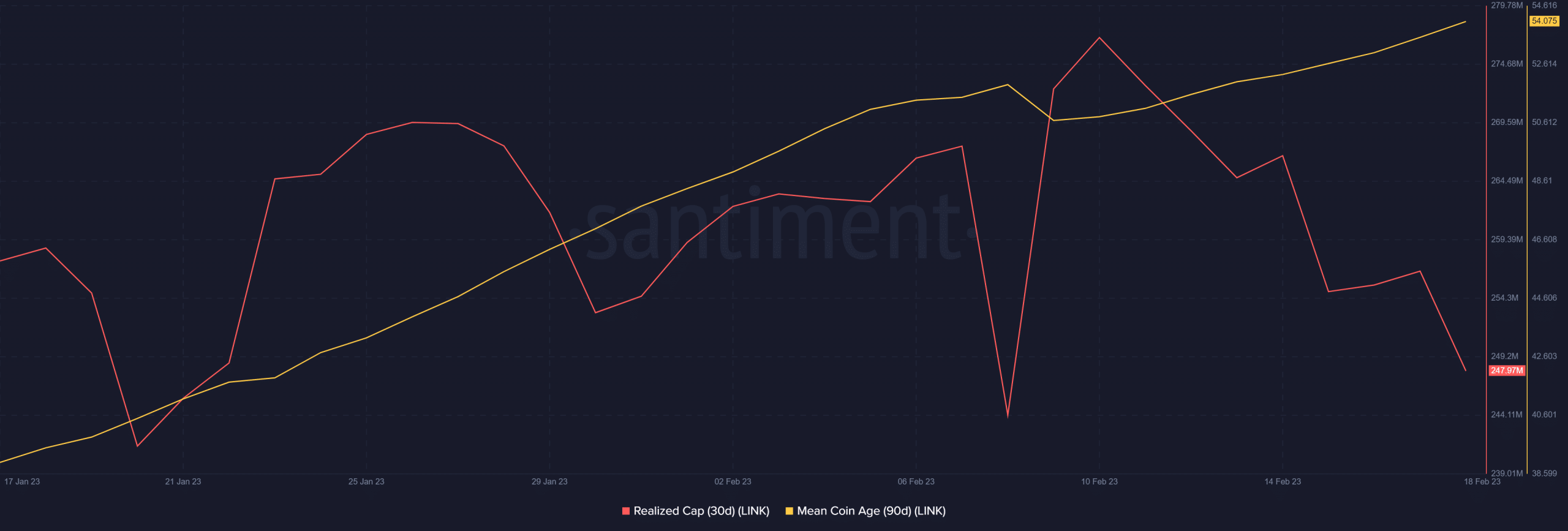

Another metric that currently highlights a potential retracement is the realized cap metric which was approaching the lower 4-week range, at press time.

A sell signal was observed the last time that the metric dropped to the lower range, coupled with a strong uptick in mean coin age.

Is your portfolio green? Check out the Chainlink Profit Calculator

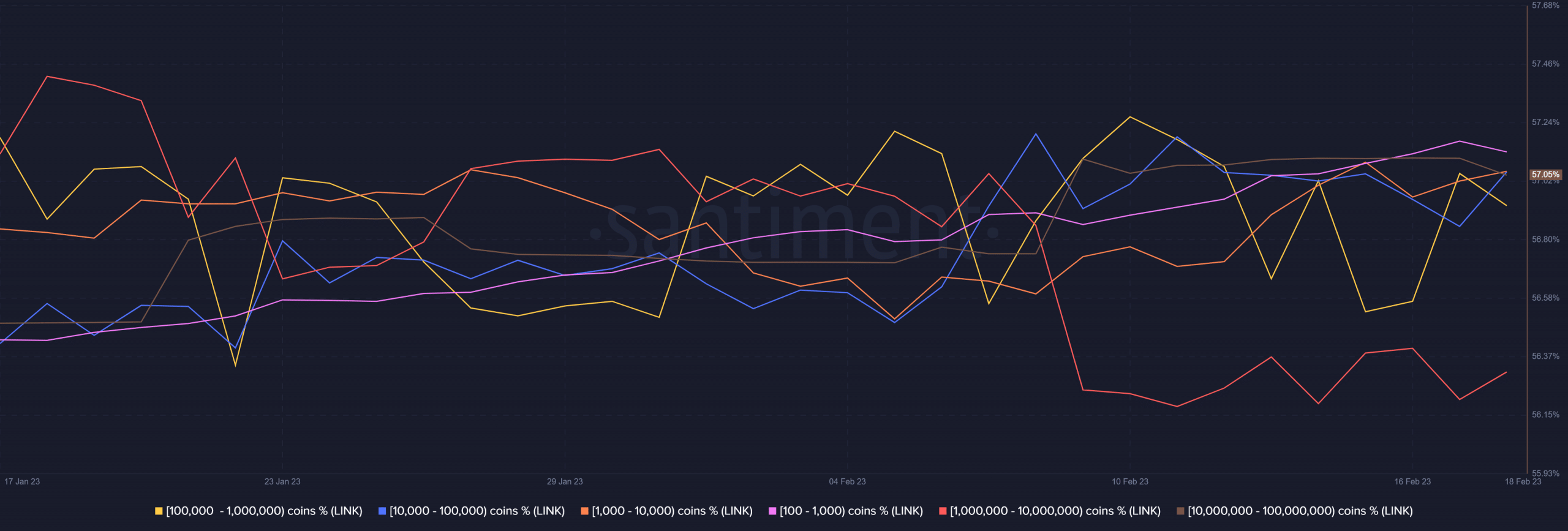

This time the mean coin age achieved a new monthly high. But the key determinant of sell pressure was whales. The latest supply distribution data revealed that there was still some buying pressure in the market.

However, the largest whales contributed to selling pressure in the last 24 hours, at the time of writing.

The latest whale data reveals that addresses holding between 100,000 to 1 million LINK and those holding over 10 million LINK started selling.

These two categories collectively control over 60% of the circulating supply. Hence their activities are likely to have a major impact on the market. It means there might be a solid opportunity for short sellers to benefit based on this assessment.