Chainlink: Can bulls rally from this key support?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bullish defense of key support could provide a springboard for short-term rally.

- Longs held a slim advantage on long/short ratio.

Chainlink’s [LINK] price action stalled at a key support over the past week. While this helped to ease the selling pressure from the $7.2 resistance level, it also presented an opportunity for bulls to rally from this price zone.

Read Chainlink’s [LINK] Price Prediction 2023-24

With Bitcoin [BTC] leading the bullish charge by climbing strongly above $27k over the past 48 hours, the signs look good for buyers to mount a solid price attack from the $6 support.

Bulls have the opportunity to replicate July gains

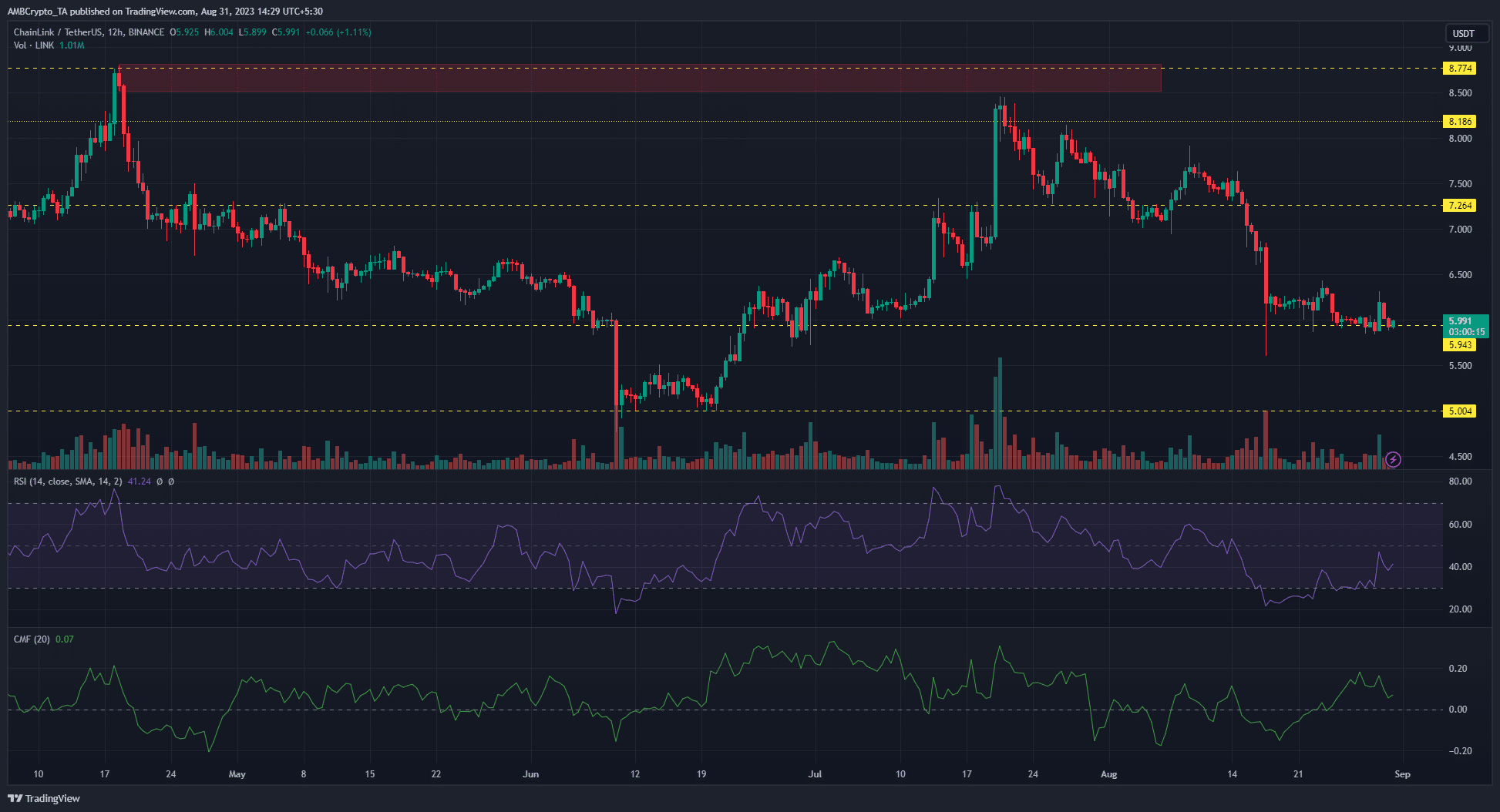

A look at LINK’s price action on the 12-hour timeframe highlighted the $6 support as a key level for bulls. Bulls rallied strongly from the level in early July, reaching the $8 price level before bears took over.

The easing of the selling pressure at the key support hinted at waning bearish momentum. Based on the historic bullish tendency at the level, buyers could take advantage to rally strongly.

The chart indicators supported a bullish move. The Chaikin Money Flow remained above the zero mark since 24 August with a positive reading of +0.05. This showed consistent capital inflows over the period. While the Relative Strength Index stayed under neutral 50, it moved clear of the oversold zone. This pointed to rising demand for LINK.

A bullish rally from this support would see buyers target the $6.5 to $7 level for profits. On the flip side, a bearish break below the support could see a free fall to the June low of $5.

How much are 1,10,100 LINKs worth today?

Buyers bidding strongly to counter shorts in the derivatives market

According to Coinglass, longs were slightly edging shorts on the exchange long/short ratio. Despite the slim margin, longs had the upper hand on eight out of the nine exchanges.

As of press time, longs held a 50.63% share of the open contracts worth $17.5 million dollars. If Bitcoin maintains its bullish reversal, it could strengthen LINK buyers in the short term.